Smartphone Newcomers Find Success in Markets with Room to Grow

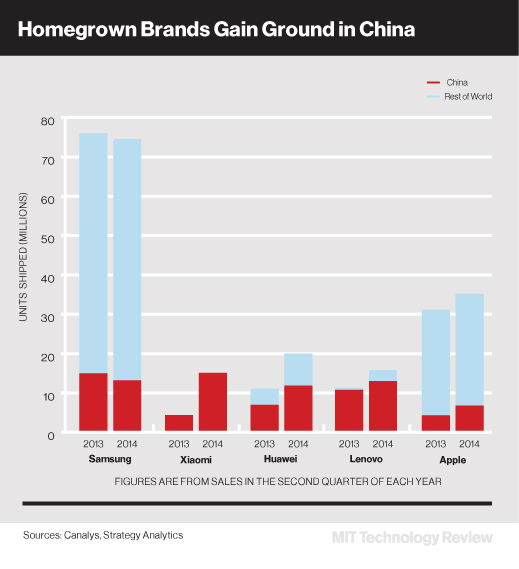

Two upstart mobile phone makers took the lead in their native markets of China and India this year, dethroning the world’s top seller, Samsung, for the first time. The newcomers, China’s Xiaomi and India’s Micromax, are now looking to gain ground in other up-and-coming markets as they take advantage of the falling cost of components and the open source Android operating system to offer inexpensive products to people looking to buy their first smartphones.

Xiaomi’s performance in China was enough to vault it into the top five smartphone makers in terms of global market share (see: “50 Smartest Companies: Xiaomi”).

Xiaomi has grown quickly with the help of its distinctive business model. It sells its phones at a similar or lower price than Samsung does. It keeps prices low by selling phones at slim margins and making money instead on apps, entertainment content, and merchandise.

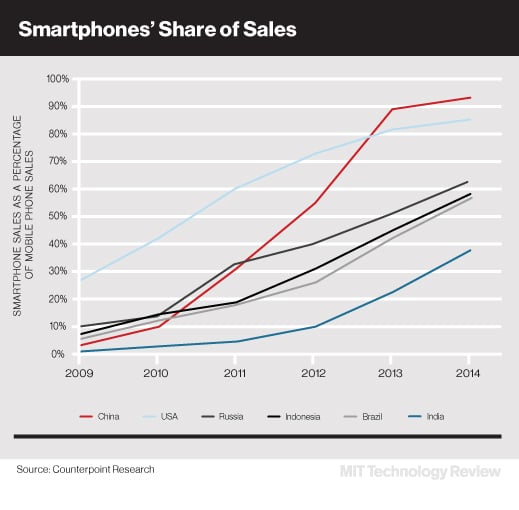

Now Xiaomi’s sales are picking up in Hong Kong, Taiwan, and Malaysia, according to Neil Shah, a research director at Counterpoint Research in Hong Kong. Xiaomi is also expanding into India, the world’s third largest smartphone market after the U.S. and China.

In India, Xiaomi faces stiff competition from India’s own fast-rising mobile brand, Micromax. India’s smartphone market is smaller than its market for more basic “feature phones”—smartphones represent only 40 percent of mobile phone sales in the second quarter of this year, which leaves opportunity for growth.

In the second quarter, Micromax replaced Samsung as the mobile phone market leader in India and rose to second place behind Samsung in smartphone sales.

Micromax and two close Indian competitors, Karbonn and Lava, are now making inroads in Russia as well as in neighboring countries including Nepal, Bangladesh, and Sri Lanka. The big Indian brands compete primarily on cost.

Keep Reading

Most Popular

Large language models can do jaw-dropping things. But nobody knows exactly why.

And that's a problem. Figuring it out is one of the biggest scientific puzzles of our time and a crucial step towards controlling more powerful future models.

How scientists traced a mysterious covid case back to six toilets

When wastewater surveillance turns into a hunt for a single infected individual, the ethics get tricky.

The problem with plug-in hybrids? Their drivers.

Plug-in hybrids are often sold as a transition to EVs, but new data from Europe shows we’re still underestimating the emissions they produce.

Stay connected

Get the latest updates from

MIT Technology Review

Discover special offers, top stories, upcoming events, and more.