Fisker’s Woes Put A123 Systems at Risk

Both the plug-in hybrid startup, and the company that supplies its batteries, appear to be in trouble.

After failing to meet the milestones required by a loan agreement with the U.S. Department of Energy, Fisker Automotive, a startup making high-end hybrid electric cars, announced this week that it will stop work on a factory in Delaware and lay off 26 people. Fisker’s troubles could prove disastrous not only for Fisker, but for A123 Systems, which supplies the automaker with lithium-ion batteries.

The events raise the prospect of two failures at a time when the DOE loan and grant programs are under scrutiny after the bankruptcy of companies that it had funded: Beacon Power, Ener1, and most famously, Solyndra, a solar-panel maker that received a $535 million loan as part of a federal loan-guarantee program.

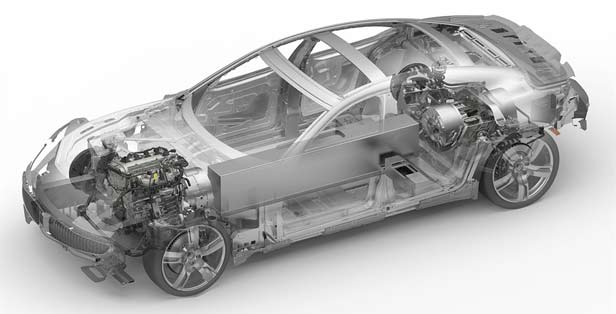

Fisker is a key customer for A123, using its batteries for its Karma plug-in hybrid luxury sedan. On Thursday, after news of Fisker’s difficulties, shares of lithium-ion battery maker A123 Systems dropped 24 percent.

This story is only available to subscribers.

Don’t settle for half the story.

Get paywall-free access to technology news for the here and now.

Subscribe now

Already a subscriber?

Sign in

Although revenues for both companies have been increasing lately, both are operating at a loss and may need to raise more funds to stay out of bankruptcy. A123 Systems has numerous small contracts to produce batteries, and some larger ones that will come into play next year. But for now, it relies heavily on Fisker for revenue. Its fate could depend on whether Fisker can raise enough money from private investors or renegotiate its DOE loan terms.

A White House review of the DOE’s loan program is expected to be released this week. In the current climate, it could be difficult for Fisker to renegotiate the terms of its DOE loan agreement, especially since the DOE is under fire for renegotiating the terms of Solyndra’s agreement.

Fisker Automotive received a loan guarantee for $528.7 million, of which it has received $193 million so far. A123 Systems, a young company that was started with the help of government funds, was recently awarded a $249 million federal grant to build battery factories. It has used about half of the grant so far. Both companies have also raised large amounts of private capital.

Both companies have had good news in recent months. After years of delays, Fisker started selling its Karma sedan in October. It has now manufactured 1,500 cars and sold “hundreds,” according to a company spokesperson. A123 Systems, a public company, announced high revenue growth in its most recent quarterly earnings statement, in November.

But A123 also warned at the time that its current growth rate wouldn’t continue, in large part because Fisker had unexpectedly canceled battery orders. As a result of the canceled orders, which Fisker blamed on oversupply due to delays in production of the Karma, A123 lowered its earnings forecasts for the year by $45 million.

A123 Systems won’t disclose precisely how much of its business comes from Fisker, but based on the earnings downgrade, one analyst estimates it was about 30 percent last year. A123 Systems will release its financial results for 2011 within a month. It doesn’t expect orders from Fisker to pick up until the spring.

A123 Systems needs as much business as it can get. Even with the revenue growth seen in the third quarter of 2011—up over 300 percent compared to the previous year—it reported losses of $173 million for the first nine months of 2011. One of its most urgent needs is to ramp up production to meet the capacity of its battery factories, which would increase revenue and decrease the cost of making each battery pack. Without orders from Fisker, more of the equipment is sitting idle than the company had expected.

Although less is known about the financial situation of Fisker, a private company, the announcement made this week shows that it was counting on continued government funding. Fisker says the shutdown of work on the factory in Delaware will not affect production of the Karma, which is made in Finland. But the Delaware factory was intended to produce the company’s second car, the yet-to-be-revealed Nina, which will be less expensive than the Karma. Fisker’s business plan involves eventually selling large volumes of the Nina.

A123 does, at least, have significant cash reserves and income from contracts with several automakers, for electricity-grid related projects, and for backup power for businesses. If it can survive this year, its outlook may look better in the years to come, when it has contracts to make more batteries.

Eventually A123 expects its largest customers to account for only 10 to 15 percent of its revenues. That’s about half as much as Fisker does today, according to the analyst’s estimate. “Fisker is a very important customer for A123 in 2011 and 2012,” says Dan Galves, a research analyst at Deutsche Bank. “But A123 has a lot of other contracts growing in 2012 or that are starting up in 2013, which means that Fisker isn’t a critical customer for the company long-term.”