Econophysicist Predicts Rogue Financial Waves

On New Year’s Day 1995, a single giant wave hit the Draupner oil platform in the North Sea off the coast of Norway. By chance, the platform was fitted with laser measuring equipment which recorded the height of waves as they passed by. This one measured in at an unprecedented 25.6 metres, about the size of a seven storey office block. The Draupner event finally confirmed the existence of rogue waves, previously known only to science through the anecdotal evidence of the few who had seen and survived them.

Curiously, the existence of rogue waves was predicted mathematically more than ten years earlier by Howell Peregrine at the University of Bristol in the UK. The theoretical prediction and the observational confirmation should have generated an obvious question: shouldn’t rogue waves also occur in other wave-like systems?

And yet it wasn’t until 2007 that the first optical rogue waves were observed in an optical fibre. Since then things have moved rapidly. This blog recently discussed the first measurement of rogue microwaves and earlier this year another group predicted the existence of rogue matter waves using numerical simulations.

But what of more abstract systems? Today Zhenya Yan at the Institute of Systems Science in Beijing says that rogue waves can also occur in financial systems, and in particular in equity markets. Traditionally, econophysicists have modelled equity pricing using the Black-Scholes economic model, in which prices change stochastically, like the movement of particles under Brownian motion.

Researchers have long known that the Black-Scholes model cannot account for the observed volatility of the real market but had no alternative to turn to. However, earlier this month, Vladimir Ivancevic at the Defence Science & Technology Organisation in Australia proposed a nonlinear wave model as an alternative to Black-Scholes.

The Ivancevic Option Pricing Model approximates to Black Scholes under certain circumstances but also allows for a rich variety of other behaviours and so has the potential to better describe real markets. Much of this behaviour is as yet unexplored.

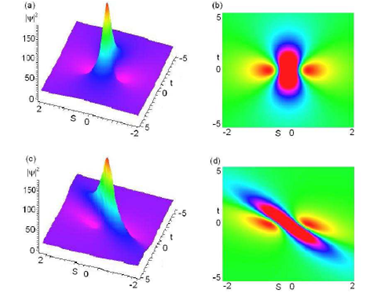

Enter Yan, who points out today that one solution of a nonlinear wave system is a rogue wave, an event of far greater magnitude than would be expected by any standard method of analysis.

That’s interesting. There’s no shortage of anecdotal evidence for the existence of financial rogue waves. Look at the Asian financial crisis of 1997 or the current global financial crisis. But econophysicists will want more than that to confirm that financial rogue waves really exist.

Perhaps what they need now is the financial equivalent of the Draupner oil platform measuring ambient wave height and waiting for the big one to hit.

Ref:arxiv.org/abs/0911.4259: Financial Rogue Waves

Keep Reading

Most Popular

Large language models can do jaw-dropping things. But nobody knows exactly why.

And that's a problem. Figuring it out is one of the biggest scientific puzzles of our time and a crucial step towards controlling more powerful future models.

How scientists traced a mysterious covid case back to six toilets

When wastewater surveillance turns into a hunt for a single infected individual, the ethics get tricky.

The problem with plug-in hybrids? Their drivers.

Plug-in hybrids are often sold as a transition to EVs, but new data from Europe shows we’re still underestimating the emissions they produce.

Stay connected

Get the latest updates from

MIT Technology Review

Discover special offers, top stories, upcoming events, and more.