Burning the U.K.’s Plutonium Stockpile Could Fast-Track New Reactors

Pressure to reduce the U.K.’s plutonium stockpile, along with generous premiums for new nuclear power generation, is breathing new life into a decades-old reactor design—GE Hitachi Nuclear Energy’s Power Reactor Innovative Small Module, or PRISM, technology. PRISM is a fast reactor, whose speedy neutrons can break down waste from spent nuclear fuel.

Since the 1960s, the U.K. has acquired a large amount of plutonium by reprocessing nuclear fuel. The plan had been to process it further so that it could be used again as fuel in a nuclear power plant, but doing so proved too technically challenging and the project was put on hold. Last month, the U.K.’s Nuclear Decommissioning Authority formally announced that PRISM provides a “credible” alternative.

If PRISM can get traction by fixing the U.K.’s plutonium problem, the design could go on to tackle a much more ambitious waste-treatment goal: burning not just plutonium but all of the long-lived transuranic byproducts that make spent nuclear fuel a 300,000-year problem. And it could generate low-carbon electricity at the same time, at prices competitive with other nuclear reactors, says Per Peterson, chair of nuclear engineering at the University of California, Berkeley.

PRISM is modeled on a 20-megawatt U.S. Department of Energy experimental reactor that ran safely and reliably at Argonne National Laboratory for three decades. After $77 million of DOE-funded design work, PRISM was submitted to the NRC for preliminary review in the early 1990s, but it was left on the shelf when DOE subsequently pulled back from fast-reactor development.

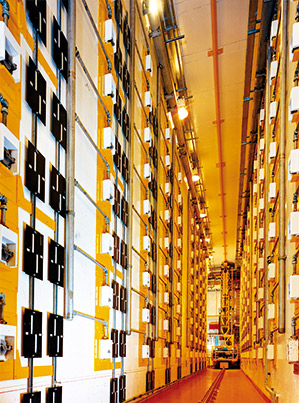

GE Hitachi never gave up, however, and has continued to hone the design. Today it believes that PRISM’s distinct features could make it cheaper and safer than fast reactors that China, India, and Korea are already aggressively developing (see “Developing Nations Put Nuclear on Fast Forward”). Like most fast reactors, PRISM is cooled with molten sodium rather than the water used in conventional commercial reactors. Unlike most, however, PRISM is a small modular reactor (see “Can Small Reactors Ignite a Nuclear Renaissance?”). At a fifth the size of conventional reactors, it’s small enough that key components can be manufactured in factories rather than built at a construction site, speeding construction and reducing costs, says Eric Loewen, technical lead for PRISM at GE Hitachi.

Unlike conventional nuclear power plants, which require electricity to pump water and stay cool, PRISM will cool off on its own in the case of a power failure, which could prevent meltdowns like the ones at Fukushima.

PRISM’s unusual kind of fuel also adds to its passive safety, says Christopher Grandy, manager for reactor engineering at the DOE’s Argonne National Lab.

Most fast reactors and commercial nuclear reactors use oxide fuels that fission more as they heat up. But PRISM will use a metal alloy fuel that expands as it heats, spacing out the fissioning atoms and thus slowing the chain reaction. This effect was demonstrated at the Argonne experimental reactor. “They turned the pumps off and the reactor just turned itself off. You can’t do that with an oxide-fueled core,” says Grandy.

These advantages have failed so far to sell PRISM in the U.S. Most recently it was passed over for DOE grants awarded last year for small modular reactor development.

PRISM wasn’t the U.K.’s first pick either. The U.K. Nuclear Decommissioning Authority had originally planned to blend plutonium and uranium to form mixed oxide ceramic, or MOX, fuel for conventional reactors. The problem, says Peterson at U.C. Berkeley, is that only France has managed to control the deadly plutonium aerosols the process creates: “It’s so technically challenging that no other country has been able to replicate it.”

The Decommissioning Authority shuttered its failed £1.2 billion ($2 billion) MOX fabrication plant in 2011. Loewen says the PRISM approach would be significantly cheaper than producing MOX.

GE Hitachi says it can best exploit the U.K.’s plutonium by running it through a pair of PRISM reactors in two stages. First, the reactors would burn plutonium-rich fuel elements for a few months each, raising their level of radioactivity to make the plutonium harder to handle and thus reduce its security risk. When the reactors had worked through the stockpile, the fuel elements could then be cycled through the reactors again for longer passes, generating power for the remainder of their 60-year design life.

Power revenues could be lucrative. The U.K. government recently guaranteed one nuclear developer rates for its power that would be nearly double last year’s average wholesale power price.

The Decommissioning Authority previously rejected PRISM, deciding that it would take too long to deploy. This time around, GE managed to convince the authority that it could build the reactors faster—in 14 to 18 years, rather than the more than 25 years originally anticipated.

Doug Parr, an atmospheric chemist and chief scientist for Greenpeace U.K., chalks up the authority’s conversion to political pressure to reduce the cost of managing nuclear waste management, which he says absorbs more than half of public spending on energy in the U.K. “Finding revenue streams from existing assets is quite a serious driver,” says Parr.

Whether GE Hitachi can deliver as promised is an open question, given the history of radioactive leaks and cost overruns associated with other reprocessing plants, fuel fabs, and fast reactors, Parr says.

The authority is still considering MOX technology. It says it will need one to two years of technical study from both GE Hitachi and vendors of MOX technologies to decide which to pursue.

Should GE Hitachi get the nod, its next hurdles will be the parallel processes of detailed design and reactor licensing. The latter may be the toughest challenge, according to Peterson. The U.K. shut down its fast-reactor program 20 years ago, and its nuclear regulator has little expertise on related topics such as the use of molten sodium and metallic fuels. As Peterson puts it, “The equipment and personnel are retired. How do you rebuild that capability?”

Keep Reading

Most Popular

Large language models can do jaw-dropping things. But nobody knows exactly why.

And that's a problem. Figuring it out is one of the biggest scientific puzzles of our time and a crucial step towards controlling more powerful future models.

The problem with plug-in hybrids? Their drivers.

Plug-in hybrids are often sold as a transition to EVs, but new data from Europe shows we’re still underestimating the emissions they produce.

How scientists traced a mysterious covid case back to six toilets

When wastewater surveillance turns into a hunt for a single infected individual, the ethics get tricky.

Google DeepMind’s new generative model makes Super Mario–like games from scratch

Genie learns how to control games by watching hours and hours of video. It could help train next-gen robots too.

Stay connected

Get the latest updates from

MIT Technology Review

Discover special offers, top stories, upcoming events, and more.