Fishing for Innovation

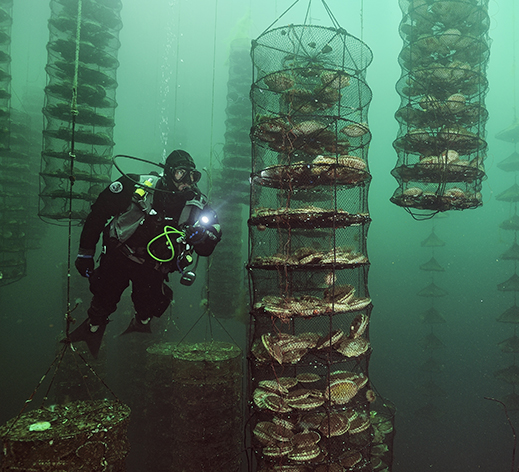

A new global investment fund called Aqua-Spark aims to change how seafood is farmed. Based in Utrecht, the Netherlands, it’s the first fund to invest solely in ventures that aim to protect both human health and the environment in the $135 billion aquaculture industry, which includes the farming of salmon, tilapia, shrimp, oysters, and other seafood, as well as aquatic plants like kelp.

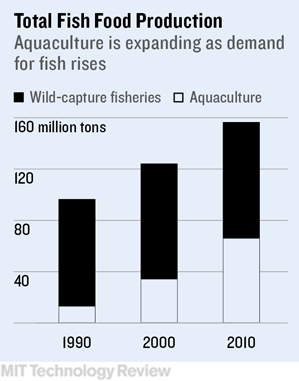

Aquaculture currently produces about half the seafood consumed worldwide, says Aqua-Spark cofounder Mike Velings, who officially launched the fund in December with his wife, Amy Novogratz. The industry will have to expand by 150 percent in the next 25 years to meet growing global demand, Velings says. Wild fish can’t satisfy that need alone: 85 percent of the world’s oceans are already being fished to their limits or beyond, according to the World Wildlife Fund.

“We are at a crossroads now, where the population is increasing, the middle class is increasing, people are eating more fish, and less fish is coming from the ocean. So there is just an immense pressure to get aquaculture right,” says Novogratz. “It needs to be done in a manner that can last.”

Over the past decade, grants have funded research into serious problems including water pollution from fish wastes, the overfishing of sardines, anchovies, and other forage fish to feed farmed seafood, and the excessive use of antibiotics and chemicals to combat disease. Though some solutions are now clear, they are not yet commercialized, Novogratz says.

“In a lot of cases, academia and research solutions aren’t giving us the solutions we need fast enough,” says Aaron McNevin, director of aquaculture at the World Wildlife Fund. At the same time, many entrepreneurs and small companies lack the resources to implement technology successfully, while some very large corporate players aren’t nimble enough to execute those innovations on a broad scale and lack incentives to change. McNevin hopes private-sector investors like Aqua-Spark will fill that gap and bring these innovations to market.

Aqua-Spark launched with 8.3 million euros ($9.1 million) from 37 investors around the world. Velings aims to have a 350-million-euro ($400 million) portfolio by 2025, with minority stakes in 60 to 80 diverse, small-to-medium-sized ventures, all of them with strong profit potential as well as good practices.

One of Aqua-Spark’s first investments was in Calysta, a biotech firm in Menlo Park, California, with a patented “microbial protein,” a fermented feed pellet for fish farms, made from methane-eating bacteria. Feed accounts for 80 percent of the cost of aquaculture operations, and the price of fish meal has soared with rising demand.

Approved by the European Union, Calysta’s protein is now being mixed into feed at some Norwegian salmon farms as a replacement for fish meal. The $10 million Calysta has raised from Aqua-Spark and other investors will finance an engineering and feasibility study to build Calysta’s first large plant capable of mass production by 2017, according to CEO Alan Shaw.

The Aqua-Spark team, which includes a network of 50 advisors, is currently vetting close to 500 potential investments, including technology to cleanse water and battle diseases, as well as large-scale aquaponics systems, where plants purify the water and fish fertilize the plants.

These are on the verge of profitability, Velings says. Aqua-Spark’s founders hope to show the industry that profitability and environmentally sound practices aren’t mutually exclusive.

Keep Reading

Most Popular

Large language models can do jaw-dropping things. But nobody knows exactly why.

And that's a problem. Figuring it out is one of the biggest scientific puzzles of our time and a crucial step towards controlling more powerful future models.

The problem with plug-in hybrids? Their drivers.

Plug-in hybrids are often sold as a transition to EVs, but new data from Europe shows we’re still underestimating the emissions they produce.

Google DeepMind’s new generative model makes Super Mario–like games from scratch

Genie learns how to control games by watching hours and hours of video. It could help train next-gen robots too.

How scientists traced a mysterious covid case back to six toilets

When wastewater surveillance turns into a hunt for a single infected individual, the ethics get tricky.

Stay connected

Get the latest updates from

MIT Technology Review

Discover special offers, top stories, upcoming events, and more.