Inside Shenzhen’s race to outdo Silicon Valley

Every day at around 4 p.m., the creeeek criikkk of stretched packing tape echoes through Huaqiangbei, Shenzhen’s sprawling neighborhood of hardware stores. Shopkeepers package up the day’s sales—selfie sticks, fidget spinners, electric scooters, drones—and by 5, crowds of people are on the move at the rapid pace locals call Shenzhen sudu, or “Shenzhen speed,” carting boxes out on motorcycles, trucks, and—if it’s a light order—zippy balance boards. From Huaqiangbei the boxes are brought to the depots of global logistics companies and loaded onto airplanes and cargo ships. In the latter case they join 24 million metric tons of container cargo going out every month from Shekou harbor—literally “snake’s mouth,” the world’s third-busiest shipping port after Shanghai and Singapore.

A few days or weeks later, the boxes arrive in destinations as nearby as Manila and Phnom Penh and as far afield as Dubai, Buenos Aires, Lagos, and Berlin. They appear in the world’s largest cities and smallest villages: selfie sticks held up in front of Indian temples, a (rebranded) Xiaomi electric scooter cruising down San Francisco’s Market Street, and a DJI drone flying over pretty much anywhere. If your gadget says “Made in China,” the chances are it came from Shenzhen.

From a population of 30,000 in the early 1970s, the city has grown to over 10 million, with gleaming high-rises, a modern transport system, and world-class retail. The local government gives grants for filing patents and for starting maker spaces. Gentrification and rising rents have made it the most expensive city in China, as the factories that fueled its boom move steadily outward into the rest of the Pearl River Delta.

Shenzhen is changing in other ways, too. Instead of just hardware (like hoverboards), it’s making sophisticated products that combine hardware with software (just-in-time bookable electric scooters, app-controlled drones) and, increasingly, artificial intelligence (translation devices, toy robots, semi-autonomous vehicles). Moving beyond its reputation for developing cheap rip-offs of other people’s ideas, it’s become more of a hub that connects innovation, manufacturing, and knowledge all over the world.

This means Shenzhen could become something that Silicon Valley—for all its extraordinary concentration of money and talent—has never quite been: a technology hub with products available for every country and almost any budget. The question is whether it can keep adapting and growing in the face of three combined threats: burgeoning barriers to globalization, an increasingly authoritarian Chinese government, and the costs of its own success.

Shanzhai and the mountain bandits of tech

Most global consumers’ first contact with Shenzhen came through products like the selfie stick. Seemingly frivolous, relatively easy to manufacture, they were born of a process of product development and distribution called shanzhai (山寨). The term literally means “mountain hideout” (an apocryphal story traces its origins to factories in the hills of northern Hong Kong).

In much the same way that open-source software enables a global community of developers to copy and remix each other’s work, rapidly creating variants on a piece of software to meet different needs, the shanzhai method delivered “hardware memes”—gadgets quickly designed and built out of easily sourced and readily interchangeable parts. Just as digital news outlets might test multiple headlines and tweets to see which one gets the most clicks, a shanzhai manufacturer would release 10 products with a mixture of copied and original designs, and go with whatever worked.

A product that took 12 to 18 months for a Western company to bring to market might take only four to six weeks within the shanzhai ecosystem. It was common for Western companies that announced a new gadget to find shanzhai versions of it on the shelves before they could put it on sale themselves. Many early shanzhai successes were copies of popular phones by brands including Nokia, Samsung, and Apple.

It’s easy to dismiss these products as cheap knockoffs, but there was a lot of experimentation with new features, too. A notable example is the dual SIM card, a feature only recently introduced to Apple phones but available for over a decade in shanzhai products.

What made this experimentation possible was the Pearl River Delta’s vibrant network of suppliers and small factories, and China’s lax attitude toward intellectual property. Entrepreneurs could decide what to produce by visiting the sprawling Huaqiangbei market, where hundreds of factories maintain storefronts, often little more than two meters wide, to showcase their wares. A successful product in Huaqiangbei was easy for competitors to identify and copy, and Chinese brands were as susceptible to imitation as Western ones. A single hit, selling as few as 10,000 units, was sufficient to turn a profit and fund nine other market failures.

But while there will always be a market for the next fidget spinner, shanzhai has its limits. Companies whose products gain a foothold in overseas markets are also being exposed to those countries’ intellectual-property laws. And as they graduate from fidget spinners and hoverboards to internet-connected lightbulbs and AI devices, they need more design and branding expertise.

If shanzhai had failed to evolve, it would have remained an interesting footnote in the history of globalization. But nothing in Shenzhen stays still for long.

From the factory floor to the design studio

A short taxi ride away from the bustle of Huaqiangbei are the offices of a design consultancy called Innozen. The calm open-plan space leads to a minimalist white meeting room with a shelf of awards, including several international design prizes.

“Shanzhai is a form of ‘blindfold design,’” explains Innozen cofounder Michael Zheng. The process, he says, contains no overarching strategy, and “the technological barriers are constantly lowering.”

Zheng’s company is one of a new breed of consultancy, known locally as an industrial design company, that has sprung up in Shenzhen to help both Western and Chinese firms develop products (translation earbuds, smart pens, VR goggles) more sophisticated than what emerges from shanzhai. Zheng works closely with people like Donny Zhang, head of another kind of consultancy, an independent design house, which is like an engineering firm with some design skills.

Zheng and Zhang represent the new creative class in China. Educated in London and New York, respectively, they speak fluent English and Chinese and are as comfortable with Western design norms and aesthetics as with Chinese business culture and production processes. Together, they help clients realize an idea, orchestrating the work between factories, custom molding shops, and software developers. They know where to source components and get them assembled, but they also understand the needs and values of a global clientele.

Industrial design companies and independent design houses are the newest parts of a larger ecosystem of business services that includes incubators, coworking spaces, and fab labs such as the Shenzhen Open Innovation Lab (SZOIL), near the border with Hong Kong. SZOIL takes in foreign and Chinese makers alike, teaches them basic fabrication and prototyping skills, and connects them with design firms like Innozen.

Financing, too, has evolved. Budding shanzhai entrepreneurs had to borrow from component suppliers and family members. Now both venture capital firms and big technology companies like Xiaomi and Tencent invest in smaller teams’ efforts. Sites like Kickstarter and Amazon also allow manufacturers to skip the rougher environs of Huaqiangbei and reach foreign markets directly. Online payment platforms like WeChat Pay and Alipay help streamline sales and costs.

As products get more advanced, they also become tied into a global software ecosystem and its norms. Many of the devices now available in Huaqiangbei use apps available on the Apple and Google app stores as well as the 360 Store, one of the main Android app stores used in China. They range from a “smart speaker” that taps into Amazon Alexa’s API to app-controlled toys that sing and dance on cue and learn voice commands from users. The software is written by a community of developers emerging in a software park in Shenzhen’s western end, as well as in the software hubs of Shanghai and Beijing. Such products require considerably more investment in design, software development, and user experience: during one studio visit, for instance, we passed a room full of workers training AI systems for autonomous vehicles.

This network of design, manufacturing services, financing, and software development, together with a growing recognition of the quality of Chinese products, is enabling Shenzhen companies to reach further into global markets. One example is the electric scooters that have appeared in cities around the world. The scooters themselves are all made in China, but the companies that brand and distribute them might be in Barcelona (Joyor), Mexico City (Grin), or California (Bird and Lime). In some cases competing distributors even use the same physical scooters, just with different branding and apps.

SZOIL founder David Li calls this the expression of “China as a service.” Instead of having to learn to build electric scooters, Joyor, Grin, Bird, and Lime can focus on the work that requires local knowledge, like distribution and getting permits from city governments.

The Pearl River Delta of hardware

It’s become fashionable to call Shenzhen the “Silicon Valley of hardware.” Even though Silicon Valley’s own name is derived from its role as the early epicenter of computer hardware, it’s useful to examine the analogy.

Like Silicon Valley, the Pearl River Delta region contains a mix of expertise and capabilities. Its factories, component suppliers, service providers, and skilled workforce are difficult to replicate. Just as Silicon Valley benefited from the open-source software movement, Shenzhen grew thanks to the open-source-like production ecosystem of shanzhai. And the Delta resembles Silicon Valley in being not a singular geography but a globally interconnected one, attracting foreign investment and collaboration and exporting its influence on the world’s technology infrastructure.

Shenzhen’s rapid growth, though, has also come with human costs, many similar to those experienced in the San Francisco Bay Area.

The three (and a half) eras of Shenzhen

Shanzhai era

A period characterized by the rapid manufacture of electronics, often copies of popular Western-made products, saw growth driven by global demand for entry-level smartphones, especially in emerging markets. Short product development cycles and an ecosystem of component suppliers delivered cheap but low-quality gadgets.Formalization era

Three factors drove this period: Workers became more skilled and demanded higher wages. Successful companies had reputations to protect and moved toward branded products. And the government began to crack down on intellectual-property theft as it took steps toward its WTO commitments.Maker movement

Following a visit to Shenzhen by Premier Li Keqiang in 2015, over a thousand “maker spaces” were set up to encourage companies to develop new products instead of copying existing ones. In reality, many were no more than coworking spaces, and almost all shut down after their business models failed.Globalization era

A more mature innovation ecosystem has emerged that understands how to serve the global market. It’s enabled by access to venture capital, global crowdsourcing platforms, primed sales channels, and the rise of a Chinese creative class that can work with global design norms.

The rising cost of living means many people from earlier waves of migration to Shenzhen can no longer afford to live there. Air quality has worsened, so factories and other polluting industries are being moved out of the city—along with the jobs that employed those first migrants. The pressures of urban life are compounded by the one-child policy China had until 2016, which puts a heavy burden on people looking after aging parents and grandparents. In a highly materialistic culture, standing still means falling behind: there is social pressure to get married, but that also comes with the expectation of buying an apartment and car. Women struggle to get promoted in a male-dominated working environment. Burnout is rife, and opportunities for exploitation are high.

Some of the constraints the city experiences, on the other hand, are unique to China. Even as more of the new products coming out of Shenzhen are internet-connected, the government of Xi Jinping is instituting tighter controls on the internet. While sites like Kickstarter and Amazon are not blocked per se, key ways of reaching international audiences, like Instagram and Twitter, are accessible only from the mainland through virtual private networks, which the government is making increasingly hard to use. WeChat Pay and Alipay, meanwhile, require a Chinese bank account, making it hard to take payment from foreign clients. All this hampers Shenzhen-based businesses’ dreams of going global.

Finally, as powerful as the Shenzhen tech ecosystem is, it relies heavily on the existence of free trade and gray-market labor, both of which are under pressure—the former from a trade war between the US and China, the latter from growing demands for better wages by the Chinese middle class. Distrust of Chinese-made products abroad is growing: many internetof-things devices, like smart plugs and security cameras, have been found to be easily hackable, and in early 2018 the heads of the main US intelligence agencies said Americans shouldn’t buy phones from Huawei and ZTE because the Chinese government might be using them to spy on or interfere with American communications networks. This isn’t just a China-US problem, but a global one of rising “technonationalism” that could dampen the rise of globalization.

But as the city’s entrepreneurs have bumped up against these limits, they have started to transcend them by exporting not only Shenzhen-made products but the Shenzhen model itself.

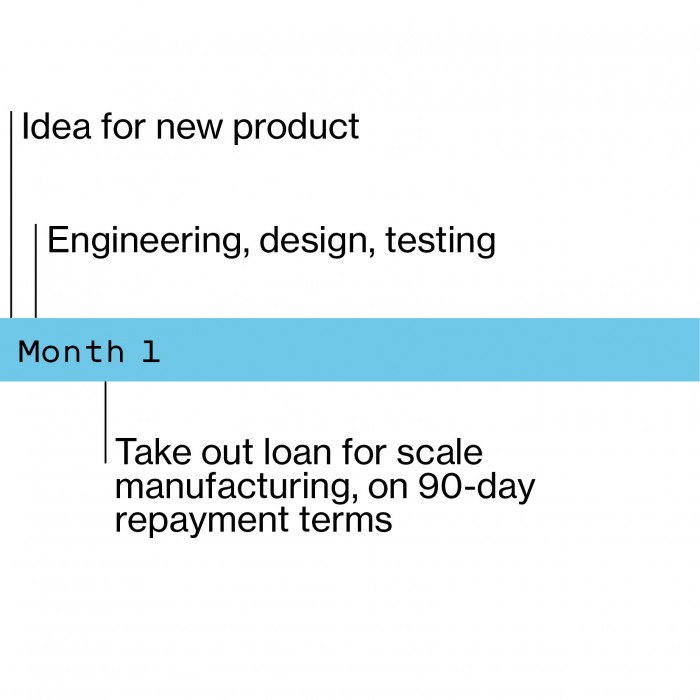

The Shenzhen product timeline

Rex Chen, a tattooed designer and engineer who moved to Shenzhen a couple of years ago, personifies the modern Chinese entrepreneur who understands Western sensibilities. He had an idea for an electric skateboard that could operate smoothly without an unsightly battery, and raised nearly $750,000 from over 1,100 backers on Kickstarter. He expertly navigates the complex web of services and manufacturing in Shenzhen, but he can test his products on the party scene in Shanghai and understands the ins and outs of the technologies he is crafting.

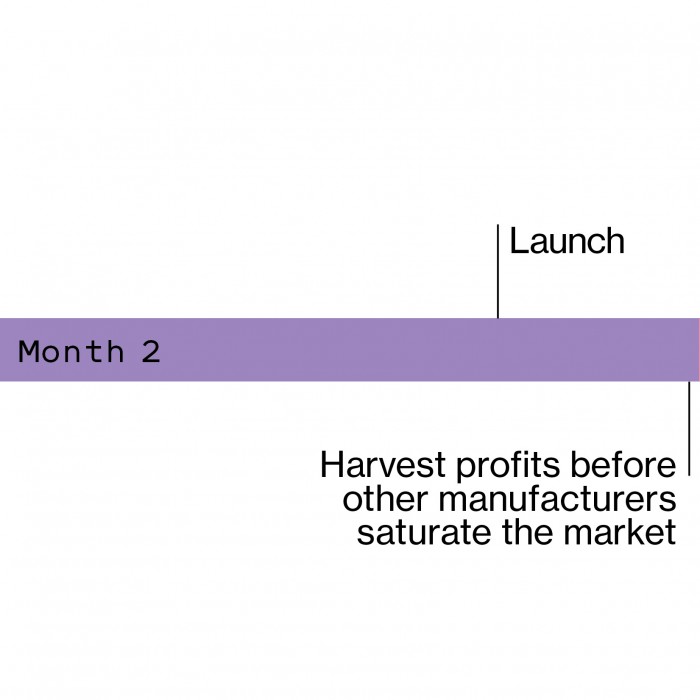

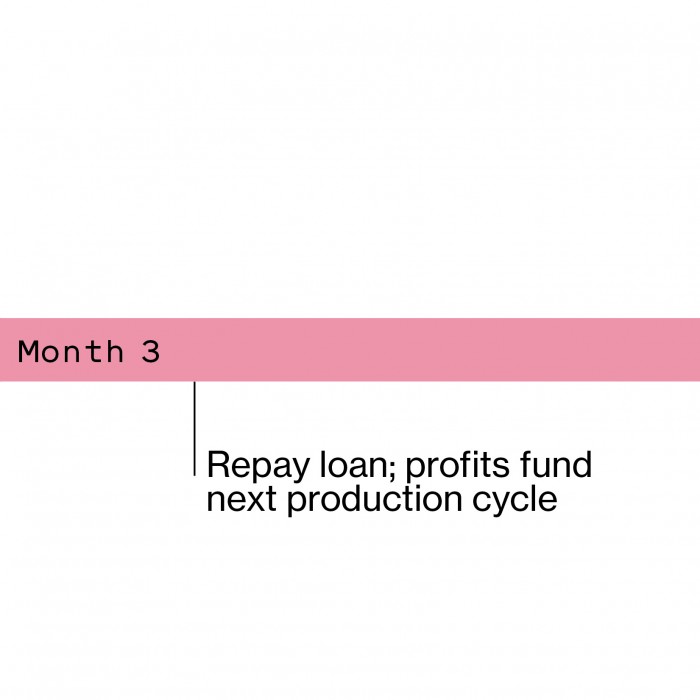

Chen reports that he has about three months from initial concept to launching and harvesting profits before copycats saturate the market. Component suppliers typically offer 90-day repayment terms. This allows Chen to fund the manufacturing run and reinvest the profit into his next concept.

“Chinese businessmen don’t care about competition in the way that you do,” Chen says. “The more people that are making the same product, the safer it is.” Indeed, if an idea is new and unproven, component suppliers will require payment up front. This tends to lead to design evolution rather than revolution—for example, going from an electric skateboard to an electric scooter.

But the pressure to work faster is always there, Chen says. “We can go from concept to market in three months. But that is still one month too slow.”

Shenzhen everywhere

Take a few. They’re very tasty.” In his high-rise office in western Shenzhen, Robin Wu hands us a few grains of moringa, a slightly bitter seed eaten in Ethiopia for its reputed health benefits. He serves us Chinese tea in styrofoam cups, and as we talk, he glances occasionally at his phone for messages and at a three-screen panorama setup he has for video calls and demos. Wu, who made headlines in 2010 as the “shanzhai king” after he produced an iPad-like device within 60 days of Apple’s releasing the original iPad, now owns and operates a series of factories in Ethiopia. Having started his Shenzhen journey by selling bootleg DVDs in the early days of Huaqiangbei, Wu is now part of a trend toward Chinese companies investing globally in manufacturing.

Shenzhen’s rising labor costs, combined with the tit-for-tat trade tariffs that China and the US have imposed on one another, are encouraging factories to move not only outside the city but outside the country. This adds to an existing trend of Chinese investment in production around the world, especially in sub-Saharan Africa and Southeast Asia, spurred by the Belt and Road Initiative—the Xi administration’s own program for expanding ports, railways, and other infrastructure across Asia, Africa, and Europe.

Exporting Shenzhen-style production sometimes also means exporting Shenzhen-style labor exploitation. A number of Chinese companies have been embroiled in scandals over pay and working conditions in Africa, for instance. It’s also unclear whether the economic gains benefit both regions equally or are mostly flowing back to China. As researchers Deborah Bräutigam and Tang Xiaoyang have observed, Chinese economic cooperation zones conducive to trade have sprung up around Africa, but data on their impact remain slim.

Yet technologists in Africa and around the world are keen to learn from the Shenzhen model. “There’s a real eagerness in Shenzhen in terms of reaching out and welcoming collaborations,” says Seyram Avle, an assistant professor at the University of Massachusetts, Amherst, who together with Silvia Lindtner at the University of Michigan has been studying connections between Shenzhen and the African continent. They have documented how entrepreneurs from countries like Ghana and Ethiopia might travel to China or use online services to build businesses for local needs, ranging from making phone chargers with LED lights to testing prototypes for agricultural and medical hardware. “I think the real hero of the story is the small-scale businesses in Accra, in Lagos, in Nairobi, in Shenzhen, reaching out across to each other and building things they think have value for their own people,” Avle says.

Shenzhen has also had a more indirect influence on the kinds of technology products the whole world is making. While hardware memes like selfie sticks and hoverboards fade from view after a flurry of attention, they—just like internet memes—leave behind echoes that crop up in new settings. The descendant of the selfie stick is the handheld gimbal stabilizer that, for as little as a hundred dollars, turns any camera into a semi-professional video platform. The hoverboard may have been a one-hit wonder fueled by social media, but scooters and balance boards are taking off as viable modes of short-distance transportation. The first toy quadcopters were little more than annoyances, but their bigger cousins, combined with specialized software, are transforming both filmmaking and surveying work.

For now, what makes Shenzhen unique as a manufacturing hub is its ability to accommodate everything from the serious to the silly, from the experimental to the sustainable, from devices that alleviate poverty to gadgets that grab headlines. When we asked Zhang about the cultural DNA embedded in the products coming out of Shenzhen, he replied, “Products made in Shenzhen have a hundred percent Chinese DNA and a hundred percent Western DNA. A hundred percent Western because, even if they’re made in China, they are consumed by the world.”

An Xiao Mina leads the product team at Meedan, a social technology company, and is the author of Memes to Movements: How the World’s Most Viral Media Is Changing Social Protest and Power.

Jan Chipchase is the founder of Studio D, a research, design, and strategy consultancy with offices in San Francisco and Tokyo.

Written with additional thanks to Studio D research intern Amber Tan and translator Vivian Qin. Research for this article was partly funded by the Hong Kong Design Trust, a project of Hong Kong Ambassadors of Design.

Keep Reading

Most Popular

Large language models can do jaw-dropping things. But nobody knows exactly why.

And that's a problem. Figuring it out is one of the biggest scientific puzzles of our time and a crucial step towards controlling more powerful future models.

How scientists traced a mysterious covid case back to six toilets

When wastewater surveillance turns into a hunt for a single infected individual, the ethics get tricky.

The problem with plug-in hybrids? Their drivers.

Plug-in hybrids are often sold as a transition to EVs, but new data from Europe shows we’re still underestimating the emissions they produce.

Stay connected

Get the latest updates from

MIT Technology Review

Discover special offers, top stories, upcoming events, and more.