College Dropout Says He’s Cracked Self-Driving Cars’ Most Crucial Component

When I met him in San Francisco this week, 22-year-old Austin Russell couldn’t help but smile when I mentioned the acrimonious legal battle between Uber and Alphabet’s self-driving car unit, Waymo.

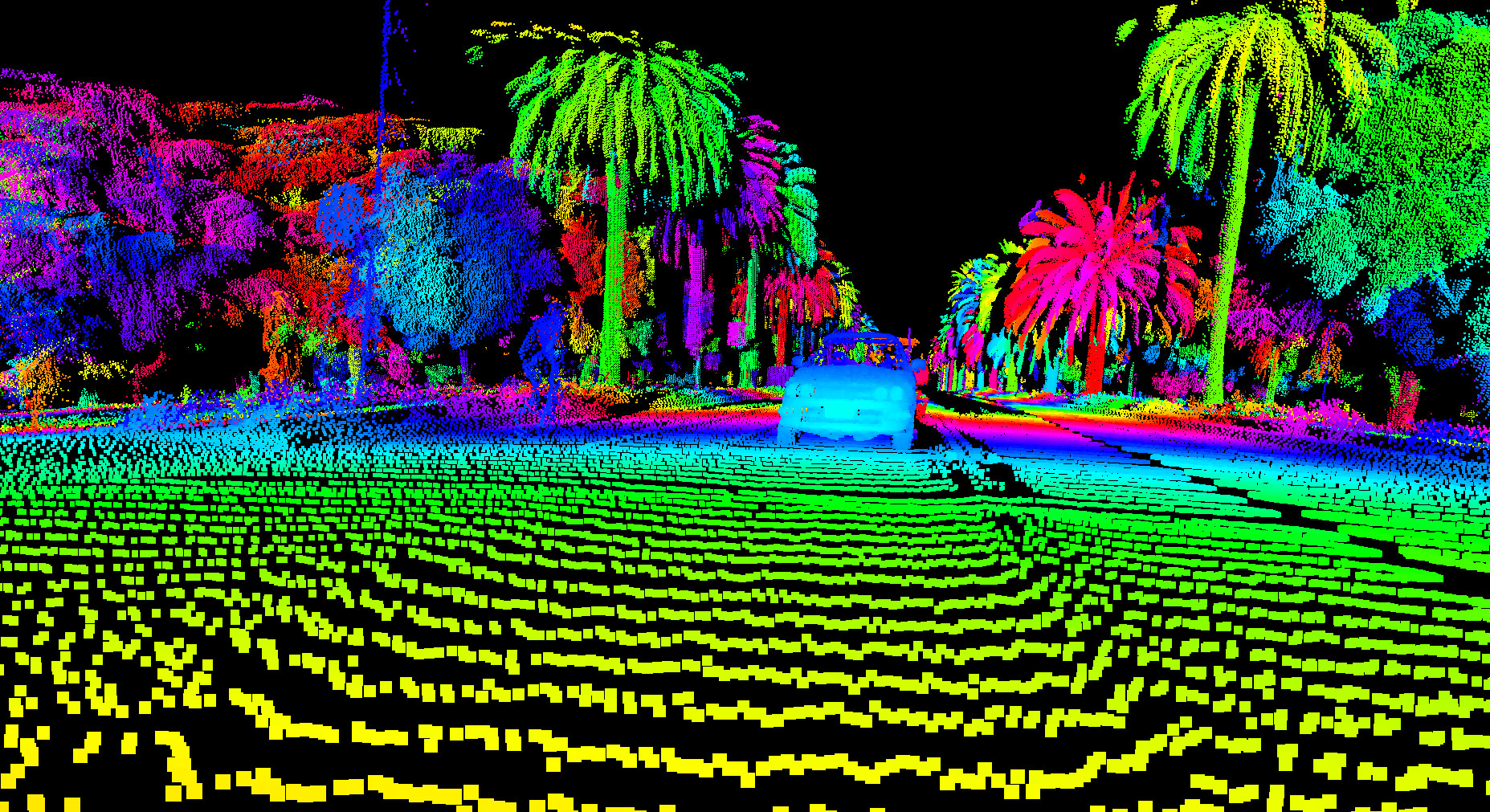

Waymo says a top engineer took secret plans for lidar sensors, which map the world in 3-D using lasers, to the ride-sharing company. Talk of the suit makes Russell grin because he says it shows the new lidar sensor his startup has spent five years developing has a ready market. “This demonstrates the necessity of lidar to the autonomous-vehicle race,” he says.

Most companies working on autonomous vehicles consider lidar sensors mandatory for vehicles to safely navigate alone and distinguish objects such as pedestrians and cyclists. But the best existing sensors are bulky, extremely expensive, and in short supply as demand surges (see “Self-Driving Cars’ Spinning Laser Problem”). Alphabet and Uber have both said they were forced to invent their own, better-performing sensors from scratch to make self-driving vehicles viable. Luminar hopes to serve automakers that would rather not go to that effort.

Russell doesn’t have a college degree—he dropped out of Stanford in return for a $100,000 check under a program started by venture capitalist Peter Thiel to encourage entrepreneurship. But Russell says a (short) lifetime of tinkering and building with electronics helped him design a new lidar sensor that sees farther and in more detail than those on the market.

The top-of-the-line sensor from Velodyne, the current market leader, looks like a spinning coffee can and costs tens of thousands of dollars. The company says it can see dark objects, such as pavement or a person in dark clothing, with 10 percent reflectivity (a measure of how readily something reflects light) at a distance of 50 meters. In a demo Monday, Luminar showed its sensor detecting such objects, and a standardized 10 percent reflectivity target, at 200 meters.

Daniel Morris, an associate professor at Michigan State University, says that should be attractive to automakers if Luminar can deliver. “A lot of current lidars don’t have good enough long-distance range,” he says. “For highway driving you really want to see far.” At 70 miles an hour, an extra 100 meters of vision would give a car’s software an additional three seconds to take action when it sees an obstacle.

One reason Luminar’s sensor offers a longer range is that it uses a longer wavelength of light than sensors on vehicles today, allowing operation at higher power without breaching eye safety rules, says Russell. The sensor can also zoom in on a particular object by directing more laser beams in that direction, using a system of small, moving mirrors that actively steer its laser. In contrast, sensors from Velodyne and others use spinning mirrors that send out beams in a fixed pattern.

Luminar says it has received $36 million in funding and has over 150 employees, split between its headquarters in an old tank repair facility on a twenty five-acre "compound" in Silicon Valley and an optical engineering and production facility in Orlando, Florida. The first run of 10,000 units is scheduled for production this year. But the startup is far from the only company trying to reinvent lidar and exploit the sudden jump in its popularity.

Velodyne is expanding its production facilities and working on a “solid state” lidar design without any moving parts. Competitor Quanergy has $135 million in funding and says it will start shipping its own solid-state lidar, priced at $250, in volume this September. Quanergy and Luminar both say companies developing self-driving cars are already testing their sensors on public roads.

Louay Eldada, CEO of Quanergy, says he isn’t worried about Luminar. Moving mirrors come with reliability problems, he says. And using a longer wavelength of light requires use of the expensive semiconductor material indium gallium arsenide to detect reflections bouncing back off the world. Quanergy, like other lidar companies, can use silicon, which is much cheaper.

Russell says Luminar can keep costs down despite using the premium material because it has developed its own custom sensor, and packages it closely with a custom silicon chip that processes its signals. He declines to give a price for Luminar's product, but says although it will be more than the $250 Quanergy promises, his sensors will be higher performance and priced competitively with lidars on the market today.

Keep Reading

Most Popular

Large language models can do jaw-dropping things. But nobody knows exactly why.

And that's a problem. Figuring it out is one of the biggest scientific puzzles of our time and a crucial step towards controlling more powerful future models.

The problem with plug-in hybrids? Their drivers.

Plug-in hybrids are often sold as a transition to EVs, but new data from Europe shows we’re still underestimating the emissions they produce.

How scientists traced a mysterious covid case back to six toilets

When wastewater surveillance turns into a hunt for a single infected individual, the ethics get tricky.

Google DeepMind’s new generative model makes Super Mario–like games from scratch

Genie learns how to control games by watching hours and hours of video. It could help train next-gen robots too.

Stay connected

Get the latest updates from

MIT Technology Review

Discover special offers, top stories, upcoming events, and more.