“MIT is where I learned to think like an economist,” says Barry Nalebuff, who recently established a charitable remainder unitrust to benefit undergraduate economics and the squash program. “I believe in giving back,” he says. “A unitrust is a fantastic opportunity to invest in MIT. The gift avoids capital gains tax and provides a partial charitable deduction.”

The unitrust will be invested in the MIT endowment—a big benefit, he says. “It’s hard for individuals to get access to this type of high-quality money management, and it’s essentially impossible without paying high fees. This way, I get to free-ride on MIT’s world-class financial management.”

Nalebuff, who earned MIT degrees in mathematics and economics in 1980, left MIT as a Rhodes scholar. He went on to teach at Harvard, Princeton, and now Yale, where he has been a professor of game theory and business strategy since 1990. In addition to his academic work, Nalebuff is coauthor of several best-selling management books, including The Art of Strategy. He met his wife, Helen Kauder, who earned an MIT degree in economics in 1982, at Senior House when they were students. They were married 10 years later.

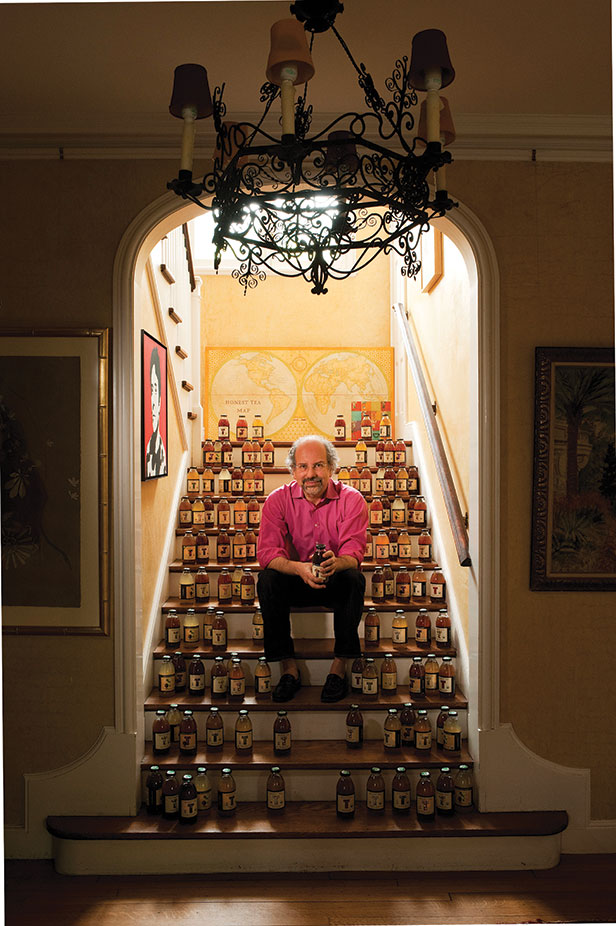

In 1998, Nalebuff and a former student cofounded Honest Tea. The company was based on economic theory—specifically, on the idea of declining marginal utility. Cutting back the sugar in iced tea would greatly reduce the calories but only marginally reduce the taste, he says. The result is “tea that tastes like tea, not liquid candy.” The company sold 100 million bottles last year. This year, Nalebuff sold Honest Tea to Coca-Cola, and that provided an opportunity to give something back.

“I’m a numbers guy. Doing the numbers shows that the unitrust is a great investment opportunity,” he says. “Just like an MIT education, a unitrust is a gift that gives back and continues to provide a lifetime of rewards. And that’s the sweetest deal there is.”

Donors can now establish trusts invested in the MIT endowment and benefit from its diversified investment portfolio. The income paid by such trusts has the potential to increase over time as the endowment does.

For giving information, contact Judy Sager: 617-253-6463; jsager@mit.edu. Or visit giving.mit.edu/ways/invest-endowment.

Keep Reading

Most Popular

Large language models can do jaw-dropping things. But nobody knows exactly why.

And that's a problem. Figuring it out is one of the biggest scientific puzzles of our time and a crucial step towards controlling more powerful future models.

How scientists traced a mysterious covid case back to six toilets

When wastewater surveillance turns into a hunt for a single infected individual, the ethics get tricky.

The problem with plug-in hybrids? Their drivers.

Plug-in hybrids are often sold as a transition to EVs, but new data from Europe shows we’re still underestimating the emissions they produce.

Google DeepMind’s new generative model makes Super Mario–like games from scratch

Genie learns how to control games by watching hours and hours of video. It could help train next-gen robots too.

Stay connected

Get the latest updates from

MIT Technology Review

Discover special offers, top stories, upcoming events, and more.