This solar giant is moving manufacturing back to the US

Tariffs and IRA tax incentives are starting to reshape global supply chains—but vast challenges lie ahead, explains Shawn Qu, founder of Canadian Solar.

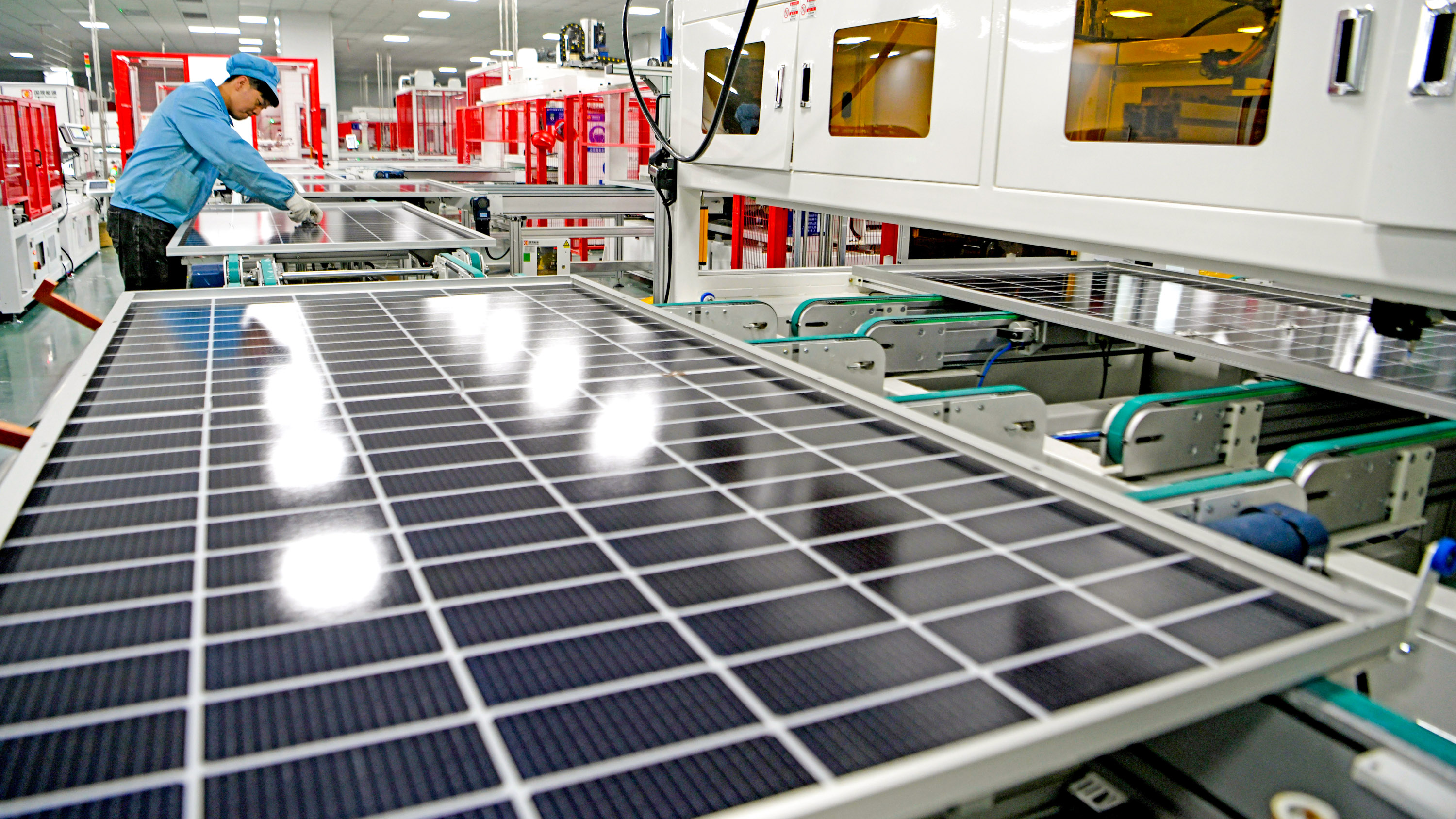

Whenever you see a solar panel, most parts of it probably come from China. The US invented the technology and once dominated its production, but over the past two decades, government subsidies and low costs in China have led most of the solar manufacturing supply chain to be concentrated there. The country will soon be responsible for over 80% of solar manufacturing capacity around the world.

But the US government is trying to change that. Through high tariffs on imports and hefty domestic tax credits, it is trying to make the cost of manufacturing solar panels in the US competitive enough for companies to want to come back and set up factories. The International Energy Agency has forecast that by 2027, solar-generated energy will be the largest source of power capacity in the world, exceeding both natural gas and coal—making it a market that already attracts over $300 billion in investment every year.

To understand the chances that the US will succeed, MIT Technology Review spoke to Shawn Qu. As the founder and chairman of Canadian Solar, one of the largest and longest-standing solar manufacturing companies in the world, Qu has observed cycle after cycle of changing demand for solar panels over the last 28 years.

After decades of mostly manufacturing in Asia, Canadian Solar is pivoting back to the US because it sees a real chance for a solar industry revival, mostly thanks to the Inflation Reduction Act (IRA) passed in 2022. The incentives provided in the bill are just enough to offset the higher manufacturing costs in the US, Qu says. He believes that US solar manufacturing capacity could grow significantly in two to three years, if the industrial policy turns out to be stable enough to keep bringing companies in.

How tariffs forced manufacturing capacity to move out of China

There are a few important steps to making a solar panel. First silicon is purified; then the resulting polysilicon is shaped and sliced into wafers. Wafers are treated with techniques like etching and coating to become solar cells, and eventually those cells are connected and assembled into solar modules.

For the past decade, China has dominated almost all of these steps, for a few reasons: low labor costs, ample supply of proficient workers, and easy access to the necessary raw materials. All these factors make made-in-China solar modules extremely price-competitive. By the end of 2024, a US-made solar panel will still cost almost three times as much as one produced in China, according to researchers at BloombergNEF.

The question for the US, then, is how to compete. One tool the government has used since 2012 is tariffs. If a solar module containing cells made in China is imported to the US, it’s subject to as much as a 250% tariff. To avoid those tariffs, many companies, including Canadian Solar, have moved solar cell manufacturing and the downstream supply chain to Southeast Asia. Labor costs and the availability of labor forces are “the number one reason” for that move, Qu says.

When Canadian Solar was founded in 2001, it made all its solar products in China. By early 2023, the company had factories in four countries: China, Thailand, Vietnam, and Canada. (Qu says it used to manufacture in Brazil and Taiwan too, but later scaled back production in response to contracting local demand.)

But that equilibrium is changing again as further tariffs imposed by the US government aim to force supply chains to move out of China. Starting in June 2024, companies importing silicon wafers from China to make cells outside the country will also be subject to tariffs. The most likely solution for solar companies would be to “set up wafer capacity or set up partnerships with wafer makers in Southeast Asia,” says Jenny Chase, the lead solar analyst at BloombergNEF.

Qu says he’s confident the company will meet the new requirements for tariff exemption after June. “They gave the industry about two years to adapt, so I believe most of the companies, at least the tier-one companies, will be able to adapt,” he says.

The IRA, and moving the factories to the US

While US policies have succeeded in turning Southeast Asia into a solar manufacturing hot spot, not much of the supply chain has actually come back to the US. But that’s slowly changing thanks to the IRA, introduced in 2022. The law will hand out tax credits for companies producing solar modules in the US, as well as those installing the panels.

The credits, Qu says, are enough to make Canadian Solar move some production from Southeast Asia to the US. “According to our modeling, the incentives provided just offset the cost differences—labor and supply chain—between Southeast Asia and the US,” he says.

Jesse Jenkins, an assistant professor in energy and engineering at Princeton University, has come to the same conclusion through his research. He says that the IRA subsidies and tax credits should offset higher costs of manufacturing in the US. “That should drive a significant increase in demand for made-In-America solar modules and subcomponents,” Jenkins says. And the early signs point that way too: since the introduction of the IRA, solar companies have announced plans to build over 40 factories in the US.

In 2023, Canadian Solar announced it would build its first solar module plant in Mesquite, Texas, and a solar cell plant in Jeffersonville, Indiana. The Texas factory started operating in late 2023, while the Indiana one is still in the works.

The remaining challenges

While the IRA has brought new hope to American solar manufacturing, there are still a few obstacles ahead.

Qu says one big challenge to getting his Texas factory up and running is the lack of experienced workers. “Let’s face the reality: there was almost no silicon-based solar manufacturing in the US, so it takes time to train people,” he says. That’s a process that he expects to take at least six months.

Another challenge to reshoring solar manufacturing is the uncertainty about whether the US will keep heavily subsidizing the clean energy industry, especially if the White House changes hands after the election this year. “The key is stability,” Qu says, “Sometimes politicians are swayed by special-interest groups.”

“Obviously, if you build a factory, then you do want to know that the incentives to support that factory will be there for a while,” says Chase. There are some indications that support for the IRA won’t necessarily be swayed by the elections. For example, jobs created in the solar industry would be concentrated in red states, so even a Republican administration would be motivated to maintain them. But there’s no guarantee that US policies won’t change course.

Deep Dive

Business

Let’s not make the same mistakes with AI that we made with social media

Social media’s unregulated evolution over the past decade holds a lot of lessons that apply directly to AI companies and technologies.

Scaling individual impact: Insights from an AI engineering leader

The rapid pace of AI has put more emphasis on individual contributors at the executive level. Capital One's Grant Gillary explores the unique challenges of being a senior engineering executive and an individual contributor.

This architect is cutting up materials to make them stronger and lighter

Emily Baker hopes her designs can make it cheaper and easier to build stuff in disaster zones or outer space.

Three takeaways about the state of Chinese tech in the US

As Chinese consumer tech giants retreat from the global spotlight, a batch of climate tech companies have become the new stars.

Stay connected

Get the latest updates from

MIT Technology Review

Discover special offers, top stories, upcoming events, and more.