Sponsored

New business models, big opportunity: Financial services

The financial services industry is turning to bold initiatives

to propel from pandemic response to business growth.

In association withOracle

By any measure, 2021 corporate planning isn’t business as usual. As the coronavirus pandemic grinds on, financial services institutions are coming out of crisis mode— addressing immediate cash management and operational challenges—with a renewed readiness for business growth.

Fortunately, most businesses across industries are doing a good job of navigating the pandemic and its economic fallout. According to a survey conducted by MIT Technology Review Insights, in association with Oracle, 80% of executives feel upbeat about their companies’ ultimate objectives for 2021. They’re either expecting to thrive—that is, sell more products and services—or change the way they do business. The worldwide research surveyed 297 executives in more than a dozen industries, primarily finance directors, C-suite, and information technology (IT) leaders. Forty-four, or or 15%, of the execu-tives work at banks or other financial services institutions.

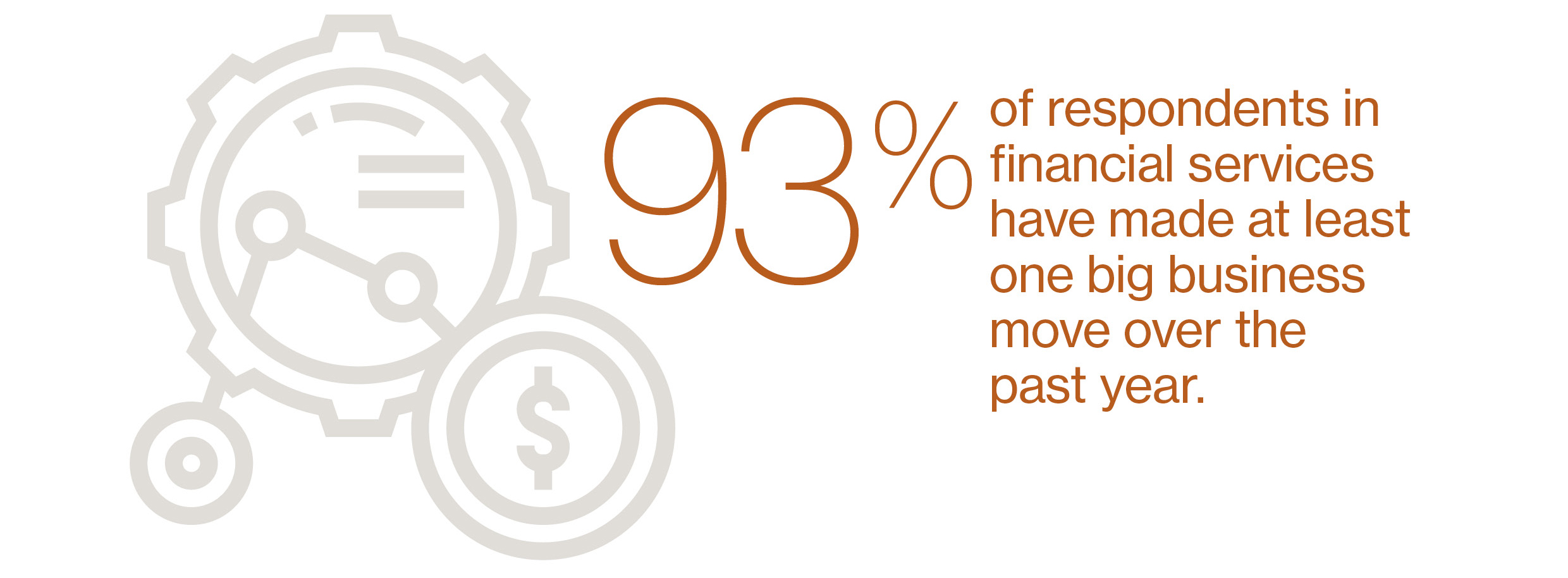

That 15% is a bold bunch—93% of them have over the past year made at least one big business move, overhauling tech infrastructure, for example, or acquiring or merging with another company—and nearly 80% will change the way they do business, by pivoting to new markets or focusing on better customer experiences.

New business models, big opportunity: Financial Services

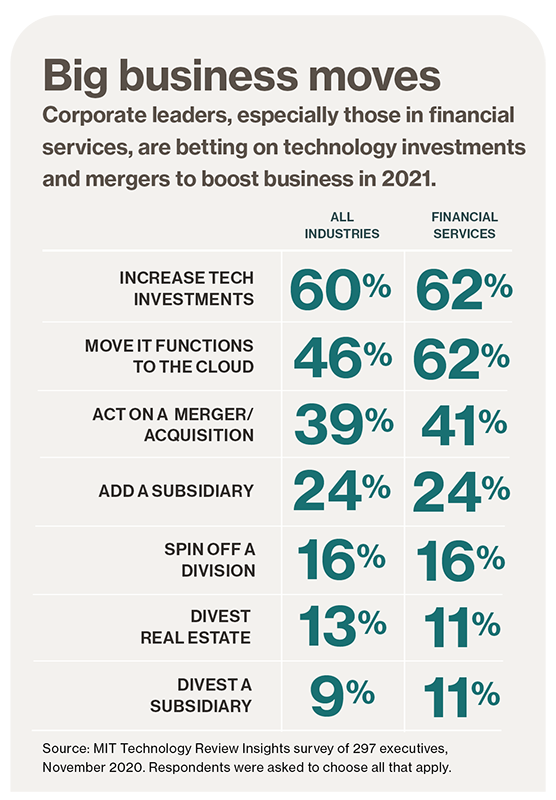

More motivated than ever, organizations in all industries are ready to cut expenses that lack a clear return on investment. So it’s no surprise that survey respondents highlight computing projects—all highly measurable— as priorities in their 2021 plans. Among financial services institutions, 62% are looking to ramp up tech investments, and another 62% expect to move IT and business functions to the cloud, compared with 46% across industries. In a recent report, Nucleus Research found that cloud deployments deliver four times the return on investment as on-premises deployments do.

Planning beyond the pandemic

The Guardian Life Insurance Company of America is an exemplar of a progressive cloud adopter—it’s now moving many of its core financial systems to the cloud. The insurer was motivated to do so—an internal study had found several opportunities, including insufficient data management, a need for lower-level data for better analytics, a lack of system integration, and manual reconciliation issues. “These pain points helped create the need for a new system,” says Marcel Esqueu, assistant vice president for financial systems transformation at Guardian. “We looked at moving to the cloud about five years ago, but we didn’t think it was ready.” Now the company deems cloud services mature enough to support the advanced functionality it requires.

Financial institutions are also looking at mergers and acquisitions as a path beyond pandemic survival. In fact, according to a Reuters report, such deals were up 80% in July, August, and September 2020 from the previous fiscal quarter to hit a whopping $1 trillion in transactions. In the MIT Technology Review Insights survey, 41% of financial services execs report that their organizations acted on a business merger or acquisition or will do so over the coming year.

“People have realized they need to consolidate to create stronger and better-equipped businesses to deal with what the world looks like going forward,” says Alison Harding-Jones, managing director at Citigroup, in the Reuters report.

Mergers and acquisitions have long been a way for an organization to expand its core business—or even gain expertise in emerging technologies. For example, while many financial institutions buy business software with built-in artificial intelligence (AI) capabilities, Mastercard acquired a Canadian AI platform company called Brighterion in 2017 to provide “mission-critical intelligence from any data source,” says Gautam Aggarwal, regional chief technology officer (CTO) at Mastercard Asia-Pacific. The company first used Brighterion’s technology for fraud detection but now puts it to work in credit scoring, anti-money laundering, and the company’s marketing efforts. “We’ve really taken Brighterion and applied it not just for the payment use case but beyond,” says Aggarwal.

Business change, outside and in

Indeed, organizations have had to innovate and respond fast to survive in the covid economy. In the survey, 81% of organizations across industries have evaluated new business models in 2020 or are planning to launch them over the next year. Among financial services institutions, improving the customer experience is paramount, with 55% reporting that they’re improving the experience they offer their customers, compared with 35% across industries.

That’s true for Jimmy Ng, group chief information officer (CIO) at Singapore-based DBS Bank. When physical branches closed during lockdowns, DBS customers— like other bank patrons the world over—did their banking online. But some of them did so only because they had to. “The question is whether this group of people will continue staying on the digital channel.” So DBS is exploring ways to keep customers who prefer in-person service engaged, exploring technologies such as augmented and virtual reality and the 5G mobile network, which enables superfast connections. “How do we enable a joyful customer journey in this remote way of engagement?”

Download the full report

This content was produced by Insights, the custom content arm of MIT Technology Review. It was not written by MIT Technology Review’s editorial staff.

Deep Dive

Humans and technology

Building a more reliable supply chain

Rapidly advancing technologies are building the modern supply chain, making transparent, collaborative, and data-driven systems a reality.

Building a data-driven health-care ecosystem

Harnessing data to improve the equity, affordability, and quality of the health care system.

Let’s not make the same mistakes with AI that we made with social media

Social media’s unregulated evolution over the past decade holds a lot of lessons that apply directly to AI companies and technologies.

Stay connected

Get the latest updates from

MIT Technology Review

Discover special offers, top stories, upcoming events, and more.