This Startup Developed a Promising New Battery Material—and a Novel Survival Strategy

As Kenan Sahin walks through the labs at Tiax, an energy technology development firm located along Boston’s tech beltway, he points to a row of little muffle furnaces in a small beige room. The company’s researchers use the ovens to heat mixtures of metals, producing slight variations of a nickel-rich cathode recipe that Sahin believes will improve the energy density, cycle life, and price of lithium-ion batteries.

If he’s right, it would represent a rare genuine advance in battery materials, one that could help tip electric vehicles into the consumer mainstream. It’s the result of 15 years of research and tens of millions of dollars of personal investment, reflecting Sahin’s patient and deliberate approach to the innovation process.

Sahin, 75, is best known for selling his billing software company, Kenan Systems, for $1.5 billion to Lucent in 1999, without having taken a dollar of outside investment. Since then, he has spent much of his time and fortune quietly working to push battery technologies forward, launching Tiax in 2002 to produce and foster promising advances before turning them over to a marketplace that’s brutalized green-tech startups (see “Why Bad Things Happen to Clean-Energy Startups”).

(Full disclosure: After the sale to Lucent, Sahin contributed $100 million to MIT, and he is a life member emeritus on the institution’s board. MIT owns MIT Technology Review.)

The company has been developing cathode materials from the start, and this spring it announced that a spinout, CAMX Power, was emerging from stealth mode. Sahin himself has become a cathode evangelist, arguing that improving the battery electrodes that power electric vehicles is the fastest way to transform the transportation sector, promising to cut costs and boost mileage range. “Cathode materials are the key to the electrification of vehicles,” says Sahin, in a slight Turkish accent that’s lingered since he first arrived in the United States on an exchange program at the age of 16.

But at least as notable as any technology advance is the company’s market survival strategy. Instead of making the cathode powder itself, CAMX lined up deals with two of the world’s largest chemical manufacturers, U.K.-based Johnson Matthey and Germany’s BASF, to produce and sell the material to battery makers. It’s a tactic designed to avoid the kind of capital expenditures that have doomed many battery wannabes, while allowing the startup to focus on pushing cathode technologies further still.

But making any inroads in the battery industry is a huge challenge, even when a startup has achieved a technological advance. Getting new materials or components to the marketplace requires shifts in practices and significant up-front investments on the part of suppliers, manufacturers, and end customers. The real test for CAMX will be whether battery makers, auto manufacturers, and electronics companies ultimately see enough promise to put the novel materials to work.

Innovation backlog

After earning his PhD in 1969 at MIT’s Sloan School of Management, Sahin spent years in academia. But in 1982, he decided to commercialize some of his research in expert systems and data processing, launching Kenan Systems with a $1,000 personal investment.

The company ultimately built transaction systems for major companies in telecommunications and banking, catching the eye of Lucent Technologies, the telecom equipment giant. He spent the next several years as vice president of software technology at Lucent’s famed Bell Labs research division. Around this period, he came to believe there was a fundamental breakdown between academic research and private industry, creating what he has described as an “innovation backlog” as corporations dismantled R&D labs and venture capitalists grew more risk averse.

Three years after the sale, he established Tiax to provide additional support for promising early ideas, jump-starting the company by acquiring the technology division of the once-prominent consulting firm Arthur D. Little for $16.5 million. “It bothers me that so many wonderful inventions are stagnating,” he told the New York Times after the purchase.

And it’s only gotten worse since then, he says now.

In particular, Sahin has come to believe that a deep innovation crisis in the United States is smothering clean-energy startups in their infancy. The short, cheap path to disruption that works for online businesses routinely fails in energy, where new companies face years of development, high manufacturing costs, and deeply entrenched players (see “Can Energy Startups Be Saved?”).

He argues that startups in the sector should focus on what startups do best—innovating—while finding ways to partner with these established companies to transform advances into products. That strategy could offer better odds at long-term survival for any given firm, he says, and revive the environment of innovation that’s necessary to drive technologies and markets forward.

At CAMX, Sahin is hoping to put this theory into action. The appeal of using a greater proportion of nickel in lithium-ion battery cathodes is the metal’s high energy density. That means it can store and release a lot of the lithium ions that ultimately power gadgets and cars, delivering energy over long periods between charges. Using more nickel also makes it possible to use significantly less cobalt, which is rare and expensive.

But most work on high-nickel cathodes to date, including research on the same basic mix of lithium, nickel, and oxide that CAMX is using, has consistently run into stability problems that shorten a battery’s life. That’s an obvious drawback in vehicles, since no one wants to buy a $35,000 car that only lasts, say, three years.

“You need to be a lot better than the incumbent. If you're 10 percent better, no one will talk to you.”

CAMX, however, has developed and patented a molecularly engineered composition that stabilizes the materials by placing small amounts of cobalt in crucial areas. This advance amounts to a new class of lithium-ion cathodes that could enable cheaper electric vehicles with longer range, according to Sahin.

In an investor presentation last month, Johnson Matthey said the CAMX material delivered as much as a 25 percent improvement in energy density over the nickel-manganese-cobalt cathode materials used in many electric vehicles today, and about a 5 percent gain over an advanced chemistry going into upcoming models. The company announced that it will invest around $260 million to begin building the first plant to produce the materials next year. BASF hasn’t yet provided additional details of its plans.

Think like Facebook

Despite the obvious need for better energy storage and the excitement around new approaches, the marketplace has been brutal for startups in this sector so far.

The high cost of manufacturing, strength of incumbent players, technical challenges and slow adoption of new technologies has forced a series of one-time darlings to pivot, retrench or file for bankruptcy, including A123 Systems, Alevo, Ambri, Aquion Energy, EnerVault, Lightsail Energy and others. In the process, venture capital interest in the sector has cooled as investors returned their focus to safer, more predictable, shorter-term bets on software, social-media, and online businesses (see “Why We Still Don’t Have Better Batteries”).

Observing the stumbles of battery ventures and other green-tech firms, Sahin came to believe that makers of energy materials needed to take a page from these fast-growing Internet businesses. “Google, Facebook, Airbnb—these are all piggyback companies that sit on the Internet,” he says. “They did not build the Internet.”

“But in the materials domain, the standard thinking is, ‘If we invent it, we’re going to make it,’” he adds. “I said, ‘No, no, no. We will find a manufacturing partner, but we have to make it makeable.’”

That presented a challenge: an unknown startup had to convince battery giants or their materials suppliers that it had built a better technology. His initial entreaties to companies including Panasonic, the world’s leading automotive battery supplier, were rebuffed. The battery makers were unwilling to spend the time and money to evaluate some other company’s materials. When Sahin finally did persuade one to try, by leveraging a career’s worth of connections, the company’s engineers didn’t know how to—or didn’t care to—test them properly.

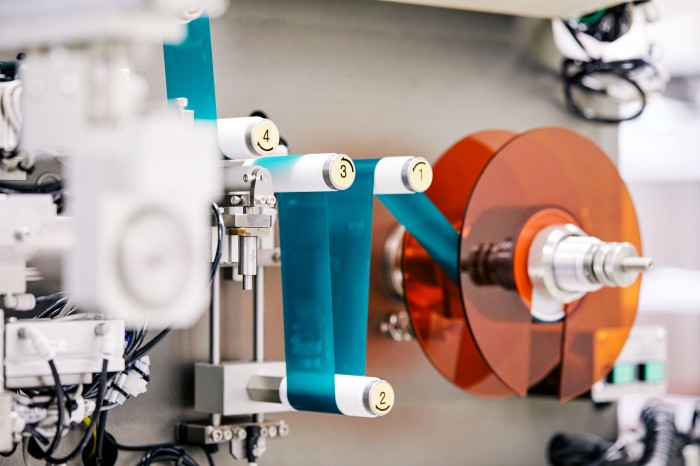

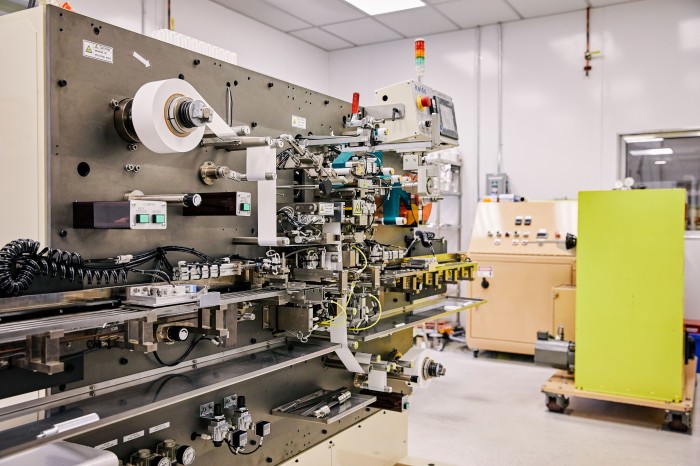

Ultimately, CAMX had to take two big, expensive steps to move forward: it built a $10 million pilot factory in Rowley, Massachusetts, to prove that the material could be produced at scale, and it developed a “battery kit” that any potential partner could use to create small cells that would demonstrate the performance of CAMX’s material.

During an interview in Sahin's second-floor office, filled with plaques and plates recognizing his achievements in academia, business and philanthropy, he places a cardboard box on a round table in the middle of the room.

He wears blue jeans and leather moccasins paired with a fine cut sports jacket, and a dress shirt with detailed blue stitching down the placket. As he speaks, he peers over a fashionable pair of glasses, with a rim that only runs along the bottom.

Sahin opens the box, and starts pulling battery components from their black foam compartments: bottles of electrolyte and binders, the company's own cathode powder, and assembly instructions in assorted languages.

He explains that it was only by creating such a kit that the company was able to demonstrate the advantages of its cathode material. This allowed potential partners to test and compare the materials without any financial investment, and only a little of their own time. Ultimately, the improvements were significant enough to convince Johnson Matthey and BASF to strike manufacturing deals, while allowing CAMX to retain its intellectual property and pursue additional deals with others. (Sahin has argued strongly that startups need to resist pressure to give away their IP as part of early revenue or funding deals.)

“It required $75 million in private capital and 15 years and everything I learned in academia, at Bell Labs, you name it—and we just managed it,” Sahin says. “And there are dozens, hundreds, of small companies out there that want to get there too.”

That’s the driving motivation for what Sahin describes as the “next stage” in his vision for the company: a new division that offers consulting and evaluation services to startups working on battery components, including cell separators, silicon anodes, or even competing cathode materials. The division will also prepare customized battery kits that these firms can use to help potential partners validate their technologies.

"So that what took us 10 years can take them 10 months,” he says.

But of course, it remains to be seen whether CAMX itself will succeed. In fact, it’s likely to take years before the company's invention lands in any consumer product. Both battery makers and auto manufacturers will need to thoroughly and independently evaluate the materials, as neither can afford to push out a product that might not perform well or safely in the real world over time.

The odds of success for any battery material or component startup are very low, even when the firm is well funded. The company has to demonstrate an advance that’s substantial, scalable, and largely free of trade-offs in order to persuade players further along the supply chain to make massive up-front investments in time and resources.

“You need to be a lot better than the incumbent,” says Gerbrand Ceder, a professor of materials science at the University of California, Berkeley, who oversees a research group co-located at Lawrence Berkeley National Laboratory that’s exploring promising battery materials. “If you’re 10 percent better, no one will talk to you.”

He adds that while CAMX’s business strategy avoids the risks involved in manufacturing, it does entail other downsides. Notably, licensing fees represent just a fraction of the profits businesses can make selling materials or finished batteries. Meanwhile, any firm that doesn’t build value beyond intellectual property could find itself in a risky position in a field notorious for infringement, parallel discoveries, and IP lawsuits.

A $2 trillion disruption

For his part, Sahin is confident in the capabilities of CAMX’s materials and believes there will be plenty of business to go around. In his office, he pulls out a few sheets of white printer paper and starts jotting down figures, columns, and arrows, narrating as he goes.

By 2035, as automobile ownership swells in nations like China and India, manufacturers could be cranking out 140 million vehicles annually, he says. Somewhere between 50 million and 70 million of them are likely to be electric, as battery prices continue to fall and nations including China, England, and Germany prepare to restrict combustion engines.

If those vehicles sold for $30,000 on average, it would add up to a $2 trillion industry annually on the high end. And an enormous cut of that will go to battery makers and suppliers.

Most of the electric-auto sector is controlled by a handful of big companies, including battery giants like Panasonic, LG Chem, and Samsung; chemical conglomerates such as Umicore and Nichia; and vehicle manufacturers like Tesla, BYD, and the Renault-Nissan alliance.

Ramping up to 70 million cars annually within the next 18 years will require them to produce or procure something like 560 billion battery cells each year—and as much as seven million metric tons of cathode materials alone. That represents a massive opportunity for any startup making real strides in cathodes, anodes, or cell components, at least if it can learn to partner with these companies in smart ways, Sahin says.

“A $2 trillion disruptive industry is going to happen," he says. "It is happening. And it’s right under our nose.”

Deep Dive

Climate change and energy

The problem with plug-in hybrids? Their drivers.

Plug-in hybrids are often sold as a transition to EVs, but new data from Europe shows we’re still underestimating the emissions they produce.

Harvard has halted its long-planned atmospheric geoengineering experiment

The decision follows years of controversy and the departure of one of the program’s key researchers.

Why hydrogen is losing the race to power cleaner cars

Batteries are dominating zero-emissions vehicles, and the fuel has better uses elsewhere.

Decarbonizing production of energy is a quick win

Clean technologies, including carbon management platforms, enable the global energy industry to play a crucial role in the transition to net zero.

Stay connected

Get the latest updates from

MIT Technology Review

Discover special offers, top stories, upcoming events, and more.