Where’s the Money for Energy Startups?

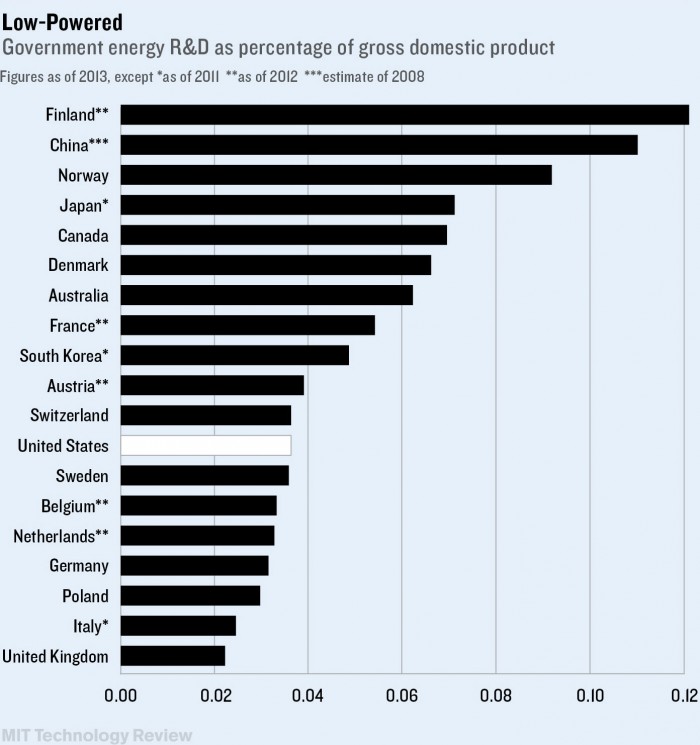

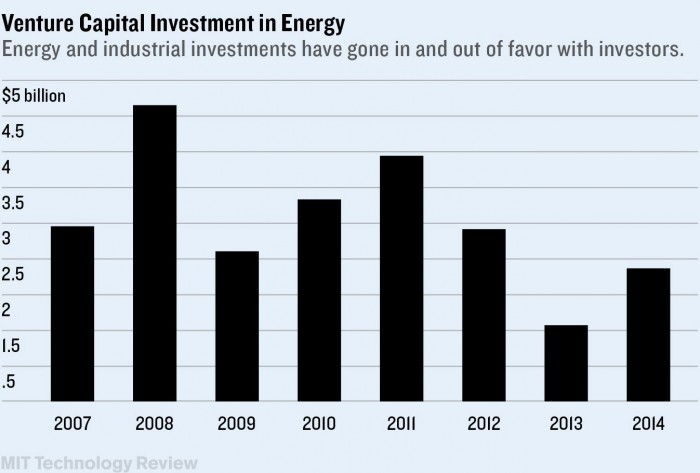

For energy technology startups in the United States, a lot has changed in five years. Between 2008 and 2011, venture capitalists were making record investments in companies building new technologies, and the government was enthusiastically doling out loans to help them commercialize products. Today, several high-profile company failures later, that support has largely evaporated. In 2014, VC investment in clean-energy companies was less than half 2011 levels. The hunt for funding is especially bleak for startups looking to produce solar cells, batteries, or biofuel, the very types of technologies probably needed to transform the world’s fossil-fuel-based energy systems.

It’s possible the enthusiasm for energy of the late 2000s was simply a Silicon Valley bubble, says David Berry, a general partner at Flagship Ventures, a firm based in Cambridge, Massachusetts, who led investments in LS9 (a biofuels company acquired last year by Renewable Energy Group) and Joule Unlimited, which is working to commercialize a process for turning carbon dioxide into fuels. As in other investing bubbles, Berry says, “you had people who got into an industry they didn’t know anything about.” At the time, the price of oil was high, the government was keen to stimulate the development of low-carbon technologies, and there was growing public concern about the climate consequences of using fossil fuels. When conventional energy prices dropped and that momentum dissipated, many companies that had been riding the wave were left stranded.

The hunt for funding is especially bleak for startups looking to produce solar cells, batteries, or biofuel, the very types of technologies probably needed to transform the world’s fossil-fuel-based energy systems.

Many of these startups had no way to raise the funds necessary for commercial-scale production projects far too expensive for most venture capitalists. In VC jargon, the companies faced the very predictable valley of death—the difficult transition from promising advance to mass-produced commercial product. Indeed, though Berry cites Joule as a success story, his other energy company, LS9, struggled to find the money it needed to reach commercial scale and was acquired by a larger public company for less than what it had raised from investors. Building even small pilot plants requires spending lots of capital well before it can be known whether the product is viable. Early technology development, and construction of commercial-scale demonstration plants, can take many years and hundreds of millions of dollars.

Companies that need to develop new hardware or a new kind of fuel often can’t progress to the point where they are generating revenue soon enough to satisfy conventional venture capital funds, which are typically expected to yield returns within seven or eight years. Even if they succeed in scaling up, they’re competing in industries with extremely low margins, further discouraging venture investors.

So who supplies the capital needed to build risky large-scale production or manufacturing facilities? Other types of investors can be more flexible, such as foundations and wealthy families interested in clean energy. One example of a company that has secured a significant investment from a family-backed investment group is Ambri, which is developing a novel liquid-metal battery for grid-scale energy storage.

Corporate venture funds with a specialty in energy can offer a helpful connection when a startup gets to the point of scaling up its manufacturing. Companies like GE, which is now invested in more than 30 energy startups, understand that competing in energy markets requires manufacturing products at large scale.

Industrial partners have provided crucial funding for the solar startup 1366 Technologies and serve as a valuable “reality check,” says founder and CEO Frank van Mierlo. The company, which is developing a cheaper way to make silicon wafers for solar cells, was founded during the exuberance of the late 2000s. It has survived thanks in part to backing by GE Ventures, and recently signed a strategic long-term partnership with South Korea’s Hanwha Q-Cells, a major solar-panel maker. The company has also raised funds outside the U.S.; an April funding round was led by a Chinese VC firm.

Throop Wilder, CEO of the early-stage lithium-ion battery startup 24M, says he and his colleagues have understood from the start that they “cannot build huge plants.” Instead, 24M, which says it can significantly cut the cost of manufacturing batteries, is pursuing a modular approach that will allow the company to build small factories for tens of millions instead of hundreds of millions.

Keep Reading

Most Popular

How scientists traced a mysterious covid case back to six toilets

When wastewater surveillance turns into a hunt for a single infected individual, the ethics get tricky.

The problem with plug-in hybrids? Their drivers.

Plug-in hybrids are often sold as a transition to EVs, but new data from Europe shows we’re still underestimating the emissions they produce.

What’s next for generative video

OpenAI's Sora has raised the bar for AI moviemaking. Here are four things to bear in mind as we wrap our heads around what's coming.

Stay connected

Get the latest updates from

MIT Technology Review

Discover special offers, top stories, upcoming events, and more.