A healthy understanding

Back in 2008, Oregon health officials had enough money to let additional people join their state-run Medicaid system. They figured demand would exceed the number of spaces available, so the state ran a drawing: 90,000 people applied, and 10,000 were accepted.

The unusual program seemed almost designed for Amy Finkelstein, PhD ’01, to study. Finkelstein, the John and Jennie S. MacDonald Professor of Economics, is a leading health economist and spends a significant amount of her time looking for new ideas and data. And this was a golden opportunity to study the impact of Medicaid, with a built-in control group.

But she first heard about the program from a comedian.

“Oregon ran this lottery,” says Finkelstein, sitting in her office in E52. “Stephen Colbert did a spoof about it. You know, I can’t imitate him, but basically: ‘Have you heard of this crazy thing? They’re running a lottery for health care. In Oregon! Scratch and sniff—did I win a kidney?’”

Suddenly in the know about a promising new research opportunity, Finkelstein set to work connecting with Oregon officials and health-economics colleagues. The defining feature of Finkelstein’s career is that she brings finely sharpened data points to health-care conversations that had been driven by mere assumptions. What difference does it make to people, medically and financially, when they get health insurance? What’s the financial impact of being hospitalized? What drives health-care costs: the decisions of doctors or the condition of patients? Time and again, Finkelstein has made such discussions more rigorous.

For instance, for decades conventional wisdom held that uninsured people did not lack access to medical care, because they could always use emergency rooms. If the uninsured routinely depended on these facilities to handle their problems, it would seem that joining Medicaid, the largely federally funded insurance program for low-income Americans, would cut down on ER use, not only because people would have other options for routine care but also because they might avoid acute medical problems by getting better preventive care. But what Finkelstein and her colleagues found defied expectations: Medicaid enrollees visit the ER more often when they first join the program, and their elevated ER use continues for at least two years. The chances that someone will make both an ER visit and a primary-care visit go up 13 percentage points with Medicaid.

Research from the Oregon Medicaid experiment also revealed several other things experts hadn’t known. Policymakers suddenly had proof that Medicaid coverage increases overall doctor visits, prescription drug use, and hospital admissions. They could say with certainty that being on Medicaid reduces patients’ out-of-pocket expenses and unpaid medical debt. And they could point to evidence that while Medicare does not seem to change some physical health measures, such as blood pressure, it does increase patients’ self-reported good health and seems to reduce the incidence of depression.

Before long, this research was landing on the front page of the New York Times.

“That was an extremely important contribution to the policy debate, around what would happen if you added more insurance coverage,” says James M. Poterba, the Mitsui Professor of Economics at MIT, who was Finkelstein’s principal dissertation advisor and is now her colleague. “It was timely; it was right on the national agenda,” he adds. “It really had a very important impact on discussion on policies like the Affordable Care Act.”

Finkelstein’s many papers on the Oregon program constitute the deepest empirical work yet done on the subject of Medicaid, but they represent just part of her research portfolio. Her work includes studies of Medicare, the federal health insurance program for seniors, as well as work on the long-term financial fallout of being hospitalized, the value of long-term-care insurance, the reasons for geographic variability in health-care costs, and much more. (See “8 things we now know about health economics thanks to Amy Finkelstein and her collaborators.”)

8 things we now know about health economics thanks to Amy Finkelstein and her collaborators

The postwar spread of health insurance—especially Medicare—greatly spurred use of medical care.

From 1950 to 1990, US spending on health care increased sixfold. Scholars once thought the growth of health insurance had little to do with this. But Finkelstein found that the spread of health insurance—especially the advent of Medicare in 1965—accounts for half the increase in medical spending. When people have coverage, they use it.

Medicare saved

patients a bundle.Health insurance reduces financial strain. Finkelstein has documented that Medicare reduced out-of-pocket medical spending and unpaid medical debt. For example, the quarter of the elderly population that had faced the largest out-of-pocket expenses saw their medical spending decline by 40%.

Insurers make a bundle on

long-term-care insurance.Long-term-care insurance covers the costs of managing chronic medical conditions, helping to pay for such things as nursing-home care and home health care. Finkelstein studied it extensively early in her career, concluding that people purchasing policies get back only 49 cents on the dollar.

Medicaid changes the way people use health care.

Finkelstein found that contrary to expectations, Medicaid enrollees increase ER visits after joining the program. Patient visits to both an ER and a primary-care doctor go up 13 percentage points with Medicaid, which also increases overall doctor visits, prescription drug use, and hospital admissions, and decreases patients’ out-of-pocket expenses and unpaid medical debt.

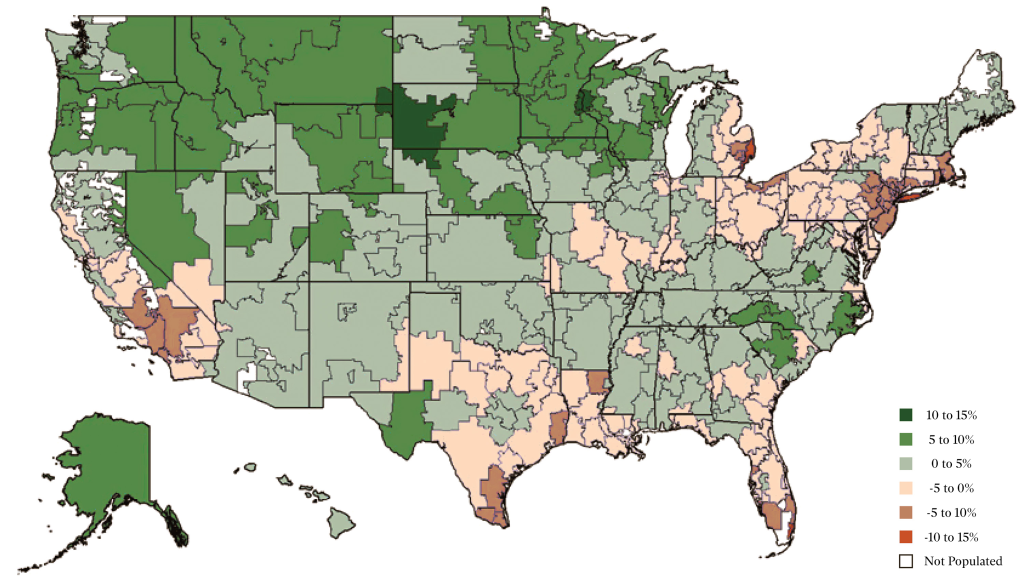

Doctors and patients are both behind the geographic differences in health-care costs.

Finkelstein has examined the geographic price disparities for health care in the US, finding that about half the cost differences are due to the characteristics of patients and about half are due to the differences among providers. She also uncovered significant variation in “diagnostic intensity”—the propensity of providers to offer tests and treatment—in different regions of the US. Miami, the Detroit area, and Long Island are especially test-heavy areas.

Bankruptcies directly caused by medical expenses have been

overestimated, but decreased earnings and increased unemployment following hospitalization have been overlooked.When presidential candidates argue about medical bankruptcies, Finkelstein’s numbers are seen as the best available. While it’s often reported that 60% of bankruptcy filings are directly attributable to medical costs, she found that it’s closer to 4%—but the financial hit from poor health is still significant in terms of reduced earnings and employment.

Being hospitalized after age 50 can damage your longterm earning potential.

Finkelstein found that even seemingly routine hospitalizations have punishing long-term effects. Among people aged 50 to 59, for instance, being hospitalized lowers employment by 11% and earnings by 20% over the next four years.

Hospitals’ proactive care teams don’t appear to help.

A study coauthored by Finkelstein and released in early 2020 showed that “hotspotting”—an attempt to reduce hospitalizations and costs for vulnerable high-use populations through the use of proactive care teams—appears to have no effect at all on patients’ rate of readmission.

From her first published paper in 2002 through the beginning of 2020, Finkelstein has authored or coauthored 49 peer-reviewed journal articles based on original research, another 10 journal articles serving as overviews of particular subjects, and eight published conference papers.

“I know a lot about Amy,” says Heidi Williams, a Stanford University economist who has coauthored papers with Finkelstein and once had an office next to her as an MIT colleague. “But there are parts of her research I don’t even know about, because she’s so prolific.”

In 2012, Finkelstein was awarded the John Bates Clark Medal, given by the American Economic Association to the best economist under 40. In 2018, she won a MacArthur fellowship, often referred to as a “genius grant.” She has also been elected to the American Academy of Arts and Sciences and (unusually for an economist) to the Institute of Medicine. And she’s the founding editor of American Economics Review: Insights and co-directs the Public Economics Program of the National Bureau of Economic Research.

Yet for all that productivity, all the awards, and all the exacting empirical studies on her CV, Finkelstein takes the position that she, like most of us, understands relatively little about the health-insurance and health-care industries.

“If you made me king or queen of the world, it’s not obvious how we should be designing our health-care system,” she says. “Which makes me a very bad cocktail party conversationalist, because when people say ‘What do you think of Medicare for All?’ or ‘How should we design health insurance?’ my usual reaction is ‘Well, I don’t know the answer, and that’s why I work on it.’ There are a lot of things I know or think I know the answer to, but those are not the things I do research on.”

Health care vs. health insurance

When Finkelstein recounts the Stephen Colbert anecdote, she pauses to correct the talk-show host. Oregon was not running a “lottery for health care,” as he had it.

“That isn’t quite right,” she says. “It’s health insurance.”

This distinction—between health care and health insurance—matters a great deal in grasping what Finkelstein does. For most of the first decade of her career, until 2010 or 2011, she focused on health insurance: what difference does it make when people have it? For the quarter of the elderly population suffering the greatest out-of-pocket medical costs relative to income, for example, she found that access to Medicare reduced their spending by 40%.

Finkelstein has continued to study health insurance, but over the last decade, she has also studied how effective health care itself is. For example, a paper she published recently in the New England Journal of Medicine found that “hotspotting”—programs aimed at preventing certain patients with complex conditions from needing to return to the hospital—had little significant impact.

Even now, though, Finkelstein regards studies about health-care outcomes as a relatively new branch of her research.

“Over time, people started saying ‘Oh, so you’re a health economist,’ because a lot of my work was on health insurance,” she recounts. “And I would say, ‘No, I’m an insurance economist.’ And my husband would tell me, ‘You say that like it’s supposed to be more interesting.’”

She adds: “I understand that also doesn’t sound like good cocktail party conversation.”

Destined for academia

Finkelstein grew up in Manhattan, the child of biology professors, and jokingly calls herself “constitutionally unsuited” to any occupation outside academia. “I always thought, correctly or incorrectly, that I was going to be a professor,” she says.

Correctly, it turns out. Finkelstein studied political science as an undergraduate at Harvard, but gravitated to economics in part because she’d taken economist Lawrence Katz’s course “Social Problems in the American Economy.” After graduating summa cum laude from Harvard, she earned a master’s in economics from Oxford University and then became a staff economist on the White House’s Council of Economic Advisers, headed by future US Federal Reserve chair Janet Yellen.

“She was a phenomenal person to work for, as were all the other senior economists there,” Finkelstein says. But on top of that, she adds, “I got exposed to so many different economic topics. When I thought about the things I enjoyed working on the most, I did some work on natural-disaster insurance, some work on automobile insurance, some work on unemployment insurance—the common denominator was insurance.”

Finkelstein liked insurance because of its imperfections—a reason that may resonate with anyone who has visited a doctor and later been charged some infuriating fee that no customer service representative can explain.

“The cartoon version of economics is Adam Smith, the invisible hand, markets functioning perfectly,” Finkelstein says. “It seemed [to me] that insurance markets were a very important set of markets for the economy in which there was clear theory, going back to [economists] Michael Rothschild, [Joseph] Stiglitz, and George Akerlof, [but] these markets did not actually work, and so there might be scope for welfare-improving government intervention.” She realized that empirical evidence on this topic could prove useful to policymakers.

From the Council of Economic Advisers, Finkelstein was admitted into MIT’s PhD program in economics, an ideal place for an empirically minded student. And among some highly motivated peers, she stood out.

“Even as an early-stage graduate student, Amy was extremely talented at tracking down data that could be brought to bear on particular questions,” says Poterba. He adds: “She has always had a really good instinct for identifying important questions that need to be studied.”

After receiving her PhD from MIT in 2001, Finkelstein spent three years as a junior fellow in the Harvard Society of Fellows. She rejoined MIT as an assistant professor in 2005 and received tenure within three years of her appointment. Her formula for success is simple: she works consistently and very hard on a subject that energizes her, continually searching for data that can be applied to pressing medical questions.

“I don’t think Amy has ever wasted time at work, ever,” says Williams, who describes her as an exceptionally clear-thinking colleague. “She’s very good about asking, ‘What are the facts?’ And she’s very entrepreneurial about getting new data.”

To a numbers-driven MIT-trained economist, the Oregon Medicaid experiment is academic catnip, because the state’s use of a lottery created two otherwise identical groups of people to study: those who gained access to Medicaid and those who did not. By comparing the results for the two groups, it is possible to get a clear look at Medicaid’s effects.

Similarly, Finkelstein’s recent work on hotspotting is important because of its methodological sophistication, which has cast doubt on a popular concept. Publications such as the New Yorker have touted data from the nation’s best-known hotspotting program, in Camden, New Jersey, which had shown apparent success: about 40% of patients who participated in the program after being released from the hospital did not need to return over the next six months.

But Finkelstein and her colleagues (including Joseph Doyle of the MIT Sloan School of Management) worked with the Camden Coalition of Healthcare Providers, the group that created the program, and conducted a randomized controlled trial. The study split a population of patients who’d just been released from the hospital in two, assigning half to the hotspotting program. The result? In both groups, about 40% did not need to be rehospitalized within six months of discharge. If a similar portion of almost any group of patients will be able to avoid returning to the hospital for six months, the apparent success of hotspotting may well be an illusion.

“If you made me king or queen of the world, it’s not obvious how we should be designing our health-care system. Which makes me a very bad cocktail party conversationalist.”

Finkelstein’s research has also shown some popular claims about health-care costs to be wrong. Consider a brief political controversy from 2019. The Washington Post fact-checked Bernie Sanders’s oft-repeated claim that 500,000 people in the US file for bankruptcy annually because of medical expenses; the number derives from a survey Elizabeth Warren helped conduct, in which people were asked if medical costs had led to their bankruptcy filings.

Surveys have their value, but in 2019, two papers by Finkelstein and colleagues, based on an intensive study of California medical and credit records, showed the numbers in more exact terms, suggesting that many fewer than 500,000 bankruptcies are directly attributable to medical expenses (as the Post noted). At the same time, though, the work revealed that the financial consequences of hospitalization, as measured in increased unemployment and lowered earnings, are still extremely serious (and can later be among the causes, if not the sole cause, of bankruptcy).

Finkelstein, for her part, stays out of the political fray, instead emphasizing the rigor of her discipline.

“I do think that economics has been at the forefront in developing credible empirical methods, which I do hope will percolate more broadly,” she says.

Examining antipoverty policy

There is no Finkelstein formula for identifying a plausible topic of study—just an ongoing effort to see if there is data or an opportunity to study a pressing question. Part of a health economist’s job, Finkelstein notes, involves pursuing potential research projects that do not pan out.

“It’s a constant dance between the questions that motivate you and the answers you can deliver,” she says. “You’re trying to find a match that’s at the intersection of interesting and feasible. You only see the times we succeed.”

That concern with empirically sound economics runs throughout Finkelstein’s household. Her husband is MIT economics professor Benjamin Olken, an antipoverty researcher who has spent years conducting field experiments in Indonesia. Olken is also a longtime member (and now the director) of MIT’s Abdul Latif Jameel Poverty Action Lab (J-PAL), the innovative research center that has made a splash by emphasizing the use of empirical findings from field experiments as a guide for antipoverty policy.

When two of J-PAL’s founders, Abhijit Banerjee and Esther Duflo, PhD ’99, won the Nobel Prize in Economics last fall, Finkelstein and Olken accompanied them to the awards ceremony in Stockholm. Finkelstein, in recent years, has become a J-PAL official as well. In 2013, she and Lawrence Katz, her old Harvard professor, launched J-PAL North America, a new branch of the organization.

Some of J-PAL North America’s research efforts are focused on health care, such as an ongoing project that arranges regular nurse visits for low-income first-time mothers in South Carolina. But its scope runs beyond health care; one project is a multi-city study of youth summer employment programs.

As co–scientific director of J-PAL North America, Finkelstein is enjoying the opportunity to design experiments. (The Oregon study, after all, examined a randomized program that was already in place.) She says she still has much to learn from Duflo and Banerjee, whose well-honed skills in the art of experiment design she admires.

In short, Finkelstein’s J-PAL work puts her in the position of learning still more about her craft, while encouraging and supporting other health-industry economists. Already a dedicated teacher at MIT, she is now doing even more to mentor junior colleagues as well.

“There been a huge influx of great young economists working on health economics, so it’s a really great time to be working in this field,” she says. For all her self-deprecating asides about the study of insurance, she wants other researchers to share her fascination with the field. “One of my main roles in life now,” she says, “is to take these very, very smart economists working on, to my mind, very boring topics and get them to study health care.”

Keep Reading

Most Popular

Large language models can do jaw-dropping things. But nobody knows exactly why.

And that's a problem. Figuring it out is one of the biggest scientific puzzles of our time and a crucial step towards controlling more powerful future models.

The problem with plug-in hybrids? Their drivers.

Plug-in hybrids are often sold as a transition to EVs, but new data from Europe shows we’re still underestimating the emissions they produce.

Google DeepMind’s new generative model makes Super Mario–like games from scratch

Genie learns how to control games by watching hours and hours of video. It could help train next-gen robots too.

How scientists traced a mysterious covid case back to six toilets

When wastewater surveillance turns into a hunt for a single infected individual, the ethics get tricky.

Stay connected

Get the latest updates from

MIT Technology Review

Discover special offers, top stories, upcoming events, and more.