Venture Capitalists Love Biotech Right Now

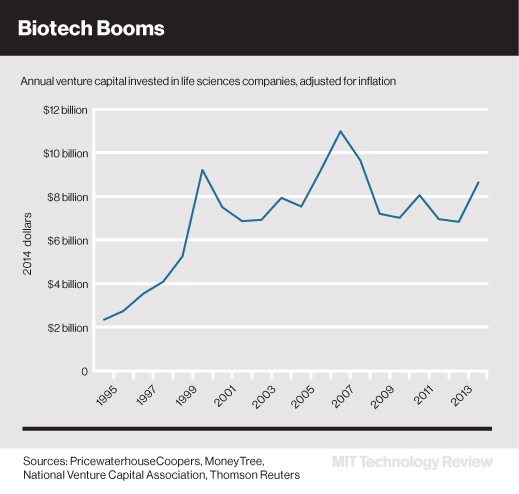

Venture capital investment in U.S. life sciences companies soared 29 percent in 2014 from the year before, reaching $8.6 billion, the highest level since 2007. And there is reason to think 2015 will also be a big year for a sector having its third boom of the last two decades.

Biotech is the second biggest category for venture investment after software. VCs are gaining confidence in life sciences companies (which include those developing new drugs and therapies as well as those that make medical devices and equipment) partly because their underlying research has advanced significantly, says Greg Vlahos, life sciences partner at PricewaterhouseCoopers, which published the new numbers. A big spike in IPOs by biotech companies over the past two years has also made the field more enticing.

Distinguishing 2014 from the booms in 2000 and 2007, says Vlahos, was the record number of “megadeals” of over $100 million. The $446 million investment round in Moderna Therapeutics, which is developing a novel class of drugs based on messenger RNA (see “Messenger RNA Could Create a New Class of Drugs”), was the largest Vlahos’s group has ever seen for a life sciences company.

Keep Reading

Most Popular

Large language models can do jaw-dropping things. But nobody knows exactly why.

And that's a problem. Figuring it out is one of the biggest scientific puzzles of our time and a crucial step towards controlling more powerful future models.

How scientists traced a mysterious covid case back to six toilets

When wastewater surveillance turns into a hunt for a single infected individual, the ethics get tricky.

The problem with plug-in hybrids? Their drivers.

Plug-in hybrids are often sold as a transition to EVs, but new data from Europe shows we’re still underestimating the emissions they produce.

Stay connected

Get the latest updates from

MIT Technology Review

Discover special offers, top stories, upcoming events, and more.