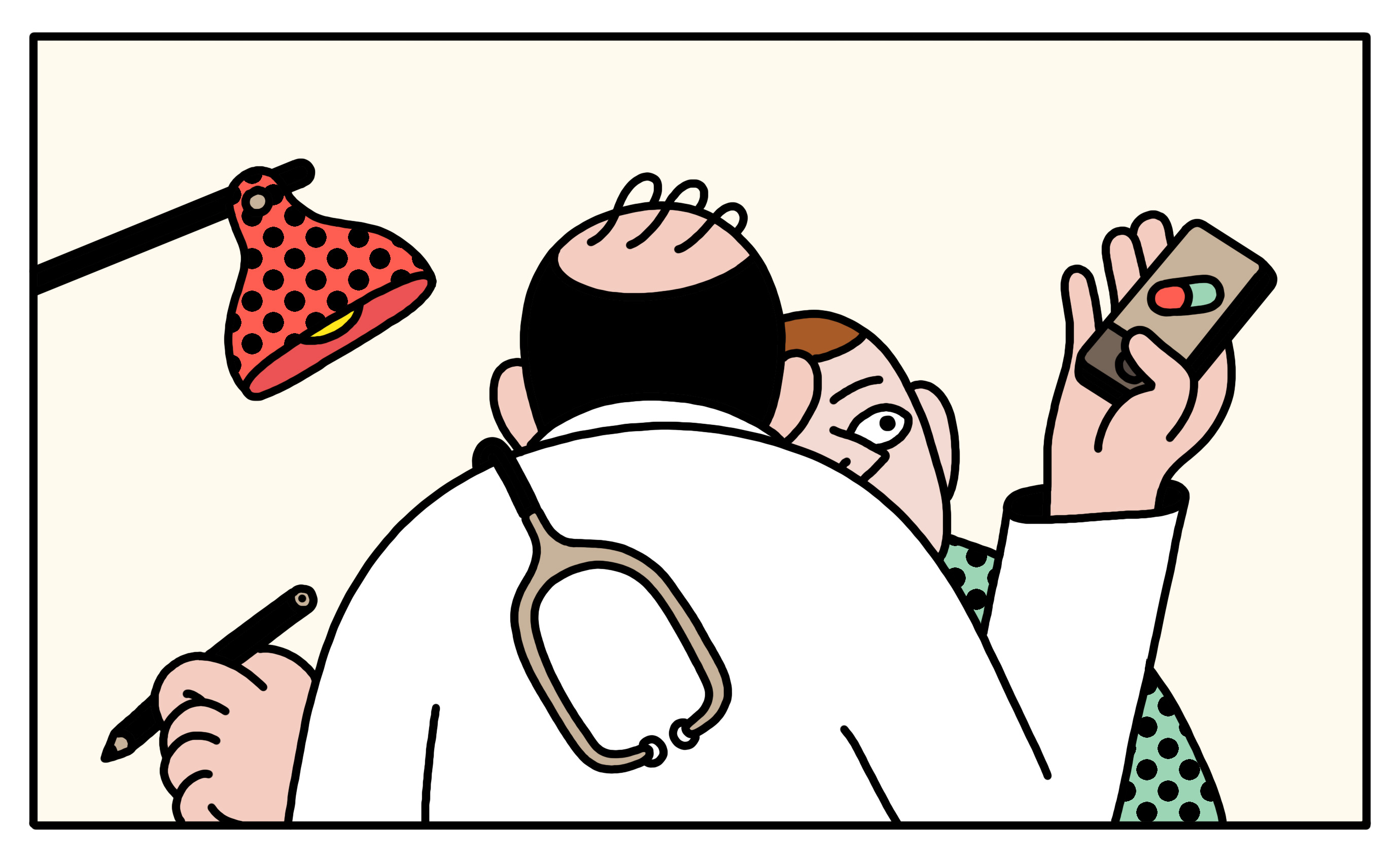

Can “Digital Therapeutics” Be as Good as Drugs?

What if an app could replace a pill? That’s the big question behind an emerging trend known as “digital therapeutics.” The idea: software that can improve a person’s health as much as a drug can, but without the same cost and side-effects.

Digital therapeutics, or “digiceuticals,” as some call them, have become a Holy Grail in some quarters of Silicon Valley, where investors see the chance to deliver medicine through your smartphone. Andreessen Horowitz, the venture firm, even predicts digital drugs will become “the third phase” of medicine, meaning the successor to the chemical and protein drugs we have now, but without the billion-dollar cost of bringing one to market.

“It’s going to seem backwards and even barbaric that our solution to everything was just giving out pills,” partner Vijay Pande wrote on the investment company’s blog.

But defining exactly what a digital therapeutic actually is can be as elusive as finding the famous chalice. “It’s still a fluid space that everyone is trying to categorize,” says Peter Hames, the British CEO of a startup called Big Health, which offers an online therapy program for insomnia suffers called sleep.io that it claims can replace “pills or potions” with visualization exercises.

Hames says digital therapies fall into two groups, which he calls “medication augmentation” and “medication replacement.” He says sleep.io is in the latter category because it actually makes sleeping pills unnecessary. “We’ve been able to show through multiple peer-reviewed studies that the outcomes are better than drugs,” he says.

The term digital therapeutics began to circulate around 2013, in large part due to Sean Duffy, CEO of Omada Health. He began using it at conferences and in the company’s marketing materials to describe its online coaching software to help pre-diabetics avoid getting sick by exercising more and losing weight.

About a dozen startups now call themselves digital therapeutics providers, and say they’re distinct from the rest of the digital health market of activity monitors, smart scales, and sleep trackers.

To distinguish themselves from “wellness” gadgets, digital therapeutics companies tend to carry out clinical tests and sometimes seek regulatory approvals –one company, Welldoc, offers a prescription-only version of its BlueStar phone app for managing diabetes, which it terms the “first FDA-cleared mobile prescription therapy.” But unlike drugs, digital therapeutics don’t usually need approval by the U.S. Food and Drug Administration, since often they promote lifestyle or dietary changes that are deemed to be low-risk.

Whether a digital therapeutic involves a tracking sensor or coaching though an app, the biggest question is whether they provide a distinct, measureable medical benefit. One startup calling itself a digital therapeutics company is Virta Health, based in San Francisco. The company raised $37 million in March. Its goal is to actually “reverse” diabetes without drugs or surgery using online coaching to get people on a special diet high in fats and low on carbs. It has a study by Indiana State University to back up the claim—about half of the 262 people with type 2 diabetes enrolled in a 10-week trial were able to reduce their blood glucose levels to non-diabetic ranges.

Steve Kraus, an investor at Bessemer Venture Partners, says he thinks digital therapeutics will be a “real thing, I really do,” but he says it’s not clear how many people will succeed with lifestyle intervention in the long run. Instead, he says, digital therapeutics used “in combination” with drugs, to make them work better, could be the idea’s sweet spot.

Some digital companies are already allying with pharmaceutical makers. One, Propeller Health, inked a deal with GlaxoSmithKline for what it calls a “digitally guided therapy” platform. The approach combines Glaxo’s asthma medications with sensors, made by Propeller, that patients attach to their inhalers to monitor when they’re used. Patients who get feedback from Propeller’s app end up using the medication less often.

To win adoption, digital therapeutics companies have striven to mimic the drug industry’s practices and standards. Big Health, based in San Francisco, went as far as testing a placebo version of its insomnia app against the real thing. One group of insomnia-sufferers were given plausible-sounding, but fake, online visualization exercises; the other received the actual cognitive behavioral therapy that Big Health says works. The digital treatment “absolutely spanked the placebo,” says Hames.

Hames believes that someday digital therapeutics companies may even outstrip drug companies when it comes to evidence. “We’re digital, so we’re going to have a firehose of data,” he says. Drugmakers don’t always track real-world results of their pills once clinical trials are done. But digital therapeutics companies could easily keep getting data. “It’s not in the drug company’s interest because they have already sold the drug,” he says. “Meanwhile, the insurance companies will say to us, ‘You have the data, so why don’t you just tell us?’”

Some drug company executives remain skeptical. Robert Plenge, vice president at Merck’s research labs, had to look up “digital therapeutics” when asked whether they were important. “I don’t totally understand what you mean,” he says. “Which might in and of itself be your answer.” Plenge doesn’t think the idea would have much impact on drug development and questioned whether digital companies will be able to prove their offerings are worth the price.

But some digital therapies are already much cheaper than your average drug. At Big Health, people are charged $400 a year, or about $33 a month, to use the insomnia software. The sleeping pill Ambien, by contrast, costs $73 for six tablets, or six nights of shut-eye.

A notable difference is that insurance often pays most of the cost of drugs and insurers are still getting used to digital therapeutics. Omada Health in 2016 again broke ground when Medicare agreed to reimburse the cost of its digital diabetes prevention program. The company didn't say how much it bills employers and insurance plans, but it would charge a self-paying customer $140 a month for the first four, then $20 per month.

Ambar Bhattacharyya, with Maverick Ventures, says he thinks insurers are ready to talk about covering digital therapies more widely. “This is an imminent issue that I suspect will be figured out within a year,” he says. If it’s good news, he says, the space is poised to explode.

Deep Dive

Policy

Is there anything more fascinating than a hidden world?

Some hidden worlds--whether in space, deep in the ocean, or in the form of waves or microbes--remain stubbornly unseen. Here's how technology is being used to reveal them.

What Luddites can teach us about resisting an automated future

Opposing technology isn’t antithetical to progress.

Africa’s push to regulate AI starts now

AI is expanding across the continent and new policies are taking shape. But poor digital infrastructure and regulatory bottlenecks could slow adoption.

A brief, weird history of brainwashing

L. Ron Hubbard, Operation Midnight Climax, and stochastic terrorism—the race for mind control changed America forever.

Stay connected

Get the latest updates from

MIT Technology Review

Discover special offers, top stories, upcoming events, and more.