The U.S. Can’t Really Undermine Russia by Exporting Gas

The crisis in Crimea has prompted calls for the U.S. to ramp up natural gas exports to Europe by quickly approving new facilities capable of liquefying the fuel and sending it overseas. The argument is that this could undermine Russia’s strategic power by reducing Europe’s heavy reliance on Russian gas.

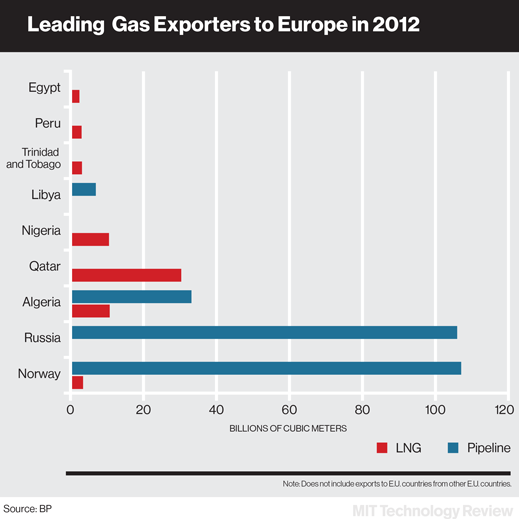

The numbers on natural gas exported to Europe show just how simplistic this argument is. Russia dominates the market, and regardless of the speed of the approval process, it will take several years and tens of billions of dollars of investment for the U.S. to come close to Russia’s exports.

In 2012, pipelines carrying Russian gas supplied 34 percent of all the natural gas sold in the European Union by non-E.U. countries. Several nations, including Bulgaria, Lithuania, and the Czech Republic, rely on Russia to supply over 80 percent of their natural gas needs. Around 80 percent of the gas exported to Europe travels by pipeline; the rest arrives as liquefied natural gas (LNG).

Natural gas exported from the U.S. to Europe must be liquefied at export terminals, a costly process that involves cooling the gas to greatly reduce its volume.

Today the U.S. has only one LNG export terminal, located in Alaska, where in recent years gas has been liquefied before being sent to Japan. The U.S. already exports a very small amount of LNG to Europe. It sent 0.1 billion cubic meters in 2012—too small to be visible on the chart above.

Companies that want to export LNG must apply for approval from the U.S. Department of Energy and the Federal Energy Regulatory Commission. Applications to sell to countries without a free trade agreement with the U.S., which include many countries in Europe, are subject to greater scrutiny, which can draw out the process.

So far five new liquefaction plants, capable of exporting a total of 240 million cubic meters per day, have been approved by the Department of Energy. But only one of those facilities, on the Gulf of Mexico, is now under construction. The company building it aims to be able to ship 78 million cubic meters per day by 2015. This will still leave U.S. exports far behind those of Russia, which sent 505 million cubic meters of gas to Europe on a single day earlier this month.

Twenty-five more applications to export LNG are pending. If these are all approved and built, it would increase U.S. LNG export capacity to nearly 850 million cubic meters per day. But these terminals will take several years to build, and approvals wouldn’t guarantee construction, given the immense costs involved.

Eight of the proposed projects would add a liquefaction facility to an existing LNG import terminal (the U.S. has 12 such terminals), which the Congressional Research Service estimates will cost between $6 billion and $10 billion each. The remaining projects entail building brand new terminals—each of which could cost as much as $20 billion.

Keep Reading

Most Popular

Large language models can do jaw-dropping things. But nobody knows exactly why.

And that's a problem. Figuring it out is one of the biggest scientific puzzles of our time and a crucial step towards controlling more powerful future models.

The problem with plug-in hybrids? Their drivers.

Plug-in hybrids are often sold as a transition to EVs, but new data from Europe shows we’re still underestimating the emissions they produce.

Google DeepMind’s new generative model makes Super Mario–like games from scratch

Genie learns how to control games by watching hours and hours of video. It could help train next-gen robots too.

How scientists traced a mysterious covid case back to six toilets

When wastewater surveillance turns into a hunt for a single infected individual, the ethics get tricky.

Stay connected

Get the latest updates from

MIT Technology Review

Discover special offers, top stories, upcoming events, and more.