Facebook’s Earnings Report Underscores Its Challenges

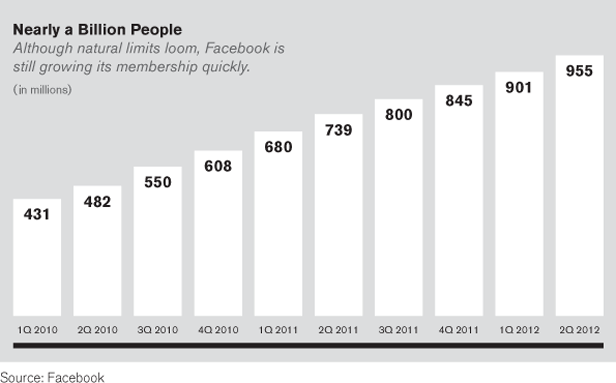

Even as Facebook nears the one billion user mark, its need for a new revenue source stood out in its first earnings release as a public company today.

One of the major concerns investors had about Facebook in its IPO was the decelerating growth of its advertising business, which accounted for 85 percent of its $3.7 billion in revenue last year. The trend continues: in the most recent quarter, advertising accounted for 84 percent of Facebook’s revenue. Overall, the company’s second quarter revenue totaled $1.18 billion, a 32 percent increase from a year earlier. That was lower than the 45 percent increase the company posted in the previous quarter from the first quarter of 2011.

Another way of looking at the numbers: in the last quarter, Facebook got $1.28 in revenue from each of its users, which is barely changed from the same time last year. That happened even though the average revenue per user in the U.S. and Canada jumped to $3.20 from $2.84 a year ago.

This is important because Facebook is nearing the limits of what it can achieve by bringing in new members: it says that as of June 30, it had 955 million active monthly users, up 29 percent from the second quarter of last year. So it is under greater pressure than ever to get more revenue out of each user (see “The Facebook Fallacy”), especially as more people access the site through mobile devices, where Facebook doesn’t bring in much revenue. Only in March did it start showing mobile ads. It calls them “sponsored stories,” and advertisers still need to be convinced that users will respond. In his call with investors today, CEO Mark Zuckerberg said the sponsored stories plan was off to an “encouraging start.”

Taking a cut from payments on the site could be a promising growth area. But most of that has come from the struggling game maker Zynga, which accounted for 11 percent of Facebook’s total revenues in the last quarter. Yesterday, Zynga reported dismal earnings results, sending its stock plummeting and calling further into question the staying power of its social gaming business model.

Keep Reading

Most Popular

Large language models can do jaw-dropping things. But nobody knows exactly why.

And that's a problem. Figuring it out is one of the biggest scientific puzzles of our time and a crucial step towards controlling more powerful future models.

The problem with plug-in hybrids? Their drivers.

Plug-in hybrids are often sold as a transition to EVs, but new data from Europe shows we’re still underestimating the emissions they produce.

Google DeepMind’s new generative model makes Super Mario–like games from scratch

Genie learns how to control games by watching hours and hours of video. It could help train next-gen robots too.

How scientists traced a mysterious covid case back to six toilets

When wastewater surveillance turns into a hunt for a single infected individual, the ethics get tricky.

Stay connected

Get the latest updates from

MIT Technology Review

Discover special offers, top stories, upcoming events, and more.