China’s GMO Stockpile

It is a hot, smoggy July weekend in Beijing, and the gates to the Forbidden City are thronged with tens of thousands of sweat-drenched tourists. Few make the trek to the city’s east side and its more tranquil China Agricultural Museum, where several formal buildings are set amid sparkling ponds ringed by lotus plants in full pink bloom. The site, which is attached to the Ministry of Agriculture, promises that it will “acquaint visitors with the brilliant agricultural history of China”—but what’s missing from the official presentation is as telling as what’s on display.

At least 9,000 years ago, people living in China were the first to cultivate rice, developing elaborate irrigation systems. Today, rice is the nation’s (and half the world’s) most important crop. Some 2,500 years ago, the Chinese also invented the first really efficient iron ploughshares, called kuan, with a curved V shape that efficiently turned hard soil. These millennia-old innovations are matched by those of the past century. A display honors Yuan Longping, China’s revered “father of hybrid rice,” who in the mid-1960s posited that if he could find male-sterile rice plants—ones unable to self-pollinate—he could create hybrid strains reliably and at large scale. (In general, hybrids are more vigorous and higher-yielding than the parent varieties.) He later found such plants and, together with other researchers, created a process to make high-yielding hybrids year after year, revolutionizing rice production.

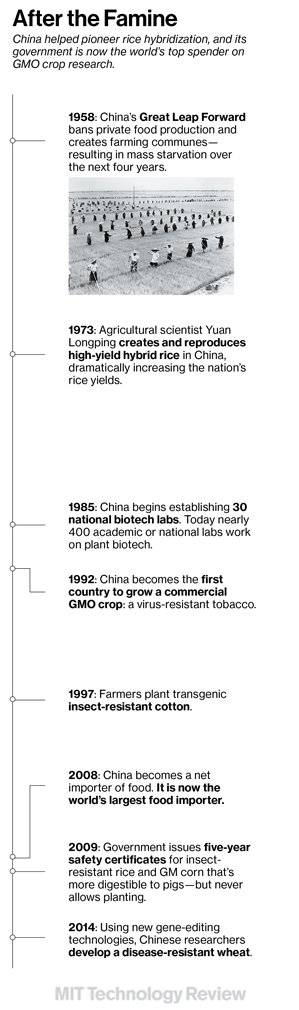

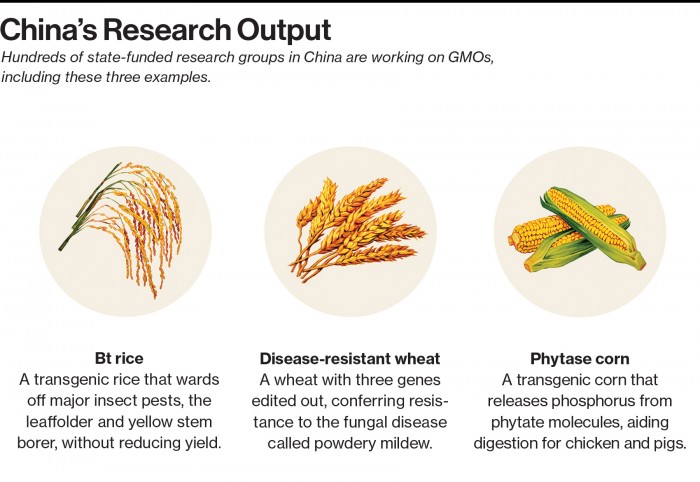

But the exhibits don’t mention the vast suffering wrought by Chinese agricultural failure. Yuan himself lived through Chairman Mao Zedong’s “Great Leap Forward” of 1958–1961, which triggered a collapse in food production and distribution by banning private farming in favor of vast collective farms. As many as 45 million people died, most by starvation. The museum also says nothing about the most fought-over product of modern-day agricultural technology: genetically modified organisms, or GMOs. Yes, there’s a 1990s-era gene gun, which used high-pressure gas to blast DNA-coated particles into plant cells to create early transgenic crops. And there’s a stalk representing the big GMO success story that used this approach: Bt cotton, a pest-resistant variety that has been planted widely in China for 15 years, greatly increasing production while slashing pesticide use. (The plant, which incorporates DNA from a soil bacterium that’s harmful to insects, makes up 90 percent of the cotton crop and by one estimate produces a $1 billion annual economic gain for farmers.) But the story seems to end more than a decade ago.

China’s ruling Communist Party faces rising popular opposition to GMOs. As in any other nation, there are a variety of views within China about whether it’s safe to eat food made with genetically engineered ingredients. But Chinese citizens have lately witnessed a number of major food safety scandals, including a 2008 disaster in which melamine-tainted milk products killed six babies or toddlers, sending 54,000 more to the hospital, and a 2010 revelation that some cooking oil sold to consumers had been recovered from drains and probably contained carcinogens. Against this backdrop, otherwise implausible-sounding claims from a vocal minority of GMO critics (such as an assertion that GMO soybean oil was associated with a higher incidence of tumors) gain traction in the country’s social media, which many Chinese favor over official state media as a source of news. The Chinese press and social media lit up when, in 2012, Greenpeace released a scary-sounding report on a research project that involved feeding children “golden rice,” which is engineered to produce beta-carotene and thus make up for vitamin A deficiencies. (It turned out that the parents were not told the rice was genetically modified; China fired three researchers involved.)

Mao’s “Great Leap Forward” triggered a collapse in food production by banning private farming in favor of vast collective farms. As many as 45 million people died.

Recent informal opinion surveys in Chinese social media suggest that large majorities believe GMOs are harmful, and scientific surveys also indicate that opposition is significant. An academic survey this year found that roughly one-third of respondents opposed GMOs outright and another 39 percent worried about them—a stark difference from earlier government surveys. Such opposition is often tinged with nationalism. With growing quantities of GM corn and soybeans being imported to China—largely for animal feed but also for processing into food ingredients such as oil—the notion is spreading through social media that Americans are trying to poison Chinese consumers, or at least foisting on them the GMOs that they refuse to eat themselves (although in fact, most processed food Americans eat contains genetically modified ingredients).

A Chinese general decreed earlier this year that no GMO ingredients, not even a little oil, should be allowed in soldiers’ food. So for now, anyway, the government is holding back on approving new GMOs for food crops. Today no genetically modified food (with the exception of a virus-resistant papaya) is grown in China, even for animal feed. The Ministry of Agriculture issued its last significant safety approvals five years ago—for a pest-resistant rice developed in China and a variety of corn whose phosphorus content is more digestible to pigs, enhancing growth and reducing subsequent pollution—but never gave the okay for actual planting. The safety certificates expired in August. A recent endorsement of GMOs by the aging Yuan Longping himself has done little to move the policy or change public opinion. Ji-kun Huang, director of the Center for Chinese Agricultural Policy, says, “The technology is ready, but politically, it’s sensitive. Commercialization will be a long way off. Rice is a staple food, and public concern about safety is serious.”

Yet despite the uncertainties, research on GMO crops continues. By one count published in Nature Biotechnology, 378 Chinese groups employing thousands of scientists are engaged in this work. The government will have spent some $4 billion on GMOs by 2020. Researchers are using the latest modification technologies and drawing from high-throughput genomic analysis of thousands of crop strains, accelerating the pace of discovery.

Cautious though they are of arousing public opposition, Chinese leaders are well aware that their country will need a lot more food. Growing it will require new agricultural tricks. The world’s most populous nation, China has more than 1.3 billion inhabitants, a number expected to rise to almost 1.4 billion by 2030. Meanwhile, accelerating climate change will pose great challenges for farmers, bringing deeper droughts, more flooding, and hotter heat waves (see “Why We Will Need Genetically Modified Foods,” January/February 2014). Although crop yields in China tripled from the 1960s through the 1990s, thanks to hybrid varieties and generous spraying of pesticides, those gains slowed significantly 15 years ago. Since then, yields have flattened. To make matters worse, rapid industrialization is eating into the supply of arable land. Finally, the population will be getting not just larger but richer; rising GDP means more demand for meat, putting huge pressure on crops. Demand for imported corn alone is expected to surge from about five million tons this year to more than 20 million tons in just 10 years. Much of that crop is expected to feed animals ultimately headed for Chinese slaughterhouses.

In anticipation, the nation is building a storehouse of genetically modified crop strains for future use. China sees this as a way of protecting its long-term security. In fact, the country is the world’s top public spender on genomics and genetic modification of crops, says Scott Rozelle, a China scholar and food security expert at the Freeman Spogli Institute for International Studies at Stanford University. “Certainly we [the United States] aren’t doing much—and the big multinationals aren’t doing much right now in terms of spending on plant biotech research,” Rozelle says. “And yet China continues to do it.” So far China has been able to feed itself, so there is no impetus to deploy this new technology, he adds. “Yet they continue to pour money into it. Are they doing it for the love of science? They are putting away for a rainy day—or a non-rainy one. And when that day comes, I think they will have more GM technologies than anyone.”

The government keeps current food prices low by investing in irrigation and subsidizing farmers, and it keeps meat on the table thanks at least in part to imported corn and soybeans. China became a net food importer in 2008 and the world’s top food importer four years later; it now imports about 5 percent of its food. This makes China’s stance on GMO food crops critical for the entire global market; if China green-lights GMOs, many other countries that export to China may accept them too.

Meanwhile, the rising use of imports puts pressure on China to do more to feed its own people, and that helps drive internal research on GMOs. Imports are “a very important issue for food security,” says Dafang Huang, chief scientist of the Biotech Research Institute at the China Academy of Agricultural Sciences in Beijing, which is collaborating on a vast array of agricultural genome sequencing and GMO efforts. “I think the high-level officials are very concerned. We have to use the new technology. We have to develop the GMO.”

Rice Editor

Exuberant and prone to charming bursts of laughter, Caixia Gao embodies the optimistic, energetic present of GMO research in China. Wearing a gray T-shirt emblazoned with “Just Do It” in large pink letters, she leads a tour of her greenhouses at the State Key Lab of Plant Cell and Chromosome Engineering at the Institute of Genetics and Developmental Biology, part of the Chinese Academy of Sciences in Beijing. She’s one of the world’s leaders in using sophisticated gene-editing technologies, including those known as TALENs and CRISPR. The earlier gene guns were analogous to shotguns: they could not precisely control where they inserted DNA into a plant cell. The process was, quite literally, hit or miss. The new methods, by contrast, insert molecules that can cut specific sequences of DNA. This makes it possible to delete or add a gene at any desired spot on the genome, or even to change just a few nucleotides, something unthinkable with older methods. Since the new tools make their changes without relying on genes taken from other species such soil bacteria, they could also answer some of the objections leveled against transgenic crops.

Gao is at the vanguard of genetic engineering in rice. As she strides through a humid greenhouse filled with test trays of rice plants (the air feels cleaner here—though anything would be better than the heavy smog outdoors), she explains that each has had one or more of its genes “knocked out” using the new editing tools. On one shelf sits a strain that grows straighter; more plants can fit in a given area. On another, she shows off one with a desirable fragrance: “It smells good and tastes good—for quality.” These features could help the market accept future strains engineered for traits such as disease resistance. Finally, she arrives at a tray of rice plants half as tall as the surrounding ones. Their small stature resulted from editing out a single gene; while the implications aren’t yet clear, the hope is that less of the plant’s energy is going into making leaves and more into making the edible seeds. That would permit higher yields.

Large-scale field trials are going on all over the country, but public data is scant. Scientists feel they must hide the locations of the trials. They have reason to worry.

Gao’s trays are part of a massive nationwide enterprise. In 2002, Chinese scientists were among the first to sequence a rice genome; this year they released the sequences of 3,000 varieties as part of a continuing effort with the International Rice Research Institute (IRRI) in the Philippines and the Beijing Genomics Institute to develop a crop known as “green super rice” (GSR). BGI has been using high-throughput technology to systematically compare these strains. The goal is to identify the genes that might be important for traits such as yield, flavor, pest and herbicide resistance, and tolerance to drought, salt, and immersion. Combined with the gene-editing tools, this new wealth of knowledge means that an era of very rapid and precise GMO development is at hand.

Gao and colleagues are doing similar systematic studies on the next-most-important crops: corn, wheat, and soybeans. They recently invented a wheat strain that resists the second-most-common wheat disease, powdery mildew. We drove to the outskirts of Beijing, where behind a row of industrial buildings, outdoor test plots were full of new crop varieties made with both conventional breeding and GMO technology. The GMOs included a soybean plant whose beans produce more oil and an acre or so of rice that can avoid leaf death.

Large-scale field trials are going on all over the country, but public data is scant. Two to three hours outside Beijing, a number of test fields of wheat have recently been harvested, Dafang Huang says. Work at the Chinese Academy of Agricultural Science includes planting drought-resistant varieties of wheat. Other Chinese institutions are making similar progress on drought-resistant corn, he adds. But like many of their colleagues across the country, the scientists feel that they must hide the locations of the trials. (They have reason to worry. Three years ago Australian Greenpeace activists destroyed a field of GM wheat plants; last year, activists in the Philippines destroyed a test plot of golden rice. Gao and Huang told me they worry that something similar could happen in China.) But while there is no central public repository of field trial data, Huang told me it was safe to assume that the plantings are widespread—and productive. “You can imagine that many, many field trials are going on in the different areas,” he says. “Basic research is very open, but for the field trials, I think the data is very secret.”

Researchers sometimes wonder if their work will ever see the light of day. “We can do research—we have enough financial support—but I don’t know if Chinese scientists can produce the product,” Gao says. At the National Key Laboratory of Crop Genetic Improvement at Huazhong Agricultural University in Wuhan, Qifa Zhang, the lab’s director, is hard at work on GSR. He also developed an insect-resistant Bt rice, which is still barred from commercialization. But he’s reticent when it comes to talking about GMOs. “Inaccurate quotations of such interviews have done me more harm than help,” he lamented in an e-mail. “I prefer not to talk.”

Going It Alone

At the beginning of this year, China released a policy document stressing the need to match its world-class basic research with a more modernized seed industry. The goal: to consolidate many of the country’s thousands of seed companies and develop ones more like Monsanto, linking basic research to large-scale production of seed. So I was looking forward to visiting Da Bei Nong Group, the giant Chinese animal feed and seed company that is the most valuable agricultural company in the Chinese market. I was to visit the DBN Biotech Research Center in Beijing, headed by Lu Yuping, former head of Syngenta’s research unit there. DBN’s projects include herbicide-tolerant soybeans as well as corn with so-called stacked traits of herbicide and insect resistance; the tour was to include a view of extensive laboratory and field trials.

Then came the indictments.

In early July, just three weeks before my visit, a federal grand jury in Des Moines, Iowa, indicted Mo Yun, wife of Da Bei Nong Group’s billionaire chairman, on one count of conspiracy to steal trade secrets: to wit, valuable corn seed from test fields in Iowa and Illinois owned by DuPont Pioneer, Monsanto, and LG Seeds. Yun’s indictment followed those of six other employees of the company or its subsidiaries in late 2013. One was accused of trying to drive across the border from Vermont to Canada with containers of kernels stashed under the seats; others are accused of packing stolen corn into Ziploc bags and attempting to FedEx them from Illinois to Hong Kong. All told, the cost to Pioneer and Monsanto totaled $500 million, prosecutors allege.

Despite all this, the circumspect, soft-spoken Lu gamely agreed to meet me for an off-site interview. Unsurprisingly, he would not comment on the U.S. indictments, saying the accusations are unrelated to his unit. But he says the DBN Biotech Center is using gene-editing technologies to create male-sterile rice, hoping to accelerate the sort of research Yuan pioneered, while it continues the top-priority research into herbicide tolerance in corn and soybeans. He stressed that the company was working on its own varieties, in part to deal with insect threats that occur mostly in China. “Some pests are China-specific, and this is our challenge—we have to have new innovations,” he says.

While the accusations fit into a larger narrative of alleged Chinese corporate espionage, it would be a mistake to assume that such malfeasance, if it’s actually occurring, is a mainstay of China’s GMO strategy. Stealing seeds would help avoid a couple of years of breeding work. But given the extensive government-funded in-house work it has to draw upon, DBN’s own biotech R&D may be as productive as that of multinational seed companies, says Carl Pray, an economist at Rutgers University who is a close watcher of the Chinese agriculture sector. His sense is that DBN is “doing some pretty good research,” he says, adding, “I don’t think that the research they are doing really can match the latest research at Monsanto, DuPont, or Syngenta, but the technology is probably getting to a point where it will work fairly well in China.”

In addition, Chinese companies would enjoy structural and economic advantages. The example of Bt cotton is instructive. Back in 1997, Monsanto introduced its insect-resistant cotton to China shortly before Biocentury Transgene, a startup partly owned by the Chinese Academy of Agricultural Sciences, started to commercialize its own Bt cotton seed, which it was able to sell for half the price. The company quickly overtook Monsanto, and today its seed commands almost the entire Chinese cotton market. It is not hard to imagine that China could repeat the feat with corn, soybeans, and other crops (Qifa Zhang is working with another major Chinese seed company, China National Seed, on rice). China has restricted R&D by multinational seed companies, leaving the market wide open to local firms. And since most of the results would be consumed within China, those companies wouldn’t have to worry about regulations in the GMO-skittish European Union or elsewhere.

Yet even promising startups—ones encouraged by the government—are holding back on GMOs. A few years ago, Xing Wang Deng arrived in Beijing to start a lab at Peking University through China’s 1,000 Talents Program, which attempts to bring Chinese-born experts back from abroad. A native of rural Hunan province, he had earned a PhD at the University of California, Berkeley, and wound up running his own lab at Yale. There, he led basic research into understanding how plants respond to light stimuli.

Nobody knows when China will begin deploying its GMO stockpile. But few doubt that at some point the government will decide to plant what it has been developing in its labs.

Since Deng has extensive experience identifying the functions of plant genes, he’s in the perfect position to guide research using next-generation, highly precise genetic tools to subtly change crop genomes. During my visit, a brand-new lab space was being readied on campus; a few miles away stood new office space for his startup company, Frontier Laboratories.

But Deng won’t include GMOs in his initial batch of products. He’s trying to develop hybrid rice and wheat varieties using chemically induced mutations and molecular biology techniques such as looking at genetic markers to aid conventional breeding. He’s even working on ways to make crops herbicide-resistant without adding genes from soil bacteria. “These might yield similar results to genetic modification,” he says. Deng’s delicate dance to avoid the GMO label is a sign of the social and political climate—for now. “It seems the government is not in a rush,” he says. “It probably has more challenging issues on its hands, so this is not one to deal with at the moment. The [need for] GMOs is not rising to [such a] crisis that the government has to deal with it.”

Crises will come. The Chinese government that wants to avoiding provoking the outrage of its GMO-wary citizens may at some point face a broader and even more distressed constituency: farmers watching crops dying, and citizens who can’t afford—or even find—enough food. Temperature increases and precipitation decreases could slash China’s net yields of rice, wheat, and corn by 13 percent over the next 35 years, according to an analysis by scientists at Peking University’s Center for Climate Research. Even an outcome that merely keeps yields flat would be catastrophic in the face of population growth and rising demand. “If we have some very serious agricultural disasters for the government officials, they have to make decisions to push the commercialization of GMOs,” says Dafang Huang.

Even if China can increase yields by improving existing agricultural practices, as it probably can, Rozelle and other China watchers expect the country to approve GM corn at some point; the demand for corn for animal feed will become too urgent, and using the crop for animal feed is far less controversial than growing it for human consumption. Nobody knows when or to what extent China will begin deploying its GMO stockpile to feed its citizens. But few doubt that at some point, when costs rise and supply gets tighter, the government will decide it’s time to plant what it has been developing in its labs. And when that happens, given China’s centrally managed economy, farms and families can be expected to adopt the technology quickly. “Once the official attitude is changed, everything will be changed very soon,” says Huang. And in the decades to come, if one of the innumerable GMO strains sprouting in the labs of Gao and others should help get the nation through a mega-drought or pronounced heat wave, that fix might well seem museum-worthy to future curators of Chinese agricultural history.

Keep Reading

Most Popular

Large language models can do jaw-dropping things. But nobody knows exactly why.

And that's a problem. Figuring it out is one of the biggest scientific puzzles of our time and a crucial step towards controlling more powerful future models.

The problem with plug-in hybrids? Their drivers.

Plug-in hybrids are often sold as a transition to EVs, but new data from Europe shows we’re still underestimating the emissions they produce.

Google DeepMind’s new generative model makes Super Mario–like games from scratch

Genie learns how to control games by watching hours and hours of video. It could help train next-gen robots too.

How scientists traced a mysterious covid case back to six toilets

When wastewater surveillance turns into a hunt for a single infected individual, the ethics get tricky.

Stay connected

Get the latest updates from

MIT Technology Review

Discover special offers, top stories, upcoming events, and more.

PHOTO ESSAY: China’s Growing Bets on GMOs

PHOTO ESSAY: China’s Growing Bets on GMOs