China wants to make the chips that will add AI to any gadget

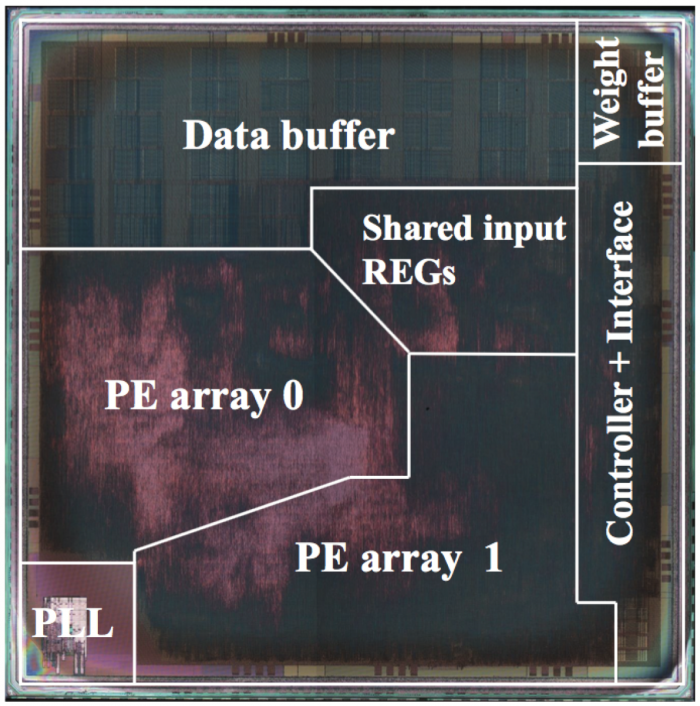

In an office at Tsinghua University in Beijing, a computer chip is crunching data from a nearby camera, looking for faces stored in a database. Seconds later, the same chip, called Thinker, is handling voice commands in Chinese. Thinker is designed to support neural networks. But what’s special is how little energy it uses—just eight AA batteries are enough to power it for a year.

Thinker can dynamically tailor its computing and memory requirements to meet the needs of the software being run. This is important since many real-world AI applications—recognizing objects in images or understanding human speech—require a combination of different kinds of neural networks with different numbers of layers.

In December 2017, a paper describing Thinker’s design was published in the IEEE Journal of Solid-State Circuits, a top journal in computer hardware design. For the Chinese research community, it was a crowning achievement.

The chip is just one example of an important trend sweeping China’s tech sector. The country’s semiconductor industry sees a unique opportunity to establish itself amid the current wave of enthusiasm for hardware optimized for AI. Computer chips are key to the success of AI, so China needs to develop its own hardware industry to become a real force in the technology (see “China’s AI Awakening”).

“Compared to how China responded to previous revolutions in information technology, the speed at which China is following the current [AI] trend is the fastest,” says Shouyi Yin, vice director of Tsinghua University’s Institute of Microelectronics and the lead author of the Thinker paper, referring to the effort to design neural-network processors in China.

Even as China has become a manufacturing hub of solar panels and smartphones, the country’s semiconductor industry lags far behind that of the U.S. Between January and September 2017, China spent $182.8 billion importing integrated circuits—a 13.5 percent increase from the previous year, according to the China Semiconductor Industry Association. Major U.S. tech companies, including Google and Intel, as well as a few startups, are developing chips for AI applications (see “The Race to Power AI’s Silicon Brains”).

In a three-year action plan to develop AI, published by China’s Ministry of Industry and Information Technology in December 2017, the government laid out a goal of being able to mass-produce neural-network processing chips by 2020.

While it is possible to run AI software using existing chips such as the powerful graphics chips or FPGAs (a kind of blank chip that can be reconfigured on the fly), those designs are expensive and do not lend themselves to small devices that use batteries. That’s why Yin’s team at Tsinghua developed Thinker.

Thinker could be embedded in a wide range of devices, such as smartphones, watches, home robots, or equipment stationed in remote areas. Yin’s team plans to launch the first product fitted with Thinker this March.

Similar projects are under way elsewhere in China. In late January, a research team at the Chinese Academy of Sciences’ Institute of Computing Technology (ICT) will have a local semiconductor manufacturer produce a small batch of chips for use in robots. The chip, called Dadu, has two cores—one for running neural networks and another for controlling motion. The neural core runs the algorithms for vision but also allows the motion core to plan the optimal route for reaching a destination or the best motion for grabbing an object.

Yinhe Han, director of the institute’s Cyber Computing Lab and head of the robot chip project, envisions a slew of applications, including robots that deliver coffee and drones controlled with hand gestures. The advantage of developing a system like this in China, he says, is the large user base, which makes updating chip design based on user experience faster.

China has tried, and failed, to shake up the chip industry before. In 2001 the ICT assembled a team to develop desktop CPUs. That team became the kernel of a Chinese chipmaker called Loongson, but the company’s products never became as widely used as the founders would have liked.

China’s integrated-circuit industry has expanded rapidly, accounting for 58 percent of the worldwide growth in the integrated-circuit market from 2000 to 2016. But in 2016, China’s share of worldwide semiconductor fabrication capacity was still only 14.2 percent, according to PwC. In a manufacturing policy announced by the central government in 2015, called Made in China 2025, chip design and fabrication was one of the key areas in which the government asked for a breakthrough.

However, Chinese chip startups find themselves in an environment that’s vastly different from the one that gave birth to Intel or Nvidia. Businesses have taken to cloud computing in droves, meaning there may be less of a market for off-the-shelf hardware, says Dongrui Fan, president of SmarCo, a Beijing-based startup that designs an AI chip for data centers that process video footage.

But China’s AI companies are increasingly also developing their own hardware.

“In the future, companies that only make chips may be fewer and fewer,” says Fengxiang Ma, director of ASIC design at Horizon Robotics, a Beijing-based startup focused on applying AI techniques in driving and cameras. In December 2017, Horizon released two computer vision chips. They can be used to enable vehicles to recognize pedestrians or help shopping malls find patterns in visitor traffic. Since its founding in 2015, the company has grown to more than 300 employees.

Ma says Horizon Robotics is not a chip company, but it designs the chips for its products in-house for better product performance and lower production cost.

For now, Chinese chip researchers have many problems to solve: how to commercialize their chip designs, how to scale up, and how to navigate a world of computing being transformed by AI. What’s not lacking, though, is ambition. “As chip researchers, we all have dreams,” says Yinhe Han of ICT. “We’ll see how far we can leap.”

Keep Reading

Most Popular

Large language models can do jaw-dropping things. But nobody knows exactly why.

And that's a problem. Figuring it out is one of the biggest scientific puzzles of our time and a crucial step towards controlling more powerful future models.

How scientists traced a mysterious covid case back to six toilets

When wastewater surveillance turns into a hunt for a single infected individual, the ethics get tricky.

The problem with plug-in hybrids? Their drivers.

Plug-in hybrids are often sold as a transition to EVs, but new data from Europe shows we’re still underestimating the emissions they produce.

Stay connected

Get the latest updates from

MIT Technology Review

Discover special offers, top stories, upcoming events, and more.