Money changes everything

Sometimes it’s been hard to tell if our shift toward transactions via machine has been a promise or a threat.

April 1969

From “Computer-Based Services in Personal Transactions”: The challenge thrown down by the computer for the future is to transmit information without the paper. This challenge leads to speculation about a “checkless society,” a phrase that has captured the imagination of journalists to the point of popularizing a concept long before economic, social, and legal aspects have been resolved. Thomas J. Watson, Jr., of IBM has written, “In banking alone, for example, the advances of yesterday are merely a faint prologue to the marvels of tomorrow. In our lifetimes we may see electronic transactions virtually eliminate the need for cash. To draw down or add to his balance, the customer in a store will insert an identification into the terminal located there, and punch out the transaction figures on the terminal’s keyboard. Instantaneously, the amount he punches out will move out of his account and enter another.”

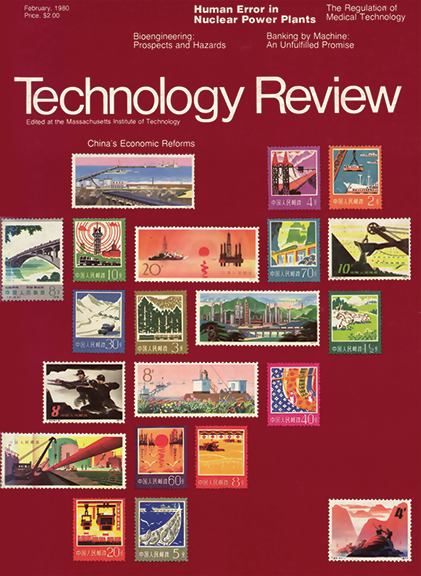

February 1980

From “The Bottom Line on Checkless Banking”: Anyone who has ever deposited money in a soda machine, only to find that it does not deliver the product, knows that we humans have difficulty dealing with nonworking machines. Upon receiving his bank statement, a friend noted a mysterious $50 charge. He drove to the bank where he confronted the manager with his problem. The manager told him that it was a “computer transaction.” The friend knew he had not used the computer terminal for a transaction that particular day. Unfortunately, feeling intimidated, the fellow let it drop and later explained, “You can’t argue with a computer.” The consumer is still skeptical of ATM terminals. Experience has shown that human nature does not take quickly to change. The benefits to banks and retailers are overshadowed by enormous costs. Therefore, growth in this area will continue to be slow.

August 1997

From “The Neverhood of Internet Commerce”: New technologies sometimes offer an illusion of benefit that holds true only within a narrow economic frame. While we eagerly chase the savings in money and effort that a new tool seems to offer, we may disregard the wider social costs that may eventually mock our sense of prosperity. Before we shift our purchases to Internet vendors, we need to recognize a hidden price we may end up paying: the demise of traditional shops. A bookstore is first and foremost a gathering spot for those who care about books and reading. In these places the purchase of a product is only part of the experience. Yes, we should use every Internet resource to explore the market and make intelligent comparisons. But when it comes to casting “dollar votes,” we can better spend the money closer to home, in a neighborhood where people actually live rather than the neverhood of digital bits.

Deep Dive

Humans and technology

Building a more reliable supply chain

Rapidly advancing technologies are building the modern supply chain, making transparent, collaborative, and data-driven systems a reality.

Building a data-driven health-care ecosystem

Harnessing data to improve the equity, affordability, and quality of the health care system.

Let’s not make the same mistakes with AI that we made with social media

Social media’s unregulated evolution over the past decade holds a lot of lessons that apply directly to AI companies and technologies.

Stay connected

Get the latest updates from

MIT Technology Review

Discover special offers, top stories, upcoming events, and more.