“It’s by far the biggest expense we have,” says Nicholas Fitzkee, the facility’s director. “The price that drives our user fees is the purchase of liquid helium, and that has pretty much doubled over the past year or so.”

Helium is excellent at conducting heat. And at temperatures close to absolute zero, at which most other materials would freeze solid, helium remains a liquid. That makes it a perfect refrigerant for anything that must be kept very cold.

Liquid helium is therefore essential to any technology that uses superconducting magnets, including magnetic resonance imaging (MRI) scanners and some fusion reactors. Helium also cools particle accelerators, quantum computers, and the infrared detectors on the James Webb Space Telescope. As a gas, helium whisks heat away from silicon to prevent damage in semiconductor fabs.

“It’s a critical element for the future,” says Richard Clarke, a UK-based helium resources consultant who co-edited a book about the element. Indeed, the European Union includes helium on its 2023 list of critical raw materials, and Canada put it on a critical minerals list too.

Again and again throughout the history of technology development, helium has played a critical role while remaining in tight supply. As part of MIT Technology Review’s 125th anniversary series, we looked back at our coverage of how helium became such an important resource, and considered how demand might change in the future.

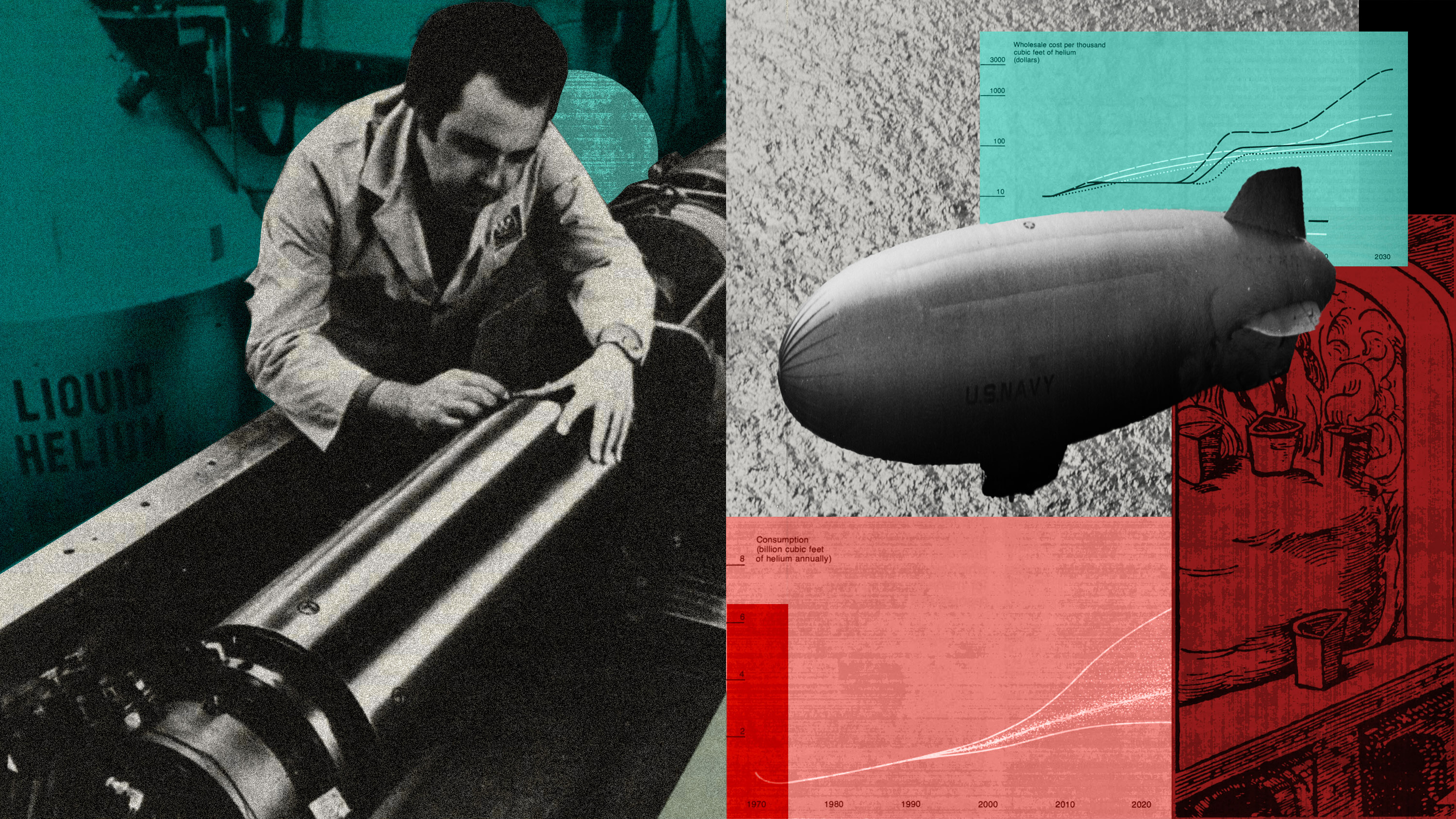

Countries have at times taken extreme measures to secure a steady helium supply. In our June 1975 issue, which focused on critical materials, a Westinghouse engineer named H. Richard Howland wrote about a controversial US program that stockpiled helium for decades.

Even today, helium is not always easy to get. The world’s supply depends primarily on just three countries—the US, Qatar, and Algeria—and fewer than 15 companies worldwide.

With so few sources, the helium market is particularly sensitive to disruptions—if a plant goes offline, or war breaks out, the element may suddenly be in short supply. And as Fitzkee noted, the price of helium has climbed rapidly in recent years, putting hospitals and research groups in a pinch.

The global helium market has experienced four shortages since 2006, says Phil Kornbluth, a helium consultant. And the price of helium has nearly doubled since 2020, from $7.57 per cubic meter to a historic high of $14 in 2023, according to the United States Geological Survey.

Some research labs, including Fitzkee’s, are now installing recycling systems for helium, and MRI manufacturers are making next-generation scanners that require less of it. But many of the world’s highest-tech industries—including computing and aerospace—will likely need even more helium in the future.

“At the end of the day, what’s happening is helium’s just getting more expensive,” says Ankesh Siddhantakar, a PhD student in sustainability management at the University of Waterloo in Canada. “The era of cheap helium is probably gone.”

A high-tech need

Helium is the second element on the periodic table, which—as you may recall from high school chemistry class—means it has just two protons (and thus two electrons).

Thanks to their simple structure, helium atoms are some of the smallest and lightest, second only to hydrogen. They’re extremely stable and don’t easily react with other stuff, which makes them easy to incorporate into industrial or chemical processes.

One major use of liquid helium over the years has been to cool the magnets inside MRI scanners, which help doctors examine organs, muscles, and blood vessels. But the cost of helium has risen so much, and the supply has been so volatile, that hospitals are eager for other options.

MRI manufacturers including Philips and GE HealthCare now sell scanners that require much less helium than previous generations. That should help, though it will take years to upgrade the roughly 50,000 MRI scanners already installed today.

Other industries are finding ways around helium too. Welders have substituted argon or hydrogen on some jobs, while chemists have switched to hydrogen for gas chromatography, a process that allows them to separate mixtures.

But there’s no good alternative to helium for most applications, and the element is much harder to recycle when it’s used as a gas. In semiconductor fabs, for example, helium gas removes heat from around the silicon to prevent damage and shields it from unwanted reactions.

With rising demand for computing driven in part by AI, the US is investing heavily in building new fabs, which will likely drive more demand for helium. “There’s no question that chip manufacturing will be the biggest application within the coming years, if it isn’t already,” says Kornbluth.

Overall, Kornbluth says, the helium industry expects to see growth in the low single digits over the next few years.

Looking further out, Clarke predicts that most industries will eventually phase out nonessential uses of helium. Instead, they will use it primarily for cryogenic cooling or in cases where there’s no alternative. That includes quantum computers, rockets, fiber-optic cables, semiconductor fabs, particle accelerators, and certain fusion reactors.

“It’s something that, for a cost reason, all these new technologies have got to take into account,” Clarke says.

Given its importance to so many industries, Siddhantakar thinks helium should be a higher priority for those thinking about managing strategic resources. In a recent analysis, he found that the global supply chains for helium, lithium, and magnesium face similar risks.

“It is a key enabler for critical applications, and that’s one of the pieces that I think need to be more understood and appreciated,” Siddhantakar says.

A delicate balance

The helium we use today formed from the breakdown of radioactive materials millions of years ago and has been trapped in rocks below Earth’s surface ever since.

Helium is usually extracted from these underground reservoirs along with natural gas, as John Mattill explained in an article from our January 1986 issue: “Helium can be readily separated from the gas before combustion, but the lower the helium concentration, the higher the cost of doing so.”

Generally speaking, helium concentrations must be at least 0.3% for gas companies to bother with it. Such levels can be found in only a handful of countries including the US, Algeria, Canada, and South Africa. Qatar has lower concentrations but produces enough natural gas to justify recovering helium at those lower levels.

Helium shortages are not caused by a lack of helium, then, but the inability of producers in those few countries to deliver it to customers everywhere in a timely manner. That can happen for any number of reasons.

“It is a very global business, and any time a war breaks out somewhere, or anything like that, it tends to impact the helium business,” says Kornbluth.

Another challenge is that helium atoms are so light Earth’s gravity can’t hold onto them. They tend to just, well, float away, even escaping specially designed tanks. Up to 50% of helium we extract is lost before it can be used, according to a new analysis presented by Siddhantakar last week at the International Round Table on Materials Criticality.

Given all this, countries that need a lot of helium—Canada, China, Brazil, Germany, France, Japan, Mexico, South Korea, and the UK are among the top importers—must constantly work to ensure a reliable supply. The US is one of the largest consumers of helium, but it’s also a leading producer.

For decades, the global helium market was closely tied to the US government, which began stockpiling helium in Texas in 1961 for military purposes. As Howland wrote in 1975, “The original justification of the federal helium conservation program was to store helium until a later time when it would be more essential and less available.”

But the US has slowly sold off much of its stockpile and is now auctioning off the remainder, with a final sale pending in the next few months. The consequences are not yet clear, though it seems likely that agencies such as NASA will have to pay more for helium in the future. As Christopher Thomas Freeburn wrote in a 1997 article titled “Save the Helium,” “By eliminating the reserve, the federal government … has placed itself at the mercies of the market.”

Customers everywhere are still overwhelmingly dependent on the US and Qatar, which together produce more than 75% of all helium the world uses. But the US has produced and exported significantly less in the past decade, while demand from US consumers rose by 40%, according to the USGS’s Robert Goodin.

Eager to fill the void, new countries are now starting to produce helium, and a flurry of companies are exploring potential projects around the world. Four helium plants opened last year in Canada, and one started up in South Africa.

Russia is set to open a massive new plant that will soon supply helium to China, thereby edging out Algeria as the world’s third-largest producer.

“Russia is going to become the number-three producer as early as 2025, and they’ll end up accounting for a quarter of the world’s supply within the next five years,” says Kornbluth.

Qatargas in Qatar is opening a fourth plant, which—together with Russia’s new facility—should expand global helium supply by about 50% in the next few years, he adds.

Some companies are now considering sites where they could extract helium without treating it as a by-product of natural gas. Helium One is exploring several such sources in Tanzania.

Will it be enough?

Back in 1975, Howland described the helium market as “an example of the false starts, inefficiencies, and economic pitfalls we must avoid to wisely preserve our exhaustible resources.”

He also predicted the US would use up much of its known helium reserves by the turn of the century. But the US still has enough helium in natural-gas reservoirs to last 150 more years, according to a recent USGS analysis.

“As with a lot of other things, it’s going to be about the sustainable management of this resource,” says Siddhantakar.

Correction: This story was updated to accurately state the concentration of helium that occurs in natural gas in Qatar.