Sponsored

The global AI agenda: The Middle East and Africa

In association withGenesys

This report is part of “The global AI agenda,” a thought leadership program by MIT Technology Review Insights examining how organizations are using AI today and planning to do so in the future. Featuring a global survey of 1,004 AI experts conducted in January and February 2020, it explores AI adoption, leading use cases, benefits, and challenges, and seeks to understand how organizations might share data with each other to develop new business models, products, and services in the years ahead.

The Middle East and Africa are unique settings for AI, compared to Western regions—and to each other. The wealthier Gulf Cooperation Council (GCC) nations are exploring AI as part of broad economic transformation plans to wean themselves from oil and reinvest surpluses into innovation, while in Africa, above and below the Sahara, AI efforts are more bottom-up, often through partnerships with global tech companies and local startups, tackling social challenges including health care and food security.

In the richer Gulf nations, AI is now part of national development plans, including Saudi Arabia’s Vision 2030 initiative. The country has assembled institutional supports as well, forming an intellectual property agency in 2017 and opening a National Centre for AI, an AI regulator, a National Data Management Office, and delivering its first AI college.

The country is also an investor in AI-driven tech companies through its stake in the Softbank Vision Fund and outlays through the national public investment agency, including into Uber, Facebook, IBM, and Cisco. The neighboring United Arab Emirates (UAE) has positioned itself as a digital innovation hub for public services and plans to use blockchain technology for 50% of government transactions by 2021.

Africa’s dynamics are different, with innovation driven by bottom-up efforts especially in health care and logistics, where home-grown innovators are tailoring technologies to solve local problems. Examples include natural language processing—Africa accounts for 30% of the world’s languages—and image recognition for wildlife conservation. Agriculture has also been a major focus as the region seeks to improve food security by increasing yield. The operational landscape is hard and local companies are well-adapted to it; one commentator likens big US tech companies to F-16 fighter planes that are highly efficient but need perfect conditions to take off, contrasted with African companies as MiGs, which can take off anywhere and don’t require the same maintenance.

This regional summary explores how executives in the Middle East and Africa see AI and its benefits, based on an MIT Technology Review Insights global survey of 1,004 senior executives worldwide. The headline findings show strong engagement with AI adoption, solid returns on investments so far, and projected increases in utilization going forward, with customer services, logistics, and fraud being the key uses cases. Challenges include a lack of data scientists and limited engagement so far in data sharing.

An AI-engaged region

The survey shows widespread AI adoption, with 82% of large companies across the region having launched AI programs by the end of 2019. While the speed of adoption slightly lags other regions, a quarter of survey respondents expect AI to power more than 30% of their business processes in three years’ time.

The region’s prominent businesses have been early AI adopters and are now creating industry-leading use cases. According to Dirk Jungnickel, senior vice president, enterprise analytics, digital, and innovation at Emirates Group, early attempts taken by his company in 2015 and 2016 to build AI capabilities did not make it beyond the proof of concept or pilot stage. That began to change in mid-2018 when, he says, the firm began to “operationalize” AI development efforts and “industrialize data science.”

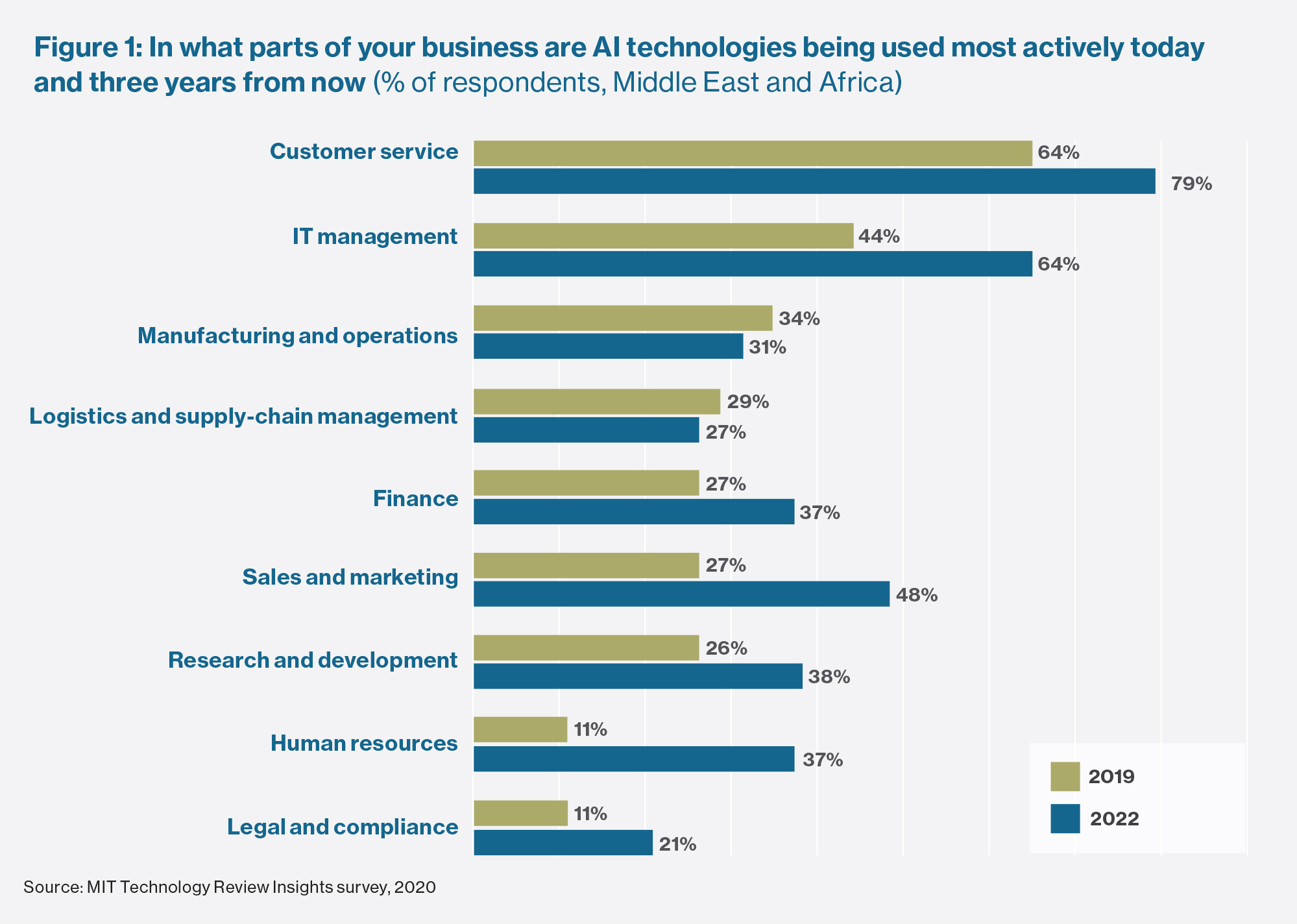

Customer service is currently the most active department in using AI, cited by 64% of respondents, and set to rise to 79% in three years. The financial service industry is a leading adopter, especially through chatbot technology. Emirates NBD, the UAE-based bank, has developed Eva, the first AI-based personal banking assistant in the Middle East. Liv, Emirates NBD’s lifestyle banking arm, also offers a conversational chatbot and the bank also uses a “Pepper” customer service robot in its Dubai branch.

Wealth management is another area seeing increased investment by financial services players servicing the high-net-worth demographic. Robo-advisory platforms that offer advanced investment services at low cost by using AI and automation to allocate and manage funds and allocations are emerging, with notable players including UAE-based Sarwa. Chatbots are also support- ing customer service in social sectors in the likes of Saudi Arabia. The nation has developed an innovation platform, the FekraTech national AI initiative—one proposed invention in the first round of the scheme was an AI-based chatbot called Nahla that helps people with chronic diseases like diabetes to better manage their condition.

AI for inclusion

In Africa, where per capita incomes are lower and many are excluded from mainstream financial services, AI-driven customer service is focused more on enabling inclusion. One domain is credit scoring. Lack of credit bureaus and people’s exclusion from many financial products is an ongoing obstacle to accessing loans, and mainstream banks have little incentive to produce risk assessments for low-income customers.

“You can do creative credit assessments using alternative data sets and AI,” says Solomon Assefa, vice president of IBM Research for Africa. “Many people have no track record in areas like purchasing a house, but they are interacting regularly with mobile money products. You can leverage that data to understand behavior and do credit management.” The same approach can be applied to small shops and businesses, working in partnership with telecommunications companies and banks, he says. Nigerian fintech Carbon is one company using machine learning to evaluate credit applications, and MyBucks, the first African fintech to be listed on the Frankfurt Stock Exchange, uses algorithms to estimate loan repayment risk and proactively reduce likelihood of missed payments by raising flags based on behavioral and transaction trend analysis.

“Many people have no track record in areas like purchasing a house, but they are interacting regularly with mobile money products. You can leverage that data to understand behavior and do credit management.”

Solomon Assefa, Vice President, Africa and Emerging Market Solutions, IBM Research

Ride-hailing is another customer convenience that has taken root in the Middle East and Africa. Uber’s recent $3.1 billion acquisition of UAE-based Careem has

given the US company access to mobility, delivery, and payments businesses across the region, including in Egypt, Jordan, Saudi Arabia, and the UAE. Observers have flagged the acquisition as a sign of the UAE’s ability to produce home-grown, high-value companies.

Changing processes to make efficiencies

More than half of surveyed businesses in the Middle East and Africa (52%) are benefitting from improved operational efficiencies and cost savings, as a result of their investments in AI. Emirates Group provides an example of savings generated from a specific AI use case: premium-class meal catering. Jungnickel explains that AI algorithms predict, for each individual flight on each day, the volume of food that will be consumed by its business class passengers. “In premium classes, customers’ first choice of hot meals must be met, which ordinarily requires stocking up to three meals per passenger. The associated costs are not only in meals but in the additional fuel consumed in supporting the weight lift. The predictions that the algorithms generate help us to prevent over-catering and reduce meal and fuel costs. On the scale that we operate, that translates into significant savings.” Other leading benefits cited in the survey include better risk management (45%) and management decision-making (45%).

Data and talent are regional challenges

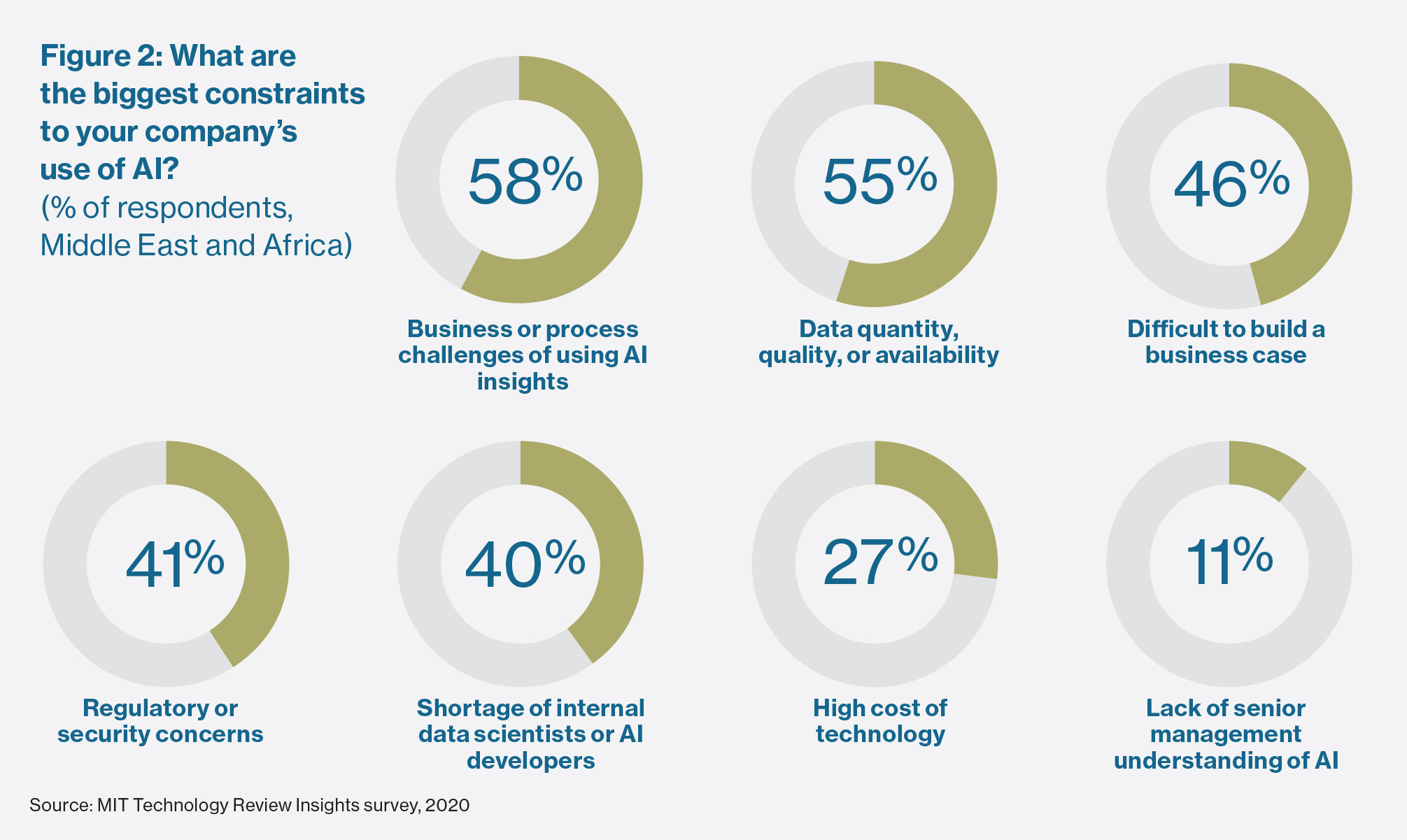

Survey respondents identify several challenges to their AI journey so far. Globally, changing business processes around AI was the greatest challenge, and felt even more keenly in the Middle East and Africa than in other regions (58% cited this as the top challenge compared to the global average of 51%). Data quantity, quality, or availability was also cited as a constraint by a larger number of respondents in this region: 55% compared to a global average of 48%. The main reasons for that were the difficulty of interfacing with open-source platforms, integrating unstructured data, and managing models for bias. Only 6% of respondents say there is not enough data.

The outlook for data sharing

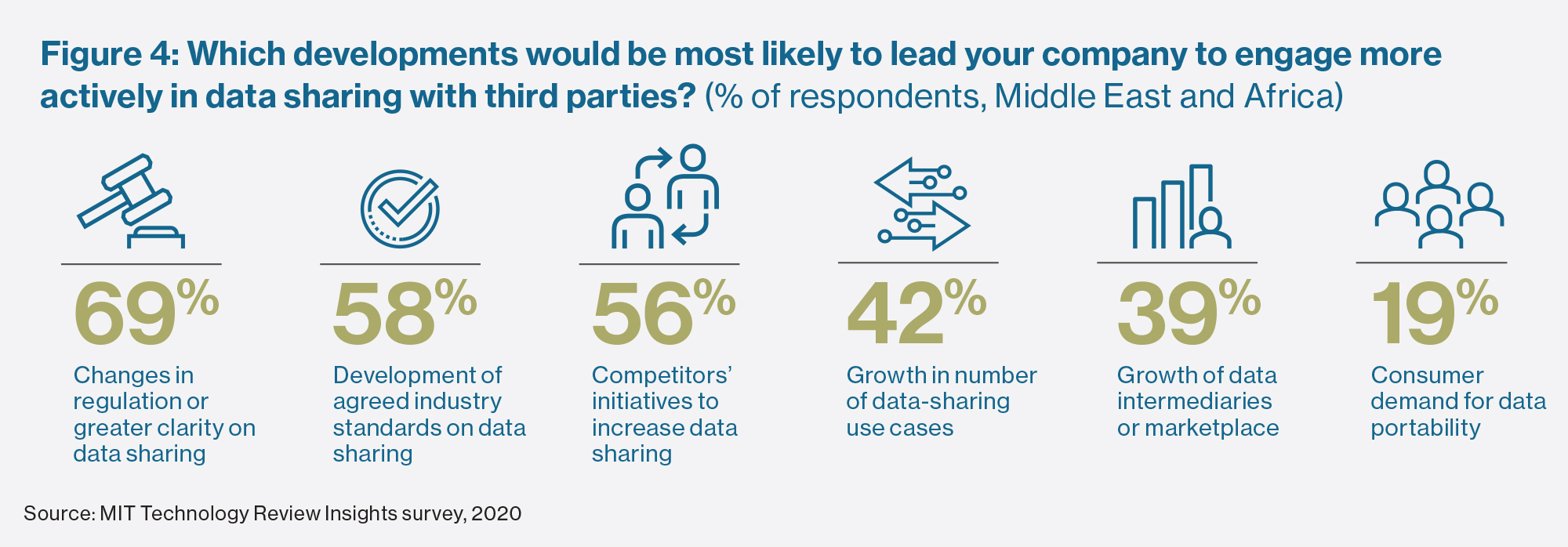

Data sharing is crucial to the successful development of AI, whose power hinges on the scale and richness of the data on which models are built. Respondents see clear benefits to data sharing between companies in their own or adjacent industries. Over half (64%) think greater speed and visibility across supply chains would be one of the top benefits, followed by new or enhanced customer services or experiences, selected by 45%.

Dubai is one of the more experimental jurisdictions in terms of data-sharing initiatives. The government’s Smart Dubai strategy contains a data initiative aiming to create and manage a data trust to serve as a repository for companies’ anonymized data, allowing members to receive aggregated insights on customer preferences, with payments made via cryptocurrency tokens; companies contributing to the trust including Majid Al Futtaim, the real estate giant, and Dubai Holding, a diversified conglomerate covering hospitality, tourism, real estate, and telecommunications.

For more, please download the full report.

Deep Dive

Artificial intelligence

Large language models can do jaw-dropping things. But nobody knows exactly why.

And that's a problem. Figuring it out is one of the biggest scientific puzzles of our time and a crucial step towards controlling more powerful future models.

Google DeepMind’s new generative model makes Super Mario–like games from scratch

Genie learns how to control games by watching hours and hours of video. It could help train next-gen robots too.

What’s next for generative video

OpenAI's Sora has raised the bar for AI moviemaking. Here are four things to bear in mind as we wrap our heads around what's coming.

Stay connected

Get the latest updates from

MIT Technology Review

Discover special offers, top stories, upcoming events, and more.