Solar Manufacturer Morgue Adds More

For solar industry watchers, this week brings another remind of how me-too technology will eventually wither away.

Thin-film solar manufacturer Global Solar has shut down, according to a report at Inside Tuscon Business. Ampluse, a startup first funded in 2009, is also preparing to close down, according to Greentech Media.

Both companies had very different approaches geared at lowering the cost of solar. But the last year has shown that challengers need to have clearly differentiated technology and business plans that allow them to scale up. A number of solar companies, both young and old have been forced into bankruptcy by the glut of solar panels on the market, driven by low-cost Chinese suppliers.

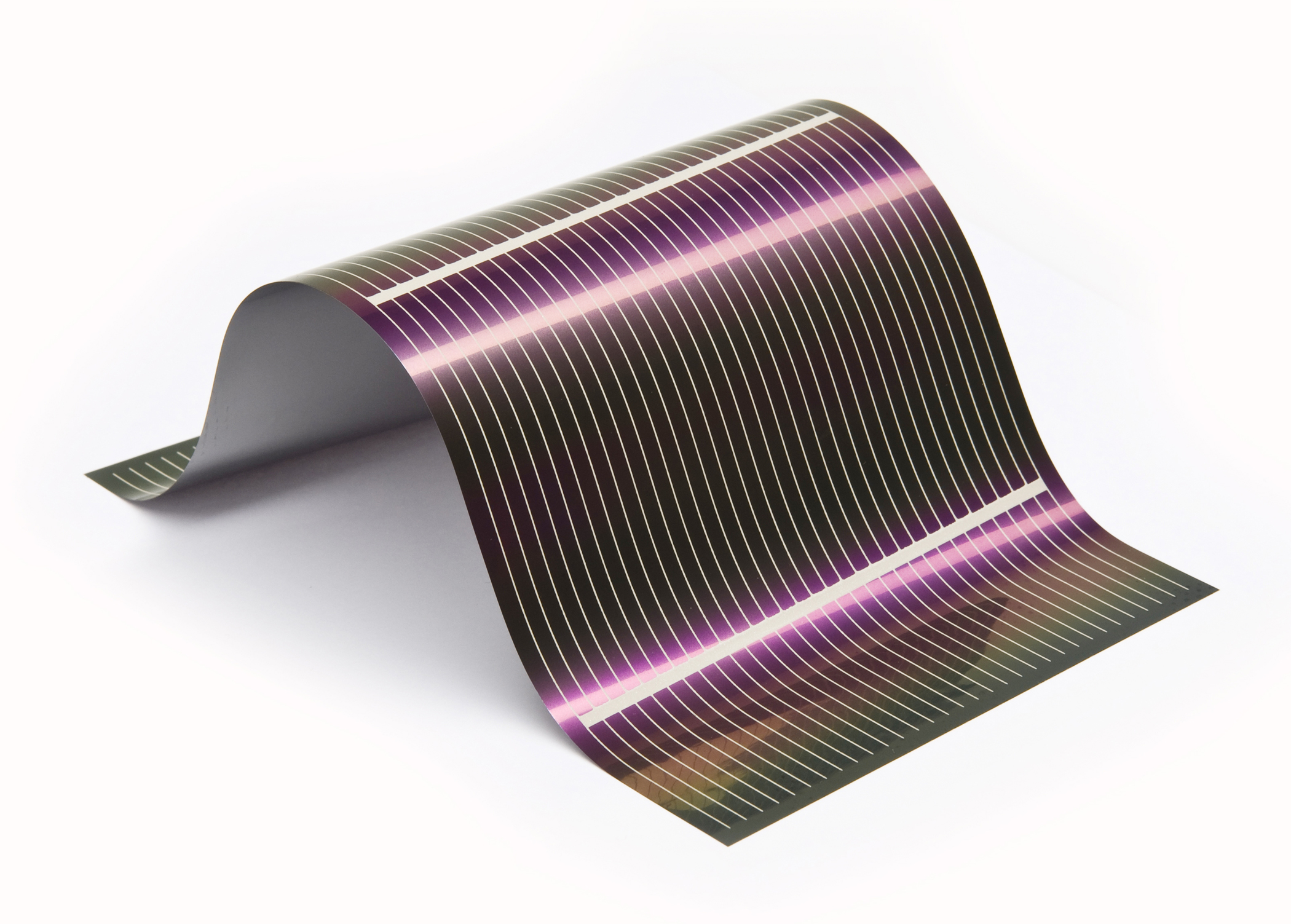

Global Solar was one of the first companies to commercialize thin-film solar cells using CIGS, a combination of copper, indium, gallium, and selenium. In 2008, I heard Global Solar’s CEO pitch investors and brashly claim that Global Solar was far ahead of rivals in developing CIGS solar products. The company made small foldable chargers for small electronics but was seeking to expand into utility-scale solar in Europe, a much larger potential market.

The company partnered with Dow for its flexible solar cells to be integrated into roofing tiles. But Dow delayed that product a number of times and eventually went with another company’s technology. The building-integrated photovoltaics business, in general, has been slow to form.

More fundamentally, the price per watt of thin-film solar cells, which are less efficient, has had difficulty keeping pace with commodity silicon panels from China. Ahead of Global Solar are several startups which have shut down or been sold at great loss to investors, including Miasole, AQT, and Abound Solar. (See Is Thin Film Solar Dead?)

Ampulse, which was started at a time when the dramatic cost reductions in solar were evident, sought to commercialize a process for making thin-film solar cells with crystalline silicon. It licensed technology from the National Renewable Energy Laboratory and Oak Ridge National Laboratory, which it said promised a 75 percent reduction in cost. (See, Manufacturing Method Promises Cheaper Silicon Solar.)

If it can actually achieve those improvements, its technology may still see the light of day. But as many small companies have seen, relationships with well financed partners, such as incumbent manufacturers, are critical to market adoption. Also, many thin-film solar companies have had technical challenges meeting performance goals as they scale from the lab to production. (See, How Solar Startups Can Survive the Shakeout.)

Analysts say more failed companies are on the way as the industry works through the oversupply of goods and soft demand in certain markets, such as Germany. For buyers, the benefits are clear: solar power has never been cheaper to buy. But for technologists the bar has never been higher.

Keep Reading

Most Popular

How scientists traced a mysterious covid case back to six toilets

When wastewater surveillance turns into a hunt for a single infected individual, the ethics get tricky.

The problem with plug-in hybrids? Their drivers.

Plug-in hybrids are often sold as a transition to EVs, but new data from Europe shows we’re still underestimating the emissions they produce.

What’s next for generative video

OpenAI's Sora has raised the bar for AI moviemaking. Here are four things to bear in mind as we wrap our heads around what's coming.

Stay connected

Get the latest updates from

MIT Technology Review

Discover special offers, top stories, upcoming events, and more.