How Wireless Carriers Are Monetizing Your Movements

Wireless operators have access to an unprecedented volume of information about users’ real-world activities, but for years these massive data troves were put to little use other than for internal planning and marketing.

This data is under lock and key no more. Under pressure to seek new revenue streams (see “AT&T Looks to Outside Developers for Innovation”), a growing number of mobile carriers are now carefully mining, packaging, and repurposing their subscriber data to create powerful statistics about how people are moving about in the real world.

More comprehensive than the data collected by any app, this is the kind of information that, experts believe, could help cities plan smarter road networks, businesses reach more potential customers, and health officials track diseases. But even if shared with the utmost of care to protect anonymity, it could also present new privacy risks for customers.

Verizon Wireless, the largest U.S. carrier with more than 98 million retail customers, shows how such a program could come together. In late 2011, the company changed its privacy policy so that it could share anonymous and aggregated subscriber data with outside parties. That made possible the launch of its Precision Market Insights division last October.

The program, still in its early days, is creating a natural extension of what already happens online, with websites tracking clicks and getting a detailed breakdown of where visitors come from and what they are interested in.

Similarly, Verizon is working to sell demographics about the people who, for example, attend an event, how they got there or the kinds of apps they use once they arrive. In a recent case study, says program spokeswoman Debra Lewis, Verizon showed that fans from Baltimore outnumbered fans from San Francisco by three to one inside the Super Bowl stadium. That information might have been expensive or difficult to obtain in other ways, such as through surveys, because not all the people in the stadium purchased their own tickets and had credit card information on file, nor had they all downloaded the Super Bowl’s app.

Other telecommunications companies are exploring similar ideas. In Europe, for example, Telefonica launched a similar program last October, and the head of this new business unit gave the keynote address at new industry conference on “big data monetization in telecoms” in January.

“It doesn’t look to me like it’s a big part of their [telcos’] business yet, though at the same time it could be,” says Vincent Blondel, an applied mathematician who is now working on a research challenge from the operator Orange to analyze two billion anonymous records of communications between five million customers in Africa.

The concerns about making such data available, Blondel says, are not that individual data points will leak out or contain compromising information but that they might be cross-referenced with other data sources to reveal unintended details about individuals or specific groups (see “How Access to Location Data Could Trample Your Privacy”).

Already, some startups are building businesses by aggregating this kind of data in useful ways, beyond what individual companies may offer. For example, AirSage, an Atlanta, Georgia, a company founded in 2000, has spent much of the last decade negotiating what it says are exclusive rights to put its hardware inside the firewalls of two of the top three U.S. wireless carriers and collect, anonymize, encrypt, and analyze cellular tower signaling data in real time. Since AirSage solidified the second of these major partnerships about a year ago (it won’t specify which specific carriers it works with), it has been processing 15 billion locations a day and can account for movement of about a third of the U.S. population in some places to within less than 100 meters, says marketing vice president Andrea Moe.

As users’ mobile devices ping cellular towers in different locations, AirSage’s algorithms look for patterns in that location data—mostly to help transportation planners and traffic reports, so far. For example, the software might infer that the owners of devices that spend time in a business park from nine to five are likely at work, so a highway engineer might be able to estimate how much traffic on the local freeway exit is due to commuters.

Other companies are starting to add additional layers of information beyond cellular network data. One customer of AirSage is a relatively small San Francisco startup, Streetlight Data which recently raised $3 million in financing backed partly by the venture capital arm of Deutsche Telekom.

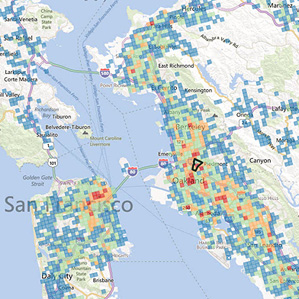

Streetlight buys both cellular network and GPS navigation data that can be mined for useful market research. (The cellular data covers a larger number of people, but the GPS data, collected by mapping software providers, can improve accuracy.) Today, many companies already build massive demographic and behavioral databases on top of U.S. Census information about households to help retailers choose where to build new stores and plan marketing budgets. But Streetlight’s software, with interactive, color-coded maps of neighborhoods and roads, offers more practical information. It can be tied to the demographics of people who work nearby, commute through on a particular highway, or are just there for a visit, rather than just supplying information about who lives in the area.

“If you’re a retailer and you are on someone’s commute path, they may pass by you 600 times a year,” says founder and CEO Laura Schewel, a transportation researcher who is also finishing her PhD at the University of California, Berkeley. “If they never come in, that’s a big missed opportunity.”

Streetlight’s work shows why such data has the potential to improve city planning. One of the company’s first customers is the Oakland Business Development Corporation, which is trying to attract businesses to a city with a reputation for crime and poverty, says Schewel. Streetlight’s data shows the patterns by which droves of wealthier people commute through the city from outlying suburbs on their way to San Francisco, and it also shows that young people visit Oakland for the growing nightlife scene. The group’s goal is to convince national chains that don’t know Oakland well and might look only at household demographics that it makes sense to open up a shop there, and then help them chose ideal locations.

Of course, all the companies involved are aware that people may have privacy concerns, and they wrestle with the challenge of conveying what “anonymous” and “aggregated” data means to people who are increasingly aware that they are carrying around a tracker in their pocket. (Verizon Wireless also does allow its customers to opt out of the program).

The companies appear to be taking many precautions to protect privacy. In Streetlight’s case, the data is obtained in batches and algorithms are used to tease out patterns that help it match locations to other sources of data, such as DMV records or U.S. Census information. The company says it can’t track any individual device on a map or target ads to any one specific person with the data it buys. Schewel also emphasizes that the data is at least a day, if not a month, old and its software doesn’t report statistics for groups of less than 15 devices.

A more important question, probably, is how people will balance their privacy concerns with the benefits of making their location data, or other mobile data about them, more available. Research and experience suggest that in practice most people don’t mind, or don’t care as much as they think they do about privacy (see “The Value of Privacy”).

There will be many uses for such data. Some will involve the race to become the platform that provides the best mobile ads and deals. Verizon, for example, now has a pilot effort within its Precision Market Insights program that allows customers to opt in to (rather than opt out of) giving Verizon permission to share more information about who and where they are, including Web browsing and app usage data. In return, they might receive deals and offers on their phone from marketers who want to reach them.

The data could also save budget-strapped governments some money. In California, the state is undertaking an unusual pilot experiment by licensing GPS data from navigation providers rather than repairing its crumbling network of sensors and detectors in the state’s roadways. Alexandre Bayen, a researcher at the University of California, Berkeley, who is helping put together the request for bidders, believes markets that give governments access to mobility data will eventually become common.

Schewel, who came to the idea for Streetlight as she was trying to give green transportation advocates better data about who uses the roads, also views her company as a long-term way to create more efficient cities by helping businesses locate closer to their customers and reducing shopping trips.

“A green transportation startup, where the core value proposition of the company is saving transportation fuel, is not a scalable idea,” she says. “But a marketing analytic startup that spits out mile reduction as its side effect? I think that is the most powerful way to be an agent for change.”

Keep Reading

Most Popular

Large language models can do jaw-dropping things. But nobody knows exactly why.

And that's a problem. Figuring it out is one of the biggest scientific puzzles of our time and a crucial step towards controlling more powerful future models.

How scientists traced a mysterious covid case back to six toilets

When wastewater surveillance turns into a hunt for a single infected individual, the ethics get tricky.

The problem with plug-in hybrids? Their drivers.

Plug-in hybrids are often sold as a transition to EVs, but new data from Europe shows we’re still underestimating the emissions they produce.

Google DeepMind’s new generative model makes Super Mario–like games from scratch

Genie learns how to control games by watching hours and hours of video. It could help train next-gen robots too.

Stay connected

Get the latest updates from

MIT Technology Review

Discover special offers, top stories, upcoming events, and more.