Sponsored

Moving money in a digital world

Security is the critical element to expanding digital-first payments.

In association withVisa

The rising adoption of digital financial services—mobile banking, online purchasing, and peer-to-peer payments—means that these days, money most often passes not through human hands but from computer to computer. No cash, no plastic cards, no paper bills or checks or envelopes or stamps. Digital is no longer just another way to move money. Every organization that moves money must meet users via computers, smartphones, and other devices, and offer rapid, secure payment services.

The covid-19 pandemic gave a boost to digital money movement, from online purchases to contactless payments and smartphone wallets, as consumers worldwide sought to shop without touching anything or going anywhere.

Moving money in a digital world

“The common denominator across almost all post-pandemic behavioral shifts is the growing importance of digital payments,” says Paul Fabara, executive vice president and chief risk officer at Visa, whose worldwide networks handled an estimated $13 trillion worth of transactions last year.

“Covid forced a market that was already growing to greatly accelerate,” says Fabara. As of 2021, 76% of adults globally have an account with a financial institution or mobile money provider, up from 68% in 2017 and 51% in 2011, according to the World Bank’s Global Findex Database. That number includes 71% of adults in developing countries. In high-income economies, nearly 95% of adults either made or received digital payments in 2021. In India, 80 million adults made their first digital payment during the pandemic; in China, 100 million.

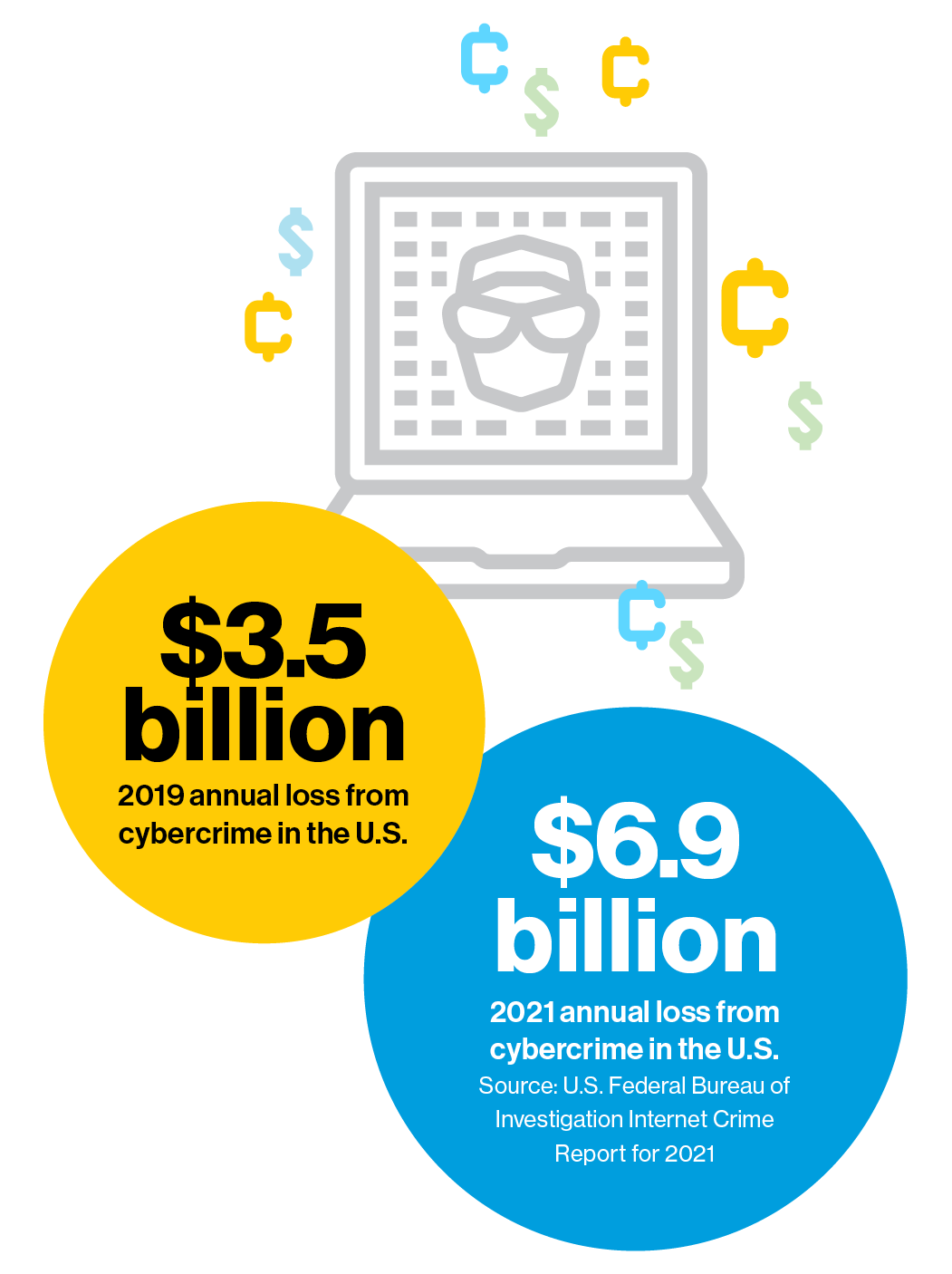

Fraudsters famously go where the money is, and their online activities are expanding right along with the growth in digital transactions. Annual losses from cybercrime in the U.S. nearly doubled between 2019 and 2021, from $3.5 billion to $6.9 billion, according to the FBI’s Internet Crime Report for 2021. Fortifying cyberspace against theft and fraud has always been urgent, and the post-pandemic boom in transactions intensified matters.

Driving digital transactions

Business-to-business customers are beginning to insist on the same seamless real-time transactions they expect as consumers, says Aaron Press, research director of worldwide payment strategies at IDC, who tracks the development and adoption of real-time payments. “If you think about the way you shop online for personal things or pay your friends using a mobile-to-mobile app, those expectations are finding their way into the business environment,” he says.

End-to-end digital transactions are here to stay. An MIT Technology Review Insights survey of global business leaders found high interest in digital payment technologies across all types and sizes of businesses. Although 36% of respondents are just getting started with digital payments, 43% expect to expand their offerings over the next 18 months, and many are venturing into cross-border transactions (37%) and cryptocurrency (18%).

What’s driving businesses to all-digital payments? The largest share of survey replies, 70%, indicate businesses prioritize improving customer experience by offering multiple payment options and saving customers time. Respondents want the benefits of operational improvements (48%) and reductions in processing costs (37%). Many want expanded options for securing payments (36%) and personalized offers to customers (35%).

"Digital payments are more efficient and dramatically reduce errors,” says Press. “You’re much less likely to fill out something the wrong way, because there are checks and balances within the system.”

This content was produced by Insights, the custom content arm of MIT Technology Review. It was not written by MIT Technology Review’s editorial staff.

Deep Dive

Computing

Inside the hunt for new physics at the world’s largest particle collider

The Large Hadron Collider hasn’t seen any new particles since the discovery of the Higgs boson in 2012. Here’s what researchers are trying to do about it.

How ASML took over the chipmaking chessboard

MIT Technology Review sat down with outgoing CTO Martin van den Brink to talk about the company’s rise to dominance and the life and death of Moore’s Law.

How Wi-Fi sensing became usable tech

After a decade of obscurity, the technology is being used to track people’s movements.

Algorithms are everywhere

Three new books warn against turning into the person the algorithm thinks you are.

Stay connected

Get the latest updates from

MIT Technology Review

Discover special offers, top stories, upcoming events, and more.