Intel Bets on Fabs, Again

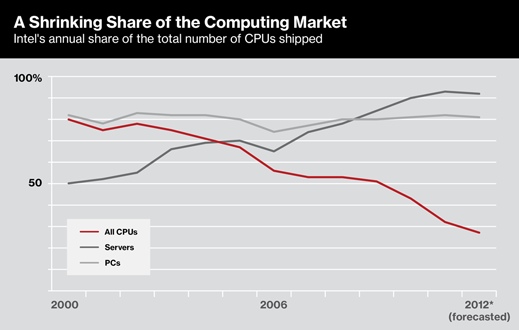

Intel, the world’s largest chipmaker, is at a crossroads. It commands 83 percent of the market for the processor chips that run PCs and laptops.

But that market has peaked, and the company has only a tiny role in the fast-growing business of providing processors for tablets and smartphones, which in 2011 accounted for about two-thirds of all computing devices sold. The company’s answer is to rely on a strategy that makes it an anomaly in the computing industry: investing heavily in cutting-edge manufacturing centered in the United States. Today, 75 percent of Intel’s output is U.S.-made.

A $5 billion dollar factory, or fab, being built in Chandler, Arizona, will make chips, slated to appear in 2014, with features as small as 14 nanometers. It’s the latest jump downward in size, a trend that’s making chips more efficient and powerful. The new chips will make use of Intel’s unrivaled 3-D transistor design, introduced with the current 22-nanometer generation, to solve efficiency problems limiting previous designs from being shrunk further (see “TR10: 3-D Transistors”). Its closest competitor’s best chips are made with 28-nanometer features. The Chandler fab’s technology and operations—and even the temperature and composition of the air inside—will be carbon copies of those at Intel’s development fabs in Oregon, in line with Intel’s “copy exactly” philosophy of making sure techniques make a smooth jump from R&D to production.

Intel’s strategy couldn’t be more different from that of the competitors it is chasing in the market for mobile processors. They typically license processor designs from U.K. company ARM—traditionally more power-efficient than Intel’s desktop chips, which is why they dominate the mobile market, where battery life is important—and produce them using what is known as the foundry model, or outsourcing production to Asian contractors such as Taiwan Semiconductor, known as TSMC. Intel has long relied on manufacturing to beat competitors. Investing heavily in advanced fab technology allowed the company to secure the contracts to provide the first PC chips in the mid-1980s, and helped push out competitors such as AMD in the 1990s and the past decade.

The make-or-break product for Intel will be its first mobile chips based on its 22-nanometer, 3-D transistor technology, due to appear in late 2013 (mobile chips from the 14 nanometer Chandler fab will be a couple of years behind). The first PC chips based on that technology appeared in April 2012, and delivered 37 percent more performance at the same power draw as those that came before, or a 50 percent cut in power use for the same performance. When the 22-nanometer mobile device chips arrive, the company needs them to lure device makers looking to build faster phones and tablets that can still last all day on a charge.

Foundries like TSMC can’t advance technology as fast as Intel, because they focus on offering low prices and many designs to hundreds of customers. On a trip to Taiwan last summer, Harvard Business School professor Willy Shih heard that TSMC likely won’t match Intel’s 22-nanometer 3-D transistors for two to four years, a gap he characterized as “enormous.”

But for manufacturing to save Intel, the technology gap has to matter to mobile-device manufacturers. It’s not yet clear that it will. Shih says Intel is now “getting their clock cleaned” in the mobile market. The reason isn’t only that companies like Samsung have opted for slower chips that use less power. Others, like Apple, have now begun designing their own processors, a step that makes them harder to copy—a strategic development that favors the flexible, adaptive manufacturing of foundries such as TSMC.

Intel is confident that its advanced manufacturing will eventually make the difference. Intel says it can build its newest chips with different types of transistors to enable some functions to prioritize efficiency, and others performance. It’s a flexibility others don’t offer, and could enable devices capable of both, say, powerful 3-D graphics and long battery life.

Keep Reading

Most Popular

Large language models can do jaw-dropping things. But nobody knows exactly why.

And that's a problem. Figuring it out is one of the biggest scientific puzzles of our time and a crucial step towards controlling more powerful future models.

The problem with plug-in hybrids? Their drivers.

Plug-in hybrids are often sold as a transition to EVs, but new data from Europe shows we’re still underestimating the emissions they produce.

Google DeepMind’s new generative model makes Super Mario–like games from scratch

Genie learns how to control games by watching hours and hours of video. It could help train next-gen robots too.

How scientists traced a mysterious covid case back to six toilets

When wastewater surveillance turns into a hunt for a single infected individual, the ethics get tricky.

Stay connected

Get the latest updates from

MIT Technology Review

Discover special offers, top stories, upcoming events, and more.