Sponsored

Cryptocurrency fuels new business opportunities

As adoption of digital assets accelerates, companies are investing in innovative products and services.

In association withPrime Trust

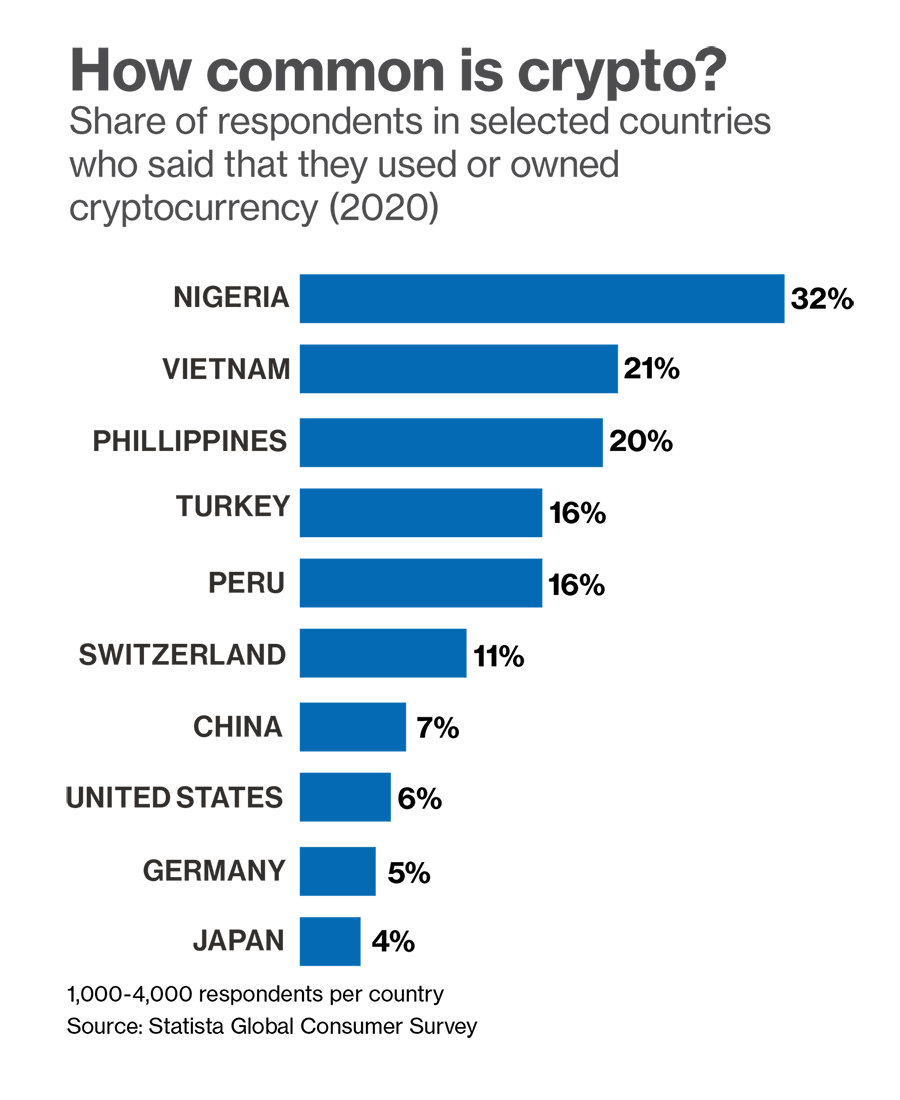

Cryptocurrency is fast gaining mainstream acceptance as consumers look for innovative ways to diversify their savings, protect against inflation, and save on transaction fees.

Big-name brands are taking note: PayPal, Starbucks, AT&T, AMC Theatres, Microsoft, and Whole Foods are among a growing battalion of organizations that now accept payment in cryptocurrencies. In fact, nearly 16,000 venues around the world accept cryptocurrency payments, according to Coinmap.org. And the cryptocurrency market is expected to grow from $1.6 billion in 2021 to $2.2 billion by 2026, according to a report published by MarketsandMarkets.

At the same time, cryptocurrency presents an opportunity for companies to create new and innovative offerings around these digital assets. Examples range from mobile apps that allow consumers to get started with cryptocurrency quickly and easily to platforms that automate bitcoin purchasing for fledgling investors.

Cryptocurrency fuels new business opportunities

But while staking a claim in today’s cryptocurrency market can drive customer engagement and competitive wins, the right set of tools and talent are required to hurdle obstacles that include consumer fears, technology headaches, and compliance concerns.

Crypto market demand

Consumer demand isn’t the only driver of enterprise cryptocurrency adoptions. Digital assets such as bitcoin, ethereum, solana, and avalanche, are based on a distributed ledger called blockchain. This decentralized approach means data is stored in an individual’s crypto wallet rather than in a centralized depository where data breaches can occur.

A blockchain general ledger is used to verify and record every transaction, making cryptocurrency transactions not only more secure than credit and debit card payments, but faster by eliminating the need for time-consuming third-party verification. “We’ve seen increasing demand from merchants—from supermarkets to fast-food chains—that want to accept crypto because it truly is a win-win for consumers and merchants,” says Sara Xi, chief product officer at Prime Trust, a fintech infrastructure provider with API crypto integration.

Lower transaction fees are another advantage of cryptocurrencies. “Crypto really needs to be adopted just like any other fiat payment rail. When consumers pay for stuff, they can simply pay with crypto and bypass conversion to a fiat currency as an intermediary,” says Xi. “Credit card processing fees will be irrelevant for merchants or consumers.”

In addition to cost savings, cryptocurrency is enabling businesses to access new target demographics. Take, for example, The Pavilions Hotels & Resorts group, a Hong Kong-based hospitality group. The Pavilions is one of the first international hotel chains to embrace digital currency payments. Customers can book rooms in many of the hotel chain’s global destinations, based on the currency and location they are situated in at the time of booking, using bitcoin, ethereum, or 40 other digital currencies.

According to Scot Toon, managing director of the Asia region of The Pavilions Hotels & Resorts, accepting cryptocurrency payments has helped The Pavilions Hotel Group to nurture lucrative crossover markets, such as luxury travelers who also happen to trade in cryptocurrency.

Joseph Lupo agrees. Lupo is a general manager with CoinBits, which helps businesses and investors securely build, manage, and protect their money in a private bitcoin portfolio. “We saw a demand for higher net-worth individuals and businesses who want to invest in this new asset class,” says Lupo. “They need an on-ramp and someone they can trust since bitcoin doesn’t have a team or headquarters, so we started Coinbits Reserve to help businesses and higher net worth individuals invest in bitcoin. We manage their investments but also focus on education and what this new form of digital, finite money can do for them.”

Crypto considerations

While companies ponder potential business models and use cases for cryptocurrency, there are factors to consider before entering the market. Cryptocurrency is still marked by volatility and wild price fluctuations. And security and regulation compliance concerns can slow adoption in more heavily regulated sectors, such as finance. “Banks are going back and forth on how they can get into crypto compliantly,” says Xi of Prime Trust. “What’s holding them back is that the regulations in this space require both crypto domain knowledge and compliance expertise to understand. Making it worse is that there haven’t been clear regulations on what’s compliant.”

Also pressing is the need for IT infrastructure to evolve to integrate cryptocurrencies. For example, The Pavilions Hotel relies on a legacy booking engine for guests to reserve a hotel room online. However, Toon says the system was unable to accept cryptocurrency payments. The company searched for an alternative, but in the end, Toon says, the hotel chain wasn’t “able to find a suitable vendor that was willing to allow us to put cryptocurrency through the booking engine.”

As a result, rather than book online, The Pavilions’ crypto-paying guests must make a direct booking through the company’s reservations center. Following a call, an agent delivers an email containing a link that guests click on or scan to complete a cryptocurrency payment. It’s an extra step that Toon says can “slow down the process. People want to book now—they don’t want to talk to anyone or email anyone. They just want to make the reservation themselves.”

As cryptocurrencies gain mainstream acceptance, Xi says businesses will increasingly seek out agnostic IT infrastructure that allows for easy integration with a wide array of features and solutions. Otherwise, she notes, “it can become overwhelming and cost prohibitive to deal with multiple vendor integrations.”

Another challenge facing organizations entering the cryptocurrency market is a scarcity of qualified talent— a key component in developing innovative products and services. “We all know that engineering and product talent in crypto is extremely hard to come by these days,” says Xi. Which, she says, can lead to one of two unfavorable outcomes: either “huge costs upfront to staff in-house teams,” or alternatively, if a company chooses to scrape by on a modest-sized team, “a really long time to go to market and a missed opportunity” to gain a competitive edge.

This content was produced by Insights, the custom content arm of MIT Technology Review. It was not written by MIT Technology Review’s editorial staff.

Deep Dive

Business

This solar giant is moving manufacturing back to the US

Tariffs and IRA tax incentives are starting to reshape global supply chains—but vast challenges lie ahead, explains Shawn Qu, founder of Canadian Solar.

Let’s not make the same mistakes with AI that we made with social media

Social media’s unregulated evolution over the past decade holds a lot of lessons that apply directly to AI companies and technologies.

Scaling individual impact: Insights from an AI engineering leader

The rapid pace of AI has put more emphasis on individual contributors at the executive level. Capital One's Grant Gillary explores the unique challenges of being a senior engineering executive and an individual contributor.

The world’s most famous concert pianos got a major tech upgrade

Steinway's Spirio pianos let you experience performances by piano virtuosos in your living room.

Stay connected

Get the latest updates from

MIT Technology Review

Discover special offers, top stories, upcoming events, and more.