Stripe Bets on Twitter for Mobile Purchases

Though 60 percent of Web traffic occurs on mobile devices, only about 15 percent of online purchases are made through that medium. The online payments company Stripe is betting that people want to buy things via mobile but are hamstrung by the annoyance of entering personal data and lengthy credit card info on a small screen.

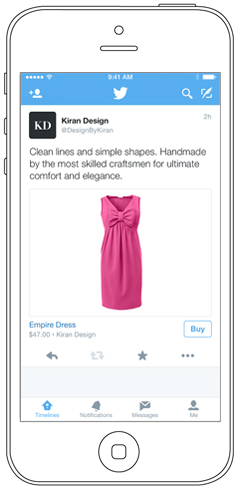

Its solution is Relay, a new service within the Stripe application programming interface (API) that a retailer such as Warby Parker can use to simplify mobile purchases by embedding a simple “buy” button in native apps or even in a tweet. Twitter is an active launch partner with Stripe on this product and has incorporated Relay into its mobile app. Using Relay, retailers can embed a “buy” button in tweets, which will launch a simple Stripe purchase confirmation dialog box to those customers who have chosen to save their credit card info in the Twitter app.

The new feature comes as Twitter searches for new ways to make its service useful – and profitable. Although over 300 million people use the service every month, the pace of new sign-ups is slowing, disappointing some investors. The company has been without a full-time CEO since June, when Dick Costolo stepped down. Twitter will allow third-party retailers to charge transactions through their feeds for free, though that could change in the future.

In his prepared remarks at the Relay launch Monday, Stripe cofounder and CEO Patrick Collison noted that Stripe has also worked with Facebook, which experimented with incorporating an earlier version of the Stripe API into its newsfeed for use by its 1.5 billion users. Given that Stripe typically collects 2.9 percent plus 30 cents on each transaction, tapping into the Facebook user base represents an enormous business opportunity. This summer, Visa was a part of a $100 million round of financing for Stripe, valuing the company at $5 billion.

There are two ways Relay works. The online eyeglass retailer Warby Parker is enabling purchases directly from its Twitter feed. Once the customer clicks on a buy button, a secure interface box from Stripe opens, asking for confirmation and then completing the transaction instantly, assuming that the user has opted in to save credit card information in the Twitter app. For security reasons, Twitter will not save the information itself – it delegates that encryption headache to Stripe.

Other companies with less Twitter-centric business models will incorporate Relay directly into their mobile apps. ShopStyle is a fashion-oriented search engine based in San Francisco that enables $1 billion worth of sales every year from 1,400 retailers, ranging from budget options such as Target and Forever 21 to the high-end Saks Fifth Avenue.

Using Relay, ShopStyle customers would have to enter card and personal data just once. Then they would be able to shop from all retailers searched across the app.

“If our customer buys something from Target, Saks, and Old Navy, they would have to enter their transaction data three times,” said Anna Fieler, executive vice president of marketing at PopSugar, the media and technology company that owns ShopStyle. “With Relay, it would be just a few taps.”

Keep Reading

Most Popular

Large language models can do jaw-dropping things. But nobody knows exactly why.

And that's a problem. Figuring it out is one of the biggest scientific puzzles of our time and a crucial step towards controlling more powerful future models.

The problem with plug-in hybrids? Their drivers.

Plug-in hybrids are often sold as a transition to EVs, but new data from Europe shows we’re still underestimating the emissions they produce.

How scientists traced a mysterious covid case back to six toilets

When wastewater surveillance turns into a hunt for a single infected individual, the ethics get tricky.

Google DeepMind’s new generative model makes Super Mario–like games from scratch

Genie learns how to control games by watching hours and hours of video. It could help train next-gen robots too.

Stay connected

Get the latest updates from

MIT Technology Review

Discover special offers, top stories, upcoming events, and more.