Groupon, Daily Deals and the Complex Question of Business Failure

In the past few years, daily deal start ups such as Groupon and Living Social have rocketed into the business world. These sites offer discount vouchers of between 40 and 60 per cent on various kinds of products and services at specific locations.

The deals are expensive for businesses. Groupon, for example, takes about half the revenue that the vouchers generate. But it argues that merchants benefit in the long run through repeat business. A crucial question is whether this works as Groupon claims.

The anecdotal evidence is mixed. Groupon says that 97 per cent of businesses that use its services want to be featured again.

Others say the advantages of daily deals have been wildly oversold. Earlier this year, US News & World Report ran a story asking whether Groupon could actually sink your business.

Today, Ayman Farahat at Adobe Inc, Nesreen Ahmed at Purdue University in Lafayette and Utpal Dholakia at Rice University in Houston throw some interesting light on this question.

They point out that many factors contribute to business failure but often these are not easily visible from the outside. At the same time, many factors contribute to the decision to offer daily deals but these too are not easily visible from outside.

So it’s easy to overlook this complexity in any analysis of business failure.

Imagine, for example, two seemingly identical restaurants one of which has a high staff turnover and is struggling to generate sales. The other is a family firm that is stable and profitable.

The struggling business decides to offer daily deals to attract new customers but goes out of business a few months later. the other business does not offer a daily deal and stays in business.

A naïve analysis would quickly see the link between the failure and the business’s decision to offer daily deals.

However, this analysis would fail to account of the hidden factors at work—the struggle to generate sales which led to the decision to offer daily deals and the high turnover of staff which caused the business to fail.

So the task for analysts is to construct a statistical model that allows for these kinds of hidden factors.

The important question then becomes this: is there any correlation between the hidden factors that cause a business to offer daily deals and the hidden factors that cause the business to fail?

That’s a much more difficult question to answer and one that ideally requires full access to the business accounts and the decision-making processes.

But there’s another way to get at the question by crunching the data on a large number of businesses. It’s this second ‘econometrics’ approach that Farahat and pals have used.

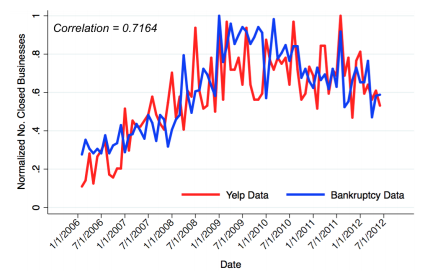

These guys studied 985 small businesses that offered Groupon daily deals in Chicago between January and July 2011. Of these, about 60 businesses failed. They then looked at the ratings and other information about these businesses on Yelp, dividing the businesses into catgories such as restaurants, spas, hair salons etc.

Finally, they constructed a mathematical model of each business that took into account the hidden factors that determine whether they offered daily deals and other hidden factors that led to the business failing.

The results are subtle but make for interesting reading. These guys say there is a correlation between the hidden factors that lead to daily deals and the hidden factors that cause a business to fail–but only for certain kinds of business.

“Our results indicate that there is a statistically signicant correlation between the unobserved factors that influence the business’ decision to offer a daily deal and the unobserved factors that impact its survival,” they say. And the effect is much stronger in some areas of business than others, for example in restaurants and spas.

But the factors involved are complex and depend crucially on the business models that the merchants rely on. For example, Farahat and co say that other work has shown that restaurants are not well suited to daily deals because they have high marginal costs, low fixed cost and are generally unable to schedule the arrival of daily deal customers.

But spas are much better suited to daily dals because their marginal cost is low, they have high fixed cost and they generally have the ability to schedule daily deal customers.

So the decision to offer a daily deal must be a more desperate measure for a restaurant than a spa.

“This is validated by our results,” say Farahat and co. “If a restaurant offers a daily deal without having any strong reason to do so, its probability of failing increases more than a Spa that had some motivation for offering a daily deal.”

So the moral of the story is that daily deals are a complex beast that suit some businesses better than others. But deciding when to use this kind of tool is tricky.

Farahat and co say they plan to do more econometric number crunching to look at other daily deal providers and to work out exactly how this kind of marketing influences business metrics such as revenue.

In the meantime, daily deal companies have their backs against the wall. Groupon’s share price is at an all time low and Amazon has written off some $137 million from the value of its stake in Living Social.

This is a state of affairs that will not be helped by the notion that daily deals are looking increasingly complex marketing instruments that few if any people really undertstand

Ref: arxiv.org/abs/1211.1694: Does a Daily Deal Promotion Signal a Distressed Business? An Empirical Investigation of Small Business Survival

Keep Reading

Most Popular

Large language models can do jaw-dropping things. But nobody knows exactly why.

And that's a problem. Figuring it out is one of the biggest scientific puzzles of our time and a crucial step towards controlling more powerful future models.

How scientists traced a mysterious covid case back to six toilets

When wastewater surveillance turns into a hunt for a single infected individual, the ethics get tricky.

The problem with plug-in hybrids? Their drivers.

Plug-in hybrids are often sold as a transition to EVs, but new data from Europe shows we’re still underestimating the emissions they produce.

Stay connected

Get the latest updates from

MIT Technology Review

Discover special offers, top stories, upcoming events, and more.