2017 Was the Year of the ICO—Now What?

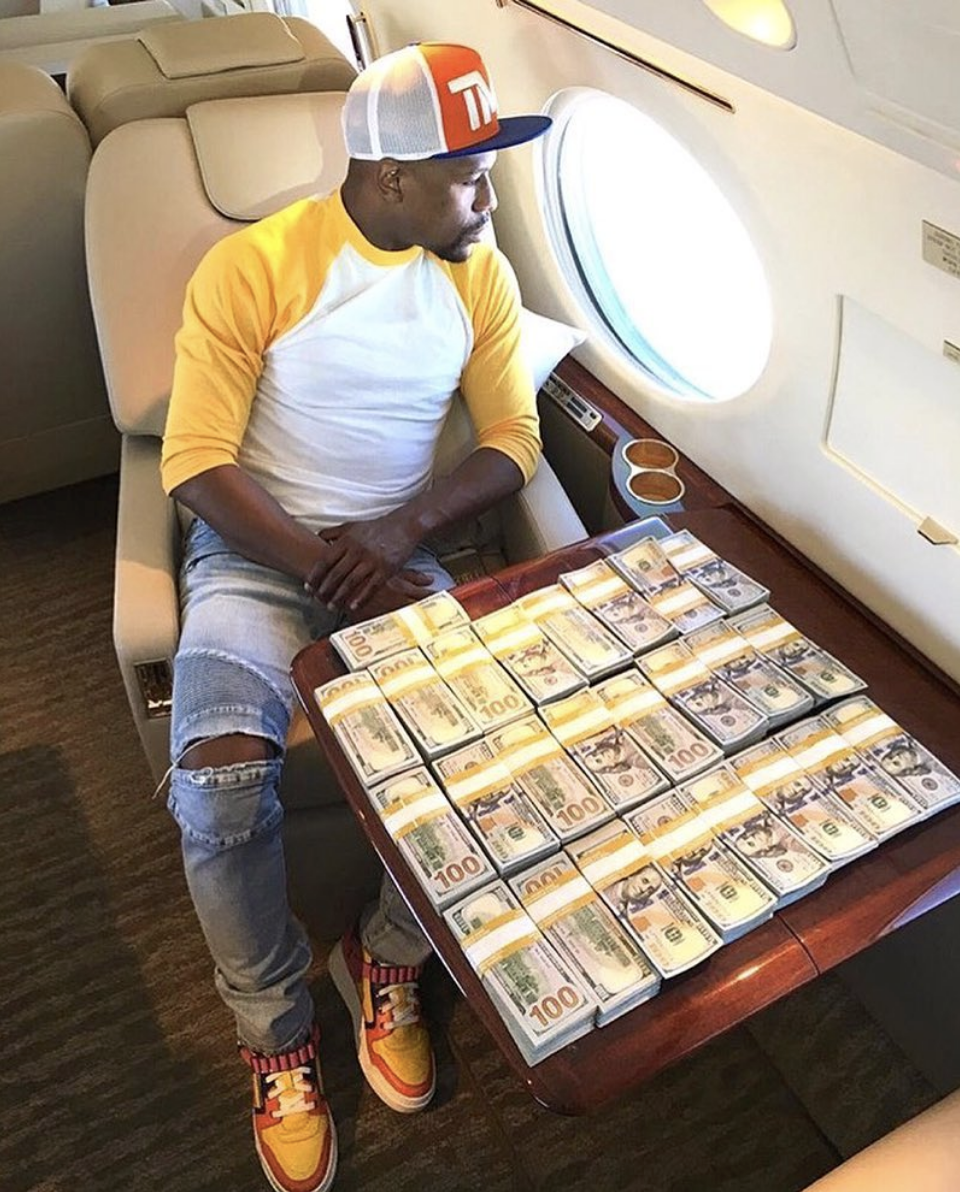

As 2017 comes to an end, Floyd “Money” Mayweather’s affinity for initial coin offerings is back in the news. Perhaps the world’s most famous boxer, Mayweather promoted no fewer than three ICOs this year, one of which, organized by a company called Centra Tech, is at the center of a new class action lawsuit that claims the offering violated U.S. securities laws.

It’s emblematic of how the year treated this flashy new fund-raising scheme. After bursting onto the scene in 2017, ICOs will enter the new year as the subject of intense scrutiny from lawmakers and financial regulators who are, like many of the rest of us, trying to figure out how to make sense of a legal gray area in which billions of dollars are suddenly flying around.

An ICO involves selling digital units of value, called tokens, that can be passed between users of a blockchain network, the same way Bitcoin users move bitcoins (see “What Bitcoin Is, and Why It Matters”). The tokens are tradeable, which makes them seem a bit like stocks. But in some cases they can also serve as a way to pay for file storage or personal data management services provided by the members of a blockchain network—something proponents refer to as “decentralized applications.” (What the Hell Is an ICO? ← Here’s a primer)

Unsurprisingly in a red-hot, unregulated corner of the financial world, ICOs saw their share of suspicious behavior in 2017. One of the most lucrative token sales of the year—a $232 million ICO for a project called Tezos, which promises to be an Ethereum-like system for decentralized applications—is now facing four separate suits by investors who allege that the organizers violated U.S. securities laws.

Some governments have cracked down on ICOs. China, for example, banned them in September and followed the move by shutting down cryptocurrency exchanges, too (see “Can China Contain Bitcoin?”). South Korea has outlawed ICOs as well, and it’s likely that more nations will follow suit next year.

The approach in the United States has so far been far more restrained. In July, the Securities and Exchange Commission released a report concluding that at least some digital tokens are securities and should be registered as such with the federal government. In the last few weeks, the SEC has stepped up action on ICOs. Last month it issued a statement warning that celebrity-backed token sales might be unlawful. (Sorry, Floyd.) Almost immediately after that, SEC chairman Jay Clayton said in an off-the-cuff remark that he had “yet to see an ICO that doesn’t have a sufficient number of hallmarks of a security.”

Shortly after the comment was made, the regulator stepped in and halted two ICOs. Clayton then issued a lengthy statement explaining the agency’s position on cryptocurrencies and ICOs, including a clear assertion that that not all tokens are necessarily securities.

So what are they, then? For the moment, they appear to be a quick way to put money in the pockets of those selling them—and potentially get into legal trouble in the process. Perhaps in 2018 we’ll find out whether they can be anything more than that.

Keep Reading

Most Popular

Large language models can do jaw-dropping things. But nobody knows exactly why.

And that's a problem. Figuring it out is one of the biggest scientific puzzles of our time and a crucial step towards controlling more powerful future models.

The problem with plug-in hybrids? Their drivers.

Plug-in hybrids are often sold as a transition to EVs, but new data from Europe shows we’re still underestimating the emissions they produce.

Google DeepMind’s new generative model makes Super Mario–like games from scratch

Genie learns how to control games by watching hours and hours of video. It could help train next-gen robots too.

How scientists traced a mysterious covid case back to six toilets

When wastewater surveillance turns into a hunt for a single infected individual, the ethics get tricky.

Stay connected

Get the latest updates from

MIT Technology Review

Discover special offers, top stories, upcoming events, and more.