Ultrafast Trades Trigger Black Swan Events Every Day, Say Econophysicists

On 6 May 2010, shares on US financial markets suddenly dropped on average by around 10 per cent but in over 300 stocks by more than 60 per cent. Moments later the prices recovered.

The event mystified economists because they had never seen anything like it (and have enough trouble explaining the ordinary workings of markets). Econophysicists have since blamed this so-called flash crash on the automated behaviour of ultrafast computer trades, which take place in periods measured in milliseconds.

These kinds of trades appear to generate emergent behaviour that has nothing to do with the actual value of a company. Instead, these events are unavoidable properties of the system itself.

That raises an important question: how can authorities prevent flash crashes and price spikes in which billions of dollars can be won and lost?

The answer is that nobody knows, not least because econophysicists do not yet understand the nature of flash crashes nor how they emerge in complex systems.

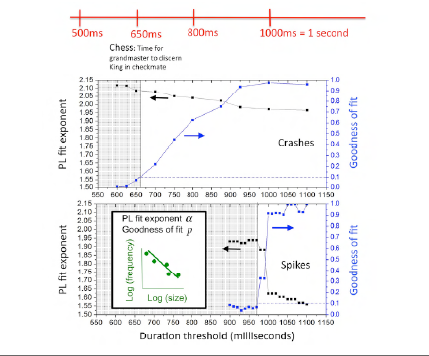

Today, however, Neil Johnson at the University of Florida in Miami and a few pals reveal an important insight into what’s going on. These guys have found evidence that the behaviour of financial markets changes dramatically on timescales shorter than a certain threshold level. This threshold, they say, is more or less exactly equal to the human reaction times.

The implication is clear. When humans trade and when they monitor the behaviour of machine trading, they can step in to override any unwanted behaviour. In that regime, markets behave in a specific way.

But when human oversight becomes impossible, because the trades take place faster than humans can react, a different behaviour occurs. That’s when flash crashes and rises set in.

The evidence comes from Johnson and co’s study of stock price movements between 2006 and 2011. These guys looked for extreme changes in a stock price, which they defined as a change greater than 0.8 per cent, over timescales shorter than 1.5 seconds.

Since human reaction times are about a second, this spans the regime when trades begin to occur faster than humans can monitor and react to them.

The first thing they discovered is that flash crashes and rises are not at all rare. Johnson and co found over18,000 of them, that’s more than one a day on average. They call them black swan events, using the terminology developed by Nassim Nicolas Taleb in his book The Black Swan.

Curiously, they found that that change in the occurrence of crashes occurs at timescales shorter than 650 milliseconds, while the transition for price spikes occurs at 950 milliseconds.

Johnson and co say this can be explained if humans are more alert to crashes than to price rises. They point out that 650 milliseconds is about the fastest a human can react to any warning sign, so it’s no surprise that the transition occurs here for crashes.

Price rises, on the other hand, are usually beneficial and so require no immediate action, which is why the transition in behaviour occurs at slightly longer timescales.

They also say that the ten stocks most susceptible to flash crashes and rises are international banks. This, they say, “hints at a hidden relationship between these ultrafast ‘fractures’ and the slow ‘breaking’ of the global financial system post-2006.”

The work also hints at a solution: to somehow reproduce the effect of human oversight at ultrafast scales. How that can be done with regulation alone isn’t clear but there is no disputing the urgency with which this matter should be addressed.

The markets are clearly changing. The need to outperform competitors is currently driving a multibillion dollar investment in machine trading at rates even faster than milliseconds. In one project, traders are financing the construction of a dedicated transatlantic cable that will shave just 5 milliseconds off the time it takes to trade stocks.

Unless it is tackled in the near future, just what kind of behaviour this race-to-the-bottom will generate, is anyone’s guess.

Ref: arxiv.org/abs/1202.1448: Financial black swans driven by ultrafast machine ecology

Keep Reading

Most Popular

Large language models can do jaw-dropping things. But nobody knows exactly why.

And that's a problem. Figuring it out is one of the biggest scientific puzzles of our time and a crucial step towards controlling more powerful future models.

The problem with plug-in hybrids? Their drivers.

Plug-in hybrids are often sold as a transition to EVs, but new data from Europe shows we’re still underestimating the emissions they produce.

Google DeepMind’s new generative model makes Super Mario–like games from scratch

Genie learns how to control games by watching hours and hours of video. It could help train next-gen robots too.

How scientists traced a mysterious covid case back to six toilets

When wastewater surveillance turns into a hunt for a single infected individual, the ethics get tricky.

Stay connected

Get the latest updates from

MIT Technology Review

Discover special offers, top stories, upcoming events, and more.