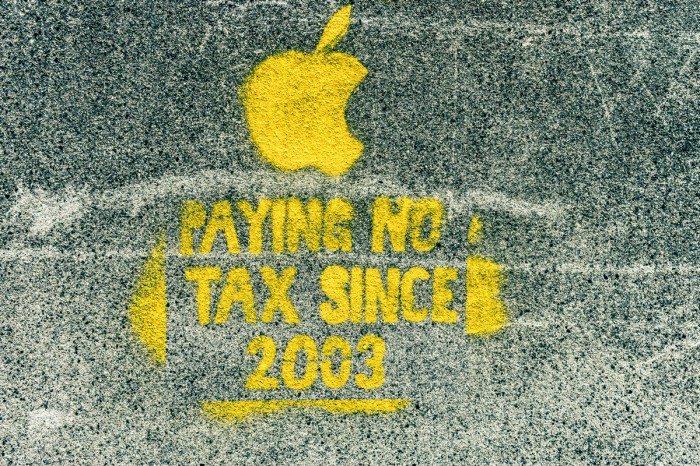

Apple’s Tax Game Is Hurting Economic Growth

$14.5 billion: that’s how much the European Union has ruled Apple owes Ireland in back taxes.

It’s a big number, though not nearly the tax bill Apple would owe the U.S. if it pulled the $92 billion in profits it is currently storing in Irish and other overseas accounts back to its home country.

CEO Tim Cook says 40 percent of that would go in taxes to the U.S. and state governments, an amount he recently told the Washington Post Apple would not be willing to pay. “It’s not a matter of being patriotic or not patriotic,” Cook said. “It doesn’t go that the more you pay, the more patriotic you are.”

Cook thinks the tax law should be changed and U.S rates lowered.

As for the EU tax ruling, he vowed to appeal. “At its root, the Commission’s case is not about how much Apple pays in taxes,” he wrote. “It is about which government collects the money.”

But no government seems to be collecting very much. According to the EU, Apple’s corporate tax rate in Ireland has been as low as 0.005 percent in recent years. And an extensive review of the company’s tax practices performed by the U.S. Senate’s Permanent Subcommittee on Investigations in 2013 found that Apple pays taxes of less than 2 percent on its overseas income, and significantly less than the 35 percent U.S. statutory corporate tax rate on its domestic income.

Many applaud companies for making smart financial moves, including minimizing what they pay in taxes. But there are consequences to Apple’s decision to make global tax planning one of its core capabilities.

While the company’s money sits in foreign accounts, it is being invested in securities like U.S. Treasuries, stocks, and other investments, not in the kind of research that could help to generate new tech breakthroughs, innovation, and jobs.

Apple has consistently spent less than competitors on research. Even in 2015, when it put a record $6 billion into R&D, that was just 3.3 percent of its $183 billion in revenue. By contrast, Intel spent more than 20 percent of its 2015 revenue on R&D. Microsoft spent 13 percent, Google 15 percent, and Amazon more than 10 percent, all according to data compiled by PricewaterhouseCoopers.

Apple has more cash than any other company—$216 billion in total, according to Moody’s Investors Service. But spending it would mean bringing it back to the U.S. and paying taxes on it. It’s far cheaper to borrow money, and that’s exactly what Apple has done, going from debt-free as recently as 2012 to $80 billion in debt as of March this year.

That money has gone to finance much of the company’s current spending, which includes a large program to buy shares back. Such buybacks help support a company’s stock price, but do little to stoke innovation.

Apple isn’t the only company hoarding profits overseas, either: Microsoft has $108 billion overseas, and General Electric has $104 billion. It’s a trend that’s helping to create a disparity between corporate performance and overall economic growth. Recent research by a trio of Columbia Business School professors found that under current tax rules and practices, less profit is being channeled into U.S. investments, contributing to lower overall economic growth.

Keep Reading

Most Popular

Large language models can do jaw-dropping things. But nobody knows exactly why.

And that's a problem. Figuring it out is one of the biggest scientific puzzles of our time and a crucial step towards controlling more powerful future models.

How scientists traced a mysterious covid case back to six toilets

When wastewater surveillance turns into a hunt for a single infected individual, the ethics get tricky.

The problem with plug-in hybrids? Their drivers.

Plug-in hybrids are often sold as a transition to EVs, but new data from Europe shows we’re still underestimating the emissions they produce.

Stay connected

Get the latest updates from

MIT Technology Review

Discover special offers, top stories, upcoming events, and more.