Before Snowden, There Was Huawei

How’s this for a tough sales job? The American sales reps of Huawei offer top-notch telecom gear at a 35 percent discount. But anytime they get near to closing a sale, their customers get a visit from the FBI or the U.S. Department of Commerce.

The message from the feds isn’t subtle: buy something else.

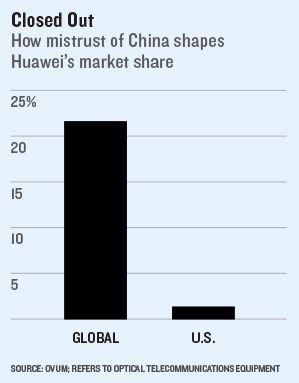

Huawei, based in Shenzhen, China, is the world’s largest seller of telecom equipment, commanding 20 percent of the market. Yet it is barely a factor in North America. Here its market share in optical equipment is just 1.4 percent, and in switches and routers it’s just 0.1 percent.

Just as Huawei has been shut out of the American market, leaks about the pervasiveness of spying by the NSA and other U.S. intelligence agencies might now hurt American companies abroad. Businesses are starting to talk of a “Snowden effect” of lost sales, dimmed prospects, and growing uncertainty, as they too come under a cloud of mistrust (see “Spying is Bad for Business”).

Huawei (pronounced wah-way) was founded in 1987 by Ren Zhengfei, a former military officer who splits the CEO job with executives who rotate every six months. As Huawei expanded overseas, suspicions began to swirl around the company, particularly in the United States. Its effort to buy 3Com, a networking company, was blocked by a trade panel that assesses national security risks. In 2011, Cisco Systems, a competitor, developed talking-point slides that laid out reasons for “Fear of Huawei.”

In 2012, partly at the Chinese company’s request, the U.S. House Intelligence Committee investigated and released a report. It offered no real proof of spying, yet it still concluded that the United States must “view with suspicion” progress by Chinese companies in the North America telecommunications market.

The concern was that somehow, with Huawei’s knowledge or without it, the Chinese government could use equipment sold by the company to eavesdrop or even to gain an advantage in a cyberwar. Huawei loudly denied the charges; it cried “discrimination.”

The irony now is that leaked National Security Agency documents suggest the U.S. was doing everything it suspected China of. The documents indicate that the U.S. may have compromised routers from Cisco, Juniper, and Huawei. It’s also believed to have weakened encryption products so the ciphers used by commercial software could be broken.

The companies named in those leaks all deny knowing of the back doors. All say they are investigating. But the loss of trust is hurting U.S. companies. In December, Cisco said the allegations caused a significant drop in sales in China. “It’s causing people to stop and then rethink decisions,” Robert Lloyd, Cisco’s president of development and sales, told investors. IBM’s hardware sales in China plunged 40 percent in the financial quarter following the leaks.

Huawei can feel vindicated, but only to a degree. Its sales haven’t picked up in the U.S. “There’s a universal lack of trust, and now we have a pretty obvious proof point of that,” says William Plummer, Huawei’s vice president for external relations in Washington, D.C. As it turns out, everyone’s gear is vulnerable. “We’ve been saying that for years,” says Plummer.

In several white papers, Huawei has outlined what it thinks are ways to improve security by adopting common standards and, perhaps, checks by third parties. James Lewis, an analyst at the Center for Strategic and International Studies, describes the challenge ahead as “how to build trusted networks from untrustworthy components.”

But the bigger fallout may be a rise in protectionism. “It’s been mostly open competition since the beginning of the Internet, and the companies that did well are the ones that won the competitions,” says Lewis. Now, with escalating security worries, countries may take the chance to stack the deck against foreign competitors or build up their own industries.

“The overall effect will be bad for the whole global economy,” says Lewis.

Keep Reading

Most Popular

Large language models can do jaw-dropping things. But nobody knows exactly why.

And that's a problem. Figuring it out is one of the biggest scientific puzzles of our time and a crucial step towards controlling more powerful future models.

How scientists traced a mysterious covid case back to six toilets

When wastewater surveillance turns into a hunt for a single infected individual, the ethics get tricky.

The problem with plug-in hybrids? Their drivers.

Plug-in hybrids are often sold as a transition to EVs, but new data from Europe shows we’re still underestimating the emissions they produce.

Stay connected

Get the latest updates from

MIT Technology Review

Discover special offers, top stories, upcoming events, and more.