Technology Is Wiping Out Companies Faster than Ever

America’s top personal computer maker, Hewlett-Packard, was dumped today from the Dow Jones Industrial Index, the list of 30 blue-chip stocks picked to reflect the essential makeup of U.S. economy.

That’s a sign of just how fast computing is changing. But technological change may also be shortening the lifespan of all great companies. (Also off the Dow Jones list today are Bank of America and Alcoa. The new additions are Nike, Visa, and Goldman Sachs.)

Someone who has looked at this question is Richard N. Foster, a consultant who helped popularize of the idea of “creative destruction” (also the cover line for our latest issue). That’s the process by which large companies eventually get crushed by innovations made elsewhere.

HP is a case in point. It sells PCs, notebook computers, and printers. And people just aren’t buying as many of those as before. Instead, they’re shifting to the fastest-spreading consumer technologies ever, smartphones and tablets (see “Are Smart Phones Spreading Faster than Any Technology in Human History?”). HP’s business—though still huge—has started to shrink.

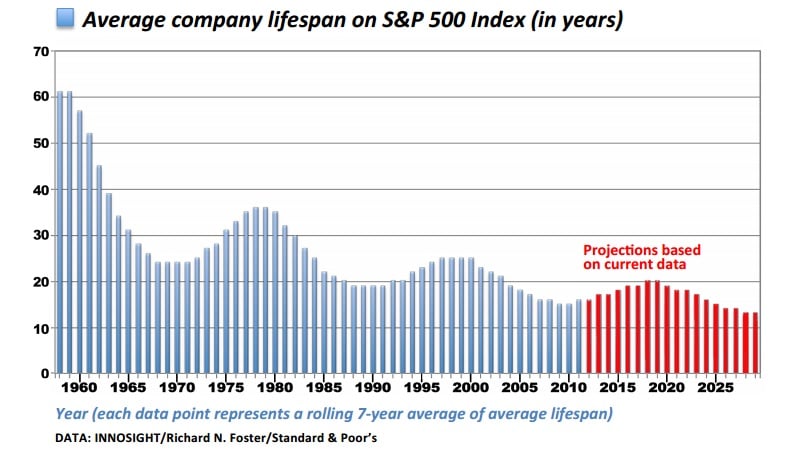

To get a handle on whether the rise and fall of great companies is speeding up, Foster looked at another, more inclusive stock index, the S&P 500, which is a list of the 500 most valuable companies traded on the U.S. stock market.

What Foster found is that the rate at which companies get bumped off the S&P 500 has been accelerating. Back in 1958, a company could expect to stay on the list for 61 years. These days, the average is just 18 years.

Companies can fall off the S&P 500 when they get too small, or get acquired. No one really knows why the rate of turnover is speeding up, but technological disruption could be one big reason. Since 2002, Google, Amazon, and Netflix have joined the S&P 500, while Kodak, the New York Times, Palm and Compaq have all been forced off, essentially by changing technology.

Today’s S&P 500 includes many familiar firms, like Apple, AT&T, Corning, Ford, Intel, and Yahoo (and Hewlett-Packard, too). Yet at today’s fast rate of turnover, three out of four names on the list will be banished into obscurity within the next fifteen years.

Foster’s view is that big companies can’t ever out-innovate the market. Instead, he thinks that to stay big, companies need to be willing to exit old businesses and enter new ones—and do it quite boldly. (HP, by contrast, can’t decide whether to jettison its PC business.)

Foster’s data do tell us which company is America’s greatest corporate survivor. It’s General Electric, the only company that’s remained on the S&P Index since it started in 1926.

Keep Reading

Most Popular

Large language models can do jaw-dropping things. But nobody knows exactly why.

And that's a problem. Figuring it out is one of the biggest scientific puzzles of our time and a crucial step towards controlling more powerful future models.

The problem with plug-in hybrids? Their drivers.

Plug-in hybrids are often sold as a transition to EVs, but new data from Europe shows we’re still underestimating the emissions they produce.

Google DeepMind’s new generative model makes Super Mario–like games from scratch

Genie learns how to control games by watching hours and hours of video. It could help train next-gen robots too.

How scientists traced a mysterious covid case back to six toilets

When wastewater surveillance turns into a hunt for a single infected individual, the ethics get tricky.

Stay connected

Get the latest updates from

MIT Technology Review

Discover special offers, top stories, upcoming events, and more.