A Shrinking Garmin Navigates the Smartphone Storm

Garmin was once one of the world’s hottest growth companies—“the next Apple,” according to some stock pickers. In 2007 the company, the world’s top seller of GPS devices for car dashboards and boat cockpits, doubled its sales on what seemed like unquenchable consumer demand for its location-finding gadgets.

Then smartphones happened.

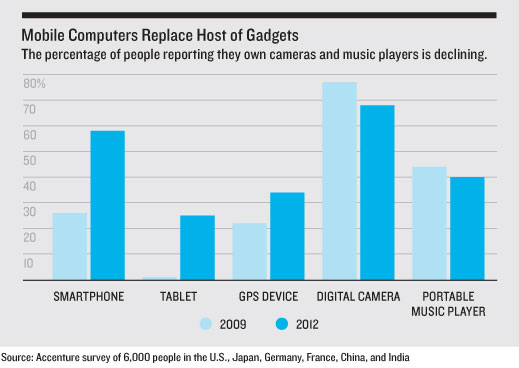

Not only have smartphones seen record-beating adoption among consumers (see “Are Smart Phones Spreading Faster than Any Technology in Human History?”), they have also become the Swiss Army knives of consumer electronics, doing a decent job at dozens of tasks once reserved for specialized hardware like cameras and GPS systems.

The effects on Garmin’s business have been withering. The company is worth less than a third of what it was in 2007, and its sales have shrunk by 15 percent. “It’s not a mystery that the personal navigation market is in a period of decline,” says Dawn Iddings, Garmin’s vice president for business development. “Mobile has permeated each one of our markets.”

Hardest hit have been Garmin’s sales of GPS devices for vehicle dashboards, also its biggest line of business. Sales in its automobile and mobile division fell 6 percent last year, to $1.5 billion, and the company predicts a bigger drop of 15 to 20 percent in the next 12 months.

Even so, Garmin has fought a successful rear-guard action by grabbing business from other GPS firms, launching top-shelf products for sportsmen and sailors, and diversifying. (In 2011, for example, it acquired a company that makes GPS-enabled training collars for dogs.)

All that has served to cushion what the company calls an unstoppable decline in demand for stand-alone GPS devices. “It’s still a really large market,” Iddings says, “but I wouldn’t want to be number 2 or number 3 [in personal navigation] at this point, that’s for sure.”

Garmin isn’t the only consumer electronics firm fighting for relevance. The popularity of smartphones, which sold around 640 million last year, has reduced sales of digital cameras and music players as well. Mobile computers, including tablets, have also begun to bite into sales of hit products like Sony’s PlayStation game console.

Some companies have responded by making their gadgets more like smartphones: Canon now sells cameras that connect to the Internet and run social apps. Polaroid, also clobbered by mobile computers, even hatched the idea of opening retail stores where people can print out pictures taken on their phones.

Garmin didn’t think phones posed much of a threat early on. Cofounder Min Kao told Forbes in 2003 that he wasn’t worried about competition from them because of high “barriers to entry”: specifically, the need to pair the GPS location signals from satellites with cartographic software.

Today, though, nearly all smartphones have those capabilities, either because they have a GPS chip or because they can pinpoint a user’s location using cell-phone towers (see “The Online Map Wars”). When a new version of Google’s free map and navigation app became available for iPhones last December, 10 million people downloaded it in just two days—almost as many as buy a Garmin GPS in a year.

To its credit, Garmin tried to head off the mobile-phone threat. It launched six navigation-friendly smartphones, including the so-called Garminfone (unveiled in 2010), but none proved successful.

The company’s strategy now starts with milking what profits are left in the market for personal GPS devices. It’s been doing that partly by introducing even higher-end models like the Nüvi 3597 LMTHD, which sells for $379.99 but comes with a fancy magnetic mount and bells-and-whistles map features. It can tell you what highway lane to be in and will alert you to “turn right at Starbucks,” something that phones can’t do.

The company has also worked hard to diversify. Last April, with Suzuki, it announced its first factory-installed dashboard “infotainment” system for cars—the result of four years of investment that saw it open new offices in automotive hubs like Detroit, Germany, Japan, and China. Garmin has also been selling more specialized GPS devices, like wristwatches to help runners map their workouts and extra-rugged handhelds for backpackers.

Those are applications of GPS where a smartphone still isn’t up to the task. “Maybe free navigation is good enough,” Iddings says, “but if you are a serious hiker and are going to hike up a big old mountain, you are probably going to want a better product.”

Keep Reading

Most Popular

Large language models can do jaw-dropping things. But nobody knows exactly why.

And that's a problem. Figuring it out is one of the biggest scientific puzzles of our time and a crucial step towards controlling more powerful future models.

How scientists traced a mysterious covid case back to six toilets

When wastewater surveillance turns into a hunt for a single infected individual, the ethics get tricky.

The problem with plug-in hybrids? Their drivers.

Plug-in hybrids are often sold as a transition to EVs, but new data from Europe shows we’re still underestimating the emissions they produce.

Stay connected

Get the latest updates from

MIT Technology Review

Discover special offers, top stories, upcoming events, and more.