A123 Systems Headed for Chinese Ownership (Again)

A Chinese-owned company won a bidding war for the assets of battery maker A123 Systems, an event that raises thorny questions over U.S. government funding for technology companies.

During a weekend auction, Wanxiang America Corporation purchased nearly all the assets of A123 Systems for $256.6 million, offering more than Milwaukee-based Johnson Controls was willing to pay. A bankruptcy court judge is expected to weigh in on the deal as early as tomorrow.

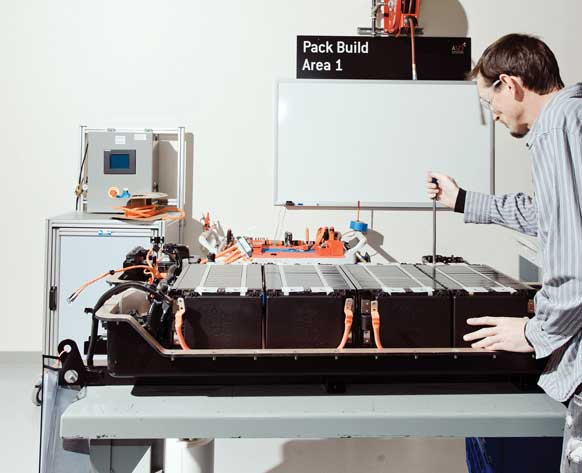

In August, Wanxiang had reached an agreement to acquire most of A123 Systems. But the proposed sale set off protests among politicians. A123 makes advanced battery technology and it received tens of millions in state and federal aid, including stimulus money to build a factory in Michigan. (See, A123’s China Deal is the Latest Energy Controversy.) A123, which makes batteries for cars and grid storage, later agreed to be acquired by Johnson Controls.

This latest deal is structured specifically for approval by the Committee for Foreign Investment in the United States (CIFIUS), which needs to review business deals that raise potential national security problems. A123 Systems’ government business would be sold off separately for $2.25 million to Woodridge, Illinois-based Navitas Systems.

There’s already a precedent set for foreign ownership of advanced battery technology. Lithium-ion battery company Ener1 was acquired by Russian investors after it declared bankruptcy. (The former CEO of Ener1, Charles Gassenheimer, served as advisor to Wanxiang in the transaction, according to the Chicago Tribune.)

The main problem A123 Systems and other auto battery makers face is tepid demand for battery-electric and plug-in hybrid vehicles. (See, Consumers Voting for Plug-in Hybrids Over EVs.) Given the overcapacity of battery manufacturing, some consolidation among battery makers is expected. And because it is a global industry, some U.S.-based companies were bound to attract buyers from overseas.

The sale of one-time high-flyer A123 Systems, which raised hundreds of millions of dollars from public and private markets, will mean steep losses for some investors. (See, A123’s Technology Just Wasn’t Good Enough.) But arguably, selling itself to a well-heeled conglomerate gives its technology and employees better prospects for the future. In a statement, the president of Wanxiang America, Pin Ni, said, “We plan to build on the engineering and manufacturing capabilities that A123 has established in the U.S. and we are committed to making the long-term investments necessary for A123 to be successful.”

Certainly, many technology companies which received U.S. government funding for research were later acquired by foreign investors. What makes A123 Systems different is that it received grant money to deploy existing technology at larger scale to bring down costs and compete with incumbents. It spent about half of a $249 million grant on a lithium-ion battery factory in Livonia, Michigan.

The policy debate worth having in the wake of A123 Systems’ fall is over the most effective role of government in advancing new technologies. There seems little debate that the government should fund basic research and most agree that applied research, along the lines of DARPA or ARPA-E, is appropriate as well.

But national and regional governments around the world offer incentives for factories or to expand technology businesses. Recent history shows there’s some real risk in having “favored” industries: in addition to U.S. auto batteries, look at China’s heavily subsidized solar industry. (See, Once Mighty Suntech Struggles to Survive.) Still, no policymaker can ignore that there’s international competition to attract business in emerging technologies, such as advanced batteries.

Given the scrutiny A123 Systems’ sale has already attracted, it’s clear that many consider batteres vital to national security interests as well. After the bankruptcy court’s ruling this week, the Committee for Foreign Investment in the United States needs to assess this latest proposal.

Keep Reading

Most Popular

Large language models can do jaw-dropping things. But nobody knows exactly why.

And that's a problem. Figuring it out is one of the biggest scientific puzzles of our time and a crucial step towards controlling more powerful future models.

The problem with plug-in hybrids? Their drivers.

Plug-in hybrids are often sold as a transition to EVs, but new data from Europe shows we’re still underestimating the emissions they produce.

How scientists traced a mysterious covid case back to six toilets

When wastewater surveillance turns into a hunt for a single infected individual, the ethics get tricky.

Google DeepMind’s new generative model makes Super Mario–like games from scratch

Genie learns how to control games by watching hours and hours of video. It could help train next-gen robots too.

Stay connected

Get the latest updates from

MIT Technology Review

Discover special offers, top stories, upcoming events, and more.